PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549788

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549788

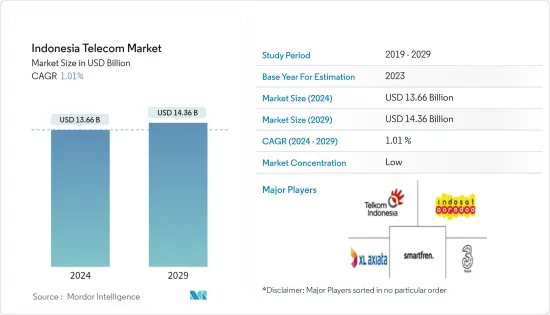

Indonesia Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia Telecom Market size is estimated at USD 13.66 billion in 2024, and is expected to reach USD 14.36 billion by 2029, growing at a CAGR of 1.01% during the forecast period (2024-2029).

The telecom market in Indonesia, which is among the biggest in the world, has plenty of opportunities to expand. This growth has been mainly caused by a possible increase in users. However, it may also be fueled by more revenue per user as the nation's earnings rise.

Key Highlights

- The growing demand for high-speed connectivity services by customers and increasing spending on the deployment of 5G infrastructure positively influence the growth of the Indonesian telecom market. With the nation's steady transition into the digital age, the industry has been poised for consistent expansion. By January 2023, GSMA Intelligence reported that the number of cellular mobile connections in Indonesia had reached approximately 354 million, highlighting the extensive penetration of mobile technology within the country.

- Indonesia actively engages with its telecommunications partners to support its transformation agenda. Notably, those aiming to play a significant role in the 5G revolution also supported the nation's tourism initiatives by enhancing its telecommunications networks. As highlighted in an OpenGov Asia report, the Minister of Communication and Information praised the rollout of 5G services, marking it as a key component of the G20 Indonesia Presidency series, aligning with the G20 Summit in Bali.

- Furthermore, in June 2024, PT Telkom Indonesia, in collaboration with SingTel and Medco Power Indonesia, announced plans for a substantial investment. The collaboration aimed to inject IDR 1.4 trillion (about USD 85 million) into the construction of an advanced data center in Batam. This facility was intended to be equipped with Artificial Intelligence (AI) infrastructure, with the project scheduled for completion over a five-year period.

- Telkomsel has been granted a 5G bandwidth of 30 MHz, while Indosat allocated 20 MHz. These allocations are less than the recommended spectrum for an optimal 5G deployment. According to GSMA, an initial allotment of 80-100 MHz for the mid-band was suggested to ensure a robust spectrum. It was noted that more smartphone models were compatible with Indosat's 1.8 GHz band compared to Telkomsel's 2.3 GHz. Given Indosat's focus on the 1.8 GHz band and its initial emphasis on the B2B sector, the demand for smartphones supporting this band is expected to rise, albeit at a moderate pace.

- By the third quarter of 2021, Indonesia experienced a 42% Y-o-Y increase in mobile network data traffic, reaching 78 exabytes (EB), which included traffic from fixed wireless access (FWA) services, according to research conducted by Ericsson. Moreover, recent projections indicated that the total mobile network data traffic was expected to exceed 370 EB by the end of 2027. By the end of 2021, the 88 million registered FWA connections were projected to surpass 230 million by 2027. It is anticipated that approximately half of these connections will utilize 5G networks.

- However, digital disruptions posed significant challenges to the growth trajectory of Indonesia's telecommunications industry. As consumer demands for faster and more reliable connectivity evolved alongside technological advancements, telecommunications operators were compelled to increase infrastructure, IT, and talent investments. Furthermore, the industry's substantial IT overhaul required significant capital expenditure (CAPEX) and involved extended lead times, further impeding market growth.

Indonesia Telecom Market Trends

Increased Pace of 5G Roll-out Driving the Market

- According to the Telecom Review Report, the government has been actively developing various spectrum bands to support the 5G network. This includes farming and refarming the frequency spectrum across different bands, ranging from low to super high. In November 2023, industry stakeholders convened at Solo Techno Park, Indonesia's first 5G park, for the 5G Ecosystems Acceleration Summit. This summit aligned with Indonesia's Digital Vision for 2030 and 2045, provided detailed insights into emerging business trends, and elucidated the challenges and opportunities associated with deploying 5G solutions for consumers, homes, and businesses.

- The government is using its internet infrastructure to enhance its digital economy. In December 2023, Virtual Internet, a 5G software provider, partnered with PT. ABC to deploy its Virtual 5G technology across Indonesia. This agreement permitted PT. ABC to distribute an unlimited number of Virtual 5G applications. If fully utilized, this could result in up to 500 million licenses, each with an average annual subscription cost of USD 4.

- As per the Ericsson Mobility Report, telecom companies benefited significantly from offering 5G solutions to industries such as manufacturing, energy, utilities, and media. The report suggested that Indonesian telecom firms could have seen a 35% increase in income, amounting to USD 8.2 billion by 2030, by focusing on business-to-business (B2B) 5G services, despite the challenges in implementing 5G technology in the country.

- Furthermore, Bali had become the sixth city to receive 5G coverage, following Surakarta, Jakarta, Surabaya, Makassar, and Balikpapan.

