PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431245

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431245

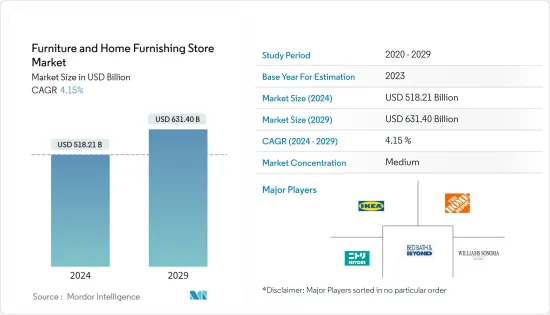

Furniture and Home Furnishing Store - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Furniture and Home Furnishing Store Market size is estimated at USD 518.21 billion in 2024, and is expected to reach USD 631.40 billion by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

Over the years, trends and new ideas have come and gone in the furniture and home furnishings industry.With increasing housing prices and a shortage of space, furniture and furnishings are being modified to make it possible to live in a smaller space. Through technology and new ideas, sofas, beds, and other types of furniture are getting better and better.

With the start of COVID-19, people were limited in what they could do in their homes, and people around the world were spending more and more time at home. This made people change the way they decorated and furnished their homes. Smart home products observed a continuous increase in purchases as consumers spent more time at home. With a growing percentage of the population working from home, multi-purpose furniture is in high demand, serving a variety of functions. This leads to furniture stores increasing their variety of products.

Over the upcoming period and in recovery from COVID-19, furniture providers started providing customers with a variety of furniture products based on their needs. Brands and stores are adopting the latest technologies to capitalize on and grow their digital marketplaces. For increasing sales and revenue, stores are providing customers with fast and free shipping, financing, a personalized experience, cash and carry, and other options.

Furniture & Home Furnishing Store Market Trends

Increasing popularity of DIY furniture and home decor

The DIY furniture market is expanding due to changes in lifestyle and an increase in modern home renovations. The availability of contemporary home renovations encourages people to build outdoor gardens and galleries in their houses, for which they purchase do-it-yourself outdoor furniture to improve the aesthetic appeal of their houses. Another factor fuelling the DIY furniture market's expansion is the world's rapid urbanization and globalization.

The rising standard of living is a result of increased urbanization. The demand for creative do-it-yourself furniture products may rise quickly because of technological advancements. The factors anticipated to propel market growth include the expansion of Furniture Stores with attractive products.

North America is Witnessing a Surge in Demand for Home Furnishings

Increasing household numbers are among the factors contributing to the Noth America real estate industry's growth. Consequently, the region market for furniture for homes is seeing growth. Additionally accelerating the real estate industry's growth is the region growing immigrant population. Home furnishings are becoming more and more in demand as North America residential construction picks up steam and the country's residential activity rises. This is especially true for newly purchased homes. It is anticipated that this will increase market demand.

The United States Census Bureau estimates that there were almost 139 million household units in the previous year. In current year, there were approximately 1.0 million new housing units added to the single-family and multifamily housing stock. It is projected that through forecasted period, the average annual number of new households will be approximately 1.22 million.

Furniture & Home Furnishing Store Industry Overview

As the economy is recovering from the impact of COVID-19 and the furniture and home furnishings market is recovering from supply chain disruptions and market fluctuations, the focus of furniture and home furnishings stores is on capturing a segment of the market to increase their market share, as a result of which they are focusing on the online and offline modes of their sales. Ashley Furniture Industries, Heritage Home Group, Herman Miller, Inter Ikea Systems, Steelcase, The Home Depot, Bed Bath & Beyond, Nitori Holdings, Williams Sonoma, and Furniture are among the existing stores, competing with each other for a larger share of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Furniture Stores

- 5.1.2 Home Furnishing Stores

- 5.2 By Ownership

- 5.2.1 Retail Chains

- 5.2.2 Independent Stores

- 5.3 By Store Type

- 5.3.1 Exclusive/Retail Showrooms

- 5.3.2 Inclusive Retailers/Dealers Store

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ashley Furniture Industries

- 6.1.2 Heritage Home Group

- 6.1.3 Herman Miller

- 6.1.4 Inter Ikea System

- 6.1.5 Steelcase

- 6.1.6 The Home Depot

- 6.1.7 Bed Bath & Beyond

- 6.1.8 Nitori Holdings

- 6.1.9 Williams Sonoma

- 6.1.10 Global Furniture

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US