Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693733

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693733

United States Feed Amino Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 187 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

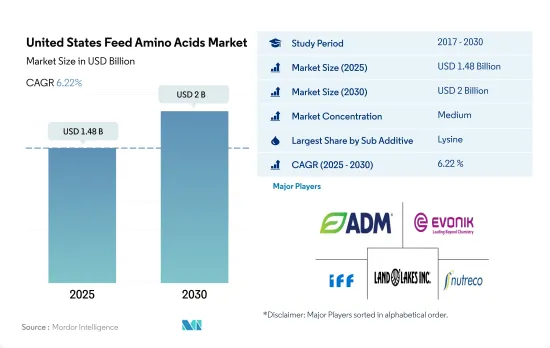

The United States Feed Amino Acids Market size is estimated at 1.48 billion USD in 2025, and is expected to reach 2 billion USD by 2030, growing at a CAGR of 6.22% during the forecast period (2025-2030).

- In the North American feed amino acid market, the United States was the most prominent player, accounting for 70% of the total market value in 2022. The demand for feed amino acids in the country was primarily driven by the need to support animal growth and meat production. Lysine and methionine were the most significant feed amino acids in terms of market value. The popularity of these amino acids could be attributed to their high efficiency in promoting gut health and digestion in animals, in addition to enhancing meat production.

- Methionine and tryptophan were the fastest-growing feed amino acids in the United States, with an impressive anticipated CAGR of 6.8% each during the forecast period. The increasing usage of animals propels this growth for meat and its importance in boosting immunity.

- Poultry and ruminants were the largest consumers of feed amino acids in the United States, accounting for 39.7% and 38.7% of the total feed amino acid market, respectively, in 2022. Ruminants had a higher share of feed amino acid usage because of the greater animal headcount and demand for amino acids in beef cattle farming. Swine was the third largest animal segment, with a 19% share of the total feed amino acids market in the country due to the high demand for red meat, including pork.

- The expected increase in demand for meat and meat products, as well as the growing awareness of the benefits of amino acids in balancing gut pH and reducing the incidence of infections, is set to be the major driving force behind the feed amino acids market in the United States. As a result, players in the feed amino acids industry are likely to keep an eye on this trend and develop strategies to capitalize on it.

United States Feed Amino Acids Market Trends

The United States poultry industry is one of the largest commercial food industry and increased consumption of meats and eggs is increasing the poultry production

- The poultry industry in the United States is thriving due to the increasing demand for eggs and poultry meat in the commercial food industry and the rising export. The country is one of the largest egg producers and exporters globally, with the total egg exports in 2020 increasing by 9.3% to 3.5 billion eggs from the previous year and the export value growing by 2.4% to USD 189 million.

- The consumption of poultry meat in the United States improved due to favorable prices, a rise in awareness of a high-protein diet, and increasing demand for poultry meat. As a result, the poultry bird headcount increased by 17.6 million in 2022 compared to the previous year. Raising chickens in small spaces and different environments makes poultry production more feasible and less expensive than beef and pork, attracting animal farmers with limited rearing areas to invest in poultry farms.

- However, the US import share is expected to decrease from 26% in 2021 to 24% in 2031, which can affect the growth of the poultry feed market. Swine flu and trade disputes with China between 2018 and 2019 also contributed to the steady poultry population during the historical period, as animal farmers were reluctant to increase rearing.

- Despite these challenges, the increasing consumption of meat and eggs and rising export, combined with the growing poultry population, are expected to drive the growth of the feed additives market in the United States during the forecast period.

Presence of a large number of fish farms and feed mills is contributing to increasing feed production for aquaculture

- Aquaculture feed production in the United States recorded an increase of 4.1% in 2022 compared to 2017. The presence of several feed mills, which totaled 6,232 in the United States alone, contributed to this increase. The per capita seafood consumption also increased from 21.88 kg in 2018 to 22.26 kg in 2022.

- Fish had a significant share among the various aquaculture feed, accounting for 83.2% in 2022. This can be attributed to the increasing awareness of the benefits of fish in the human diet, high demand in the international market, expansion of the retail sector, and the presence of numerous fish farms in the country. Most fish farms are located in Ohio, and the most consumed fish is catfish. This is because catfish can convert pellet feed into pounds of fish.

- Shrimp accounted for 7.5% of the aquaculture feed market in 2022, as it is the other most consumed aquatic animal due to the rise in demand for seafood and its high protein content. However, the country depends on other countries for shrimp, which affected its growth during the study period. On the other hand, other aquatic species witnessed high growth in demand, as the demand for bivalves from restaurants increased after COVID-19 due to their popularity as a main cuisine. The high number of feed mills and rising demand for fish and seafood, with increasing feed production of aquaculture, are expected to drive the growth of the feed additives market in the United States during the forecast period.

United States Feed Amino Acids Industry Overview

The United States Feed Amino Acids Market is moderately consolidated, with the top five companies occupying 45.82%. The major players in this market are Archer Daniel Midland Co., Evonik Industries AG, IFF(Danisco Animal Nutrition), Land O'Lakes and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93767

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Lysine

- 5.1.2 Methionine

- 5.1.3 Threonine

- 5.1.4 Tryptophan

- 5.1.5 Other Amino Acids

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 fish

- 5.2.1.1.4 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 Alltech, Inc.

- 6.4.4 Archer Daniel Midland Co.

- 6.4.5 Evonik Industries AG

- 6.4.6 IFF(Danisco Animal Nutrition)

- 6.4.7 Kemin Industries

- 6.4.8 Land O'Lakes

- 6.4.9 Novus International, Inc.

- 6.4.10 SHV (Nutreco NV)

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.