Higher Demand for OTT Services Driving the Market

- Over-the-top (OTT) services, including streaming video, Voice over Internet Protocol (VoIP), and messaging applications, have gained significant popularity in Indonesia. Telecom operators adapted to this trend by offering bundled services, partnering with OTT providers, or developing their own OTT offerings to remain competitive in the market.

- In May 2024, Vidio, a streaming platform based in Indonesia and owned by the local conglomerate Emtek Group, announced plans to increase its number of paid subscribers to 8 million within the next two to three years. This target would have approximately doubled its subscriber base, which was 4.1 million as of 2023.

- Furthermore, in May 2024, ZTE Corporation, a global provider of integrated information and communication technology solutions, and MyRepublic, an internet service provider, announced the launch of Indonesia's first Wi-Fi 7 product at ZTE Day 2024. This event marked a significant collaboration between ZTE and MyRepublic, highlighting their dedication to advancing technological innovation and facilitating the commercial implementation of Wi-Fi 7. By introducing the Wi-Fi 7 CPE, MyRepublic aimed to provide users with a network experience that offered unprecedented high speeds and low latency.

- According to a Future of TV analysis by The Trade Desk, OTT streaming experienced a meteoric rise in popularity after the COVID-19 pandemic. Over one in three Indonesians already streamed material over the top (OTT) as OTT became a popular form of entertainment where people could watch their favorite shows across devices whenever and wherever they wanted. Indonesia led in the Southeast Asian region with a strong 40% Y-o-Y rise in OTT consumption.

- Smartphone costs decreased, mobile broadband coverage improved, and internet access became more reasonably priced. The expansion of OTT in Indonesia was linked to these trends. OTT platforms adjusted their offers to attract these customers by considering consumer preferences. More local and Asian content was available on the top three platforms than on any other platform in Indonesia's Play Store entertainment category. A weekly payment option was available in Vidio's subscription configuration for its sports broadcasting service.

Indonesia Telecom Industry Overview

The Indonesian telecom market is highly fragmented in nature. Some major players in the market studied are Telkom Indonesia, Indosat Ooredoo, XL Axiata, Smartfren Telecom, and Tri Indonesia. The market also hosts other internet service providers (ISPs), MVNOs, and fixed-line service providers. Some Indonesian telecommunication companies are competitive internationally and hold strong ground in the global telecom space.

- April 2024: Malaysian conglomerate Axiata Group and Indonesian group PT Sinar Mas announced plans to strengthen their position in the market by planning to merge their telecom operations, XL Axiata and Smartfren, into a USD 3.5 billion entity. This merger intends to combine their customer bases, resulting in approximately 94 million mobile subscribers. XL Axiata contributed around 58 million customers, while Smartfren added about 36 million. This strategic move was designed to create a stronger competitor to Telkomsel, which had over 158 million mobile users as of September 2023. Furthermore, it positioned the merged entity to closely rival Indosat Ooredoo Hutchison, which had approximately 100 million mobile subscribers.

- April 2024: Scala Inc. and PT Telkom Indonesia (Persero) Tbk (Telkom), Indonesia's state-owned telecommunications company based in Bandung, announced a strategic business alliance. This partnership will be dedicated to fostering innovation and development within the agricultural sector. By combining their strengths, both organizations aim to address significant challenges and seize opportunities in this crucial industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on the Market

- 4.5 Regulatory Landscape in Indonesia

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Pace of 5G Roll Out

- 5.1.2 Digital Transformation Boosting Telecom

- 5.2 Market Restraints

- 5.2.1 Security Related Challenges

- 5.3 Analysis of the Market based on Connectivity (Coverage to Include In-depth Trend Analysis)

- 5.3.1 Fixed Network

- 5.3.1.1 Broadband (Cable Modem, Wireline-fiber, Wireline DSL, Fixed Wi-Fi and Trends Regarding ADSL/VDSL, FTTP/B, Cable Modem, FWA, and 5G FWA)

- 5.3.1.2 Narrowband

- 5.3.2 Mobile Network

- 5.3.2.1 Smartphone and Mobile Penetration

- 5.3.2.2 Mobile Broadband

- 5.3.2.3 2G, 3G, 4G, and 5G Connections

- 5.3.2.4 Smart Home IoT and M2M Connections

- 5.3.1 Fixed Network

- 5.4 Analysis of Telecom Towers (Coverage to Include In-depth Trend Analysis of Various Types of Towers, like Lattice, Guyed, Monopole, and Stealth Towers)

6 MARKET SEGMENTATION

- 6.1 Segmentation by Services (Coverage to Include Average Revenue Per User for Overall Services Segment, Market Sizes and Estimates for Each Segment for the Period of 2020-2027, and In-depth Trend Analysis)

- 6.1.1 Voice Services

- 6.1.1.1 Wired

- 6.1.1.2 Wireless

- 6.1.2 Data and Messaging Services (Coverage to Include Internet and Handset Data Packages and Package Discounts)

- 6.1.3 OTT and Pay TV Services

- 6.1.1 Voice Services

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Telkom Indonesia

- 7.1.2 Indosat Ooredoo

- 7.1.3 XL Axiata

- 7.1.4 Smartfren Telecom

- 7.1.5 Tri Indonesia

- 7.1.6 Net1 Indonesia

- 7.1.7 Emtek

- 7.1.8 Bakrie Telecom

- 7.1.9 First Media

- 7.1.10 Transvision

- 7.1.11 Optiva Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS