PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431029

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431029

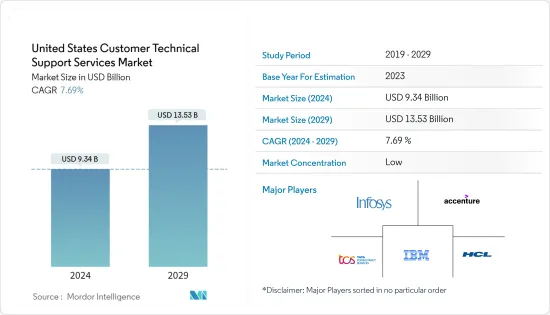

United States Customer Technical Support Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States Customer Technical Support Services Market size is estimated at USD 9.34 billion in 2024, and is expected to reach USD 13.53 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

Key Highlights

- American businesses are increasingly embracing intelligent automation as part of initiatives for digital transformation that provide immediate advantages. To improve customer assistance during the pandemic, more American businesses are implementing conversational AI technologies, like chatbots, virtual agents, and voice assistants. The most common hosting choice for conversational AI is the public cloud, although on-premises deployment is preferred in heavily regulated sectors like banking and healthcare.

- A New York-based business called Lang.ai is creating a technology that automatically tags client chats to handle service issues rapidly. It revealed in May 2022 that it had raised USD 10.5 million in a Series A fundraising round coordinated by Nava Ventures (bringing its total raised to USD 15 million). Existing help desk platforms, like Zendesk and Intercom, are used by the platform to extract concepts from customer inquiries.

- Focusing on long-term commitment effectively preserves a positive relationship between suppliers and customers, much like other technical support trends. Companies that outsource seek clients with whom they may develop a long-term connection. Contrarily, choosing the ideal technical support outsourcing partner is a time-consuming process. Businesses are working to establish long-term cooperation and reliable relationships so that both companies can profit from one another cost-effectively. Therefore, long-term ties are far more beneficial than short-term commitments when it comes to business development.

- The rising fraudulent activities in the name of tech support make the customers suspicious; it hampers and tarnishes the image of the tech support industry and makes it difficult for technical assistance due to low trust and suspicion toward such services. This overall costs the company their support operations and forms a challenge for them.

- Due to COVID-19 and its rapid adoption of online channels across customers, businesses have developed extraordinary speed to provide top-notch customer service and compassionate employee care. Brands have reviewed how they use contact centers, how their staff provides great customer experiences, where those employees work, and how they might use digital channels to support the growth in contact center volume. During the pandemic, the market was initially at risk due to the sharp rise in call volume and abrupt switch to remote work-from-home models, but over time, these changes have given rise to a tremendous opportunity for the United States Customer Technical Support Services Market.

United States Customer Technical Support Services Market Trends

Increasing Requirement for Software Update to Drive the Market

- The United States is highly susceptible to cyberattacks and hacking, according to the FBI, CISA, and NSA identified attacks involving ransomware against 14 of the 16 critical infrastructure sectors in the United States in 2021 alone. Additionally, the number of ransomware complaints filed to the FBI's Internet Crime Complaint Center (IC3) climbed by 82% between 2019 and 2021, while ransom payments increased by 449% within the same time frame.

- According to the shifting technological landscape and the regular introduction of new viruses, enterprise IT software needs to be updated and patched on a regular basis to be safe from cyberattacks. Cyberattacks are more likely to occur with outdated and vulnerable software, which can lead to the loss of important and valuable data. There are already cyberattack tools on the market designed to take advantage of recently discovered software and hardware vulnerabilities. Businesses may suffer considerable financial and operational losses as a result of such attacks, which increases the demand for patch management software.

- Software support services are typically provided for specific software packages as technical support or break/fix services. These services include revenue from on-demand, incident-based support, or long-term technical support contracts. Typical components of software support services include remote troubleshooting capabilities, installation assistance, and fundamental usability support. Remote troubleshooting skills may be offered over the phone and online communication channels and automatically using tools that run on the customer's device or are online.

- The installation of new software, software updates, migrations for significant software releases, various proactive or reactive on-site services, and support for custom applications or infrastructure software are all software support services. A product vendor, a consultancy company, or a third-party software maintainer are all capable of providing services. This category of software goods and technologies includes infrastructure, application, and commercial and customized operating systems. Updates and upgrades to software licensing codes, which manufacturers frequently classify as software maintenance, are not included in software support services.

- In the natural course of events, industry disruptors appear before the peak of an S-curve. Organizations have time to plan for and welcome change. COVID-19, on the other hand, arrived like a curveball from left field. Digital transformation quickly transitioned from optional to necessary, and some businesses lacked the agility to thrive. Many organizations must immediately adopt untested remote work technology to continue operating. Project management tools like Basecamp, Zoom, and Google Docs, have become standard. The pandemic's immediate impact caused numerous gaps in the installation and updating of software and systems. The personnel must now complete an upgrade formerly handled by an on-site IT team. The need for technical support services increased as a result.

Increasing Adoption of Smart Home Devices and Electronics to Boost the Market Growth

- The United States is one of the world's largest electronics consumers. This is merely attributable to several elements, including substantial disposable income, the enormous demand for high-end goods, greater adoption of cutting-edge technologies, the presence of multiple top electronics manufacturers, and high standards of living. The consumer electronics market in North America is anticipated to rise over the future years due to recent developments in various electronic items. According to a Consumer Electronics Association annual poll, American households spend USD 1,200 on electronic devices annually and are expanding their home networks. The average home has 25, according to the Consumer Electronics Association, and the top five growth categories include digital video recorders, network routers or hubs, MP3 players, cable modems, and digital cameras.

- According to a new projection from the Consumer Technology Association, the US consumer technology industry is anticipated to earn over USD 505 billion in retail sales revenue for the first time (CTA). The forecast shows a 2.8% increase in sales over the excellent 9.6% growth over 2020 in 2021. The strong demand for smartphones, automotive technology, health devices, and streaming services will drive much of the anticipated income.

- According to the CTA, Smartphone shipments are anticipated to increase by 3% from 2021 to 154.1 million devices, or USD 74.7 billion in shipment revenues, in 2022 (149.6 million). The increasing trend is caused by the expanding availability of 5G, as 73% of smartphone shipments (revenues of USD 61.37 billion) will be made up of 5G devices in the upcoming year. The availability of foldable phones will provide consumers with additional options, which will increase demand.

- The most popular wearable technology for keeping customers connected, productive, and entertained are wireless headphones and smartwatches. This year, smartwatch shipments are expected to bring in USD 7.1 billion, an increase of 8% from 2021. An estimated USD 9.3 billion in shipment revenues for truly wireless earbuds are predicted for this year, up 3% from 2021 to 2022.

- Through the pandemic, connected fitness equipment expanded significantly, resulting in shipment revenues of around USD 3.8 billion in 2021. According to the CTA, the shipment revenue for linked exercise equipment would increase by 17% to close to USD 4.5 billion in 2022. This development trajectory implies that even as clubs and exercise programs reopen, health-conscious consumers are finding it convenient and practical to exercise at home.

United States Customer Technical Support Services Industry Overview

Due to the presence of big multinational companies, the United States Customer Technical Support Services Market is highly competitive. Businesses that operate in the market are stepping up their efforts to create compact and affordable technical outsourcing assistance. Companies are using inorganic growth tactics, such as mergers, acquisitions, and partnerships with technology partners, to increase their reach and offer more sophisticated product lines to gain a competitive advantage in terms of acquiring maximum market share.

- May 22: Matt Martinez has been appointed by Penetron USA as the region's account manager for Southern USA. With an emphasis on the Southern United States, where the company has had recent great growth, this most recent hire is another step in the continued expansion of the Penetron Technical and Customer Support team.

- December 2021: Kingswood Capital ManagemL.P., L.U.S., a US private investment company based in Los Angeles, California, has acquired Senture, a significant business process outsourcing operator for government services in the United States, according to Teleperformance, a leading global group in digitally integrated business services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Requirement For Software Update

- 5.1.2 Increasing Adoption of Smart Home Devices And Electronics

- 5.2 Market Challenges

- 5.2.1 Increasing Fraud Related To Tech Support

- 5.3 Assessment Of The Impact Of Covid-19 On The Industry

- 5.4 Breakdown Of Consumers Contacting Customer Support By Channel For 2020

6 MARKET SEGMENTATION

- 6.1 Market Estimation And Forecast For Consumer Technical Support Services

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infosys Ltd

- 7.1.2 Wipro Ltd

- 7.1.3 Accenture Plc

- 7.1.4 Collabera Inc.

- 7.1.5 CSS Corp

- 7.1.6 HCL Technologies Limited

- 7.1.7 Genpact Ltd

- 7.1.8 IBM Corporation

- 7.1.9 Teleperformance SE

- 7.1.10 Support.com Inc. (GGH Inc.)

- 7.1.11 Tata Consultancy Services

- 7.1.12 Askpcexperts

- 7.1.13 UStechsupport (Realdefense Llc)

8 MARKET OPPORTUNITIES AND FUTURE TRENDS