PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906127

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906127

Japan Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

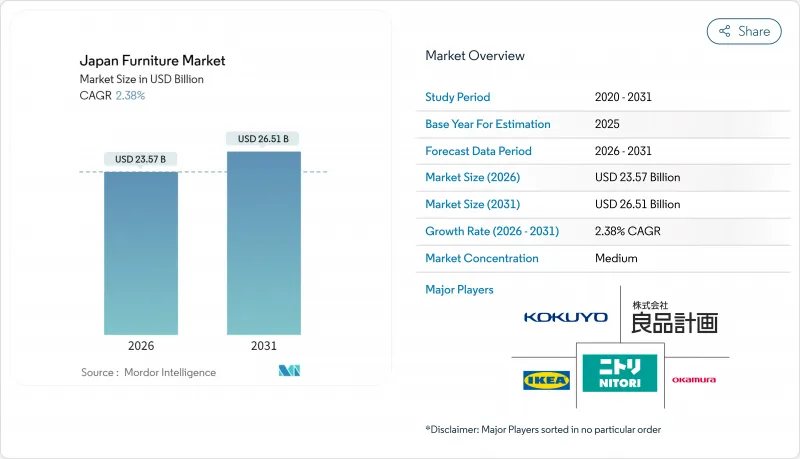

Japan furniture market size in 2026 is estimated at USD 23.57 billion, growing from 2025 value of USD 23.02 billion with 2031 projections showing USD 26.51 billion, growing at 2.38% CAGR over 2026-2031.

Steady growth stems from demographic aging, sustained urban migration, and government incentives that favor domestic wood utilization, rather than from short-term macro cycles. Demand is tilting toward space-saving designs, senior-friendly ergonomics, and premium durability, trends that collectively steer product development and pricing. Major players, led by Nitori, IKEA Japan, and MUJI, pursue vertical integration, omnichannel retail, and sustainable material innovation to defend share and improve margins. Currency volatility heightens raw-material cost risks, yet tourism recovery and digital retail adoption provide offsetting opportunities.

Regional dynamics reveal Kanto's commanding 32.51% market share in 2024, anchored by Tokyo's population density of 6,402.6 persons per square kilometer, yet Kyushu & Okinawa lead regional growth at 3.64% CAGR. This geographic divergence reflects migration patterns where 85.30% of Tokyo's 96,000 annual in-migrants are aged 20-29, creating urban furniture demand, while southern regions benefit from tourism recovery and lifestyle migration.

Japan Furniture Market Trends and Insights

Rapid Aging Population Driving Senior-Friendly Furniture

Japan's population share aged 65 and older surpassed 30% in 2025, and 40.70% of households now include at least one senior member. Manufacturers respond by embedding adjustable heights, grab rails, and anti-microbial surfaces in everyday products, thereby expanding beyond clinical settings. France Bed displayed sixty welfare designs at HCR 2024, while Paramount Bed introduced multi-position electric frames that lessen caregiver strain. Rising longevity fuels premiumization because older buyers place higher value on durability, comfort, and smart-home connectivity. Government policy that favors aging-in-place grants and nursing-home expansion further boosts institutional demand. Collectively, these forces add roughly 0.8 percentage points to the long-term growth outlook.

Urban Downsizing Boosts Space-Saving Modular Products

Tokyo's population density now exceeds 6,400 persons per square kilometer, and single-person households reached 38.10% of the national total in 2024. Small apartments averaging 20 square meters make multifunctional furniture essential for daily living. MUJI's renovation partnership with the Urban Renaissance Agency more than doubled rental inquiries for compact open-plan units, confirming market acceptance. Meanwhile, start-ups such as Subsclife rent modular sets that fold into desks or beds, easing relocation for a highly mobile workforce. Space constraints encourage lightweight composites and collapsible frames that reduce delivery costs and enable one-person assembly. These trends collectively contribute an additional 0.60% to the medium-term CAGR.

Yen-Driven Spikes in Imported Timber Costs

A 15% depreciation in the yen between 2023 and 2025 lifted CIF prices for Southeast Asian plywood and North American hardwoods. Smaller manufacturers lack hedging capacity and face margin compression as raw-material outlays rise faster than retail prices. Larger chains mitigate volatility by pre-buying inventory and expanding domestic sourcing under the government's subsidy framework. Cost pressure is also being offset by surging inbound tourism that increases hospitality demand, yet the net effect still subtracts about 0.4 percentage points from market growth. The restraint is expected to ease once currency rates stabilize or pass-through pricing gains acceptance.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidies for Domestic Wood Utilization

- Subscription Furniture Models Gain Millennial Traction

- Decline in New Rural Housing Starts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare products expanded at a 3.02% CAGR, surpassing the Japan furniture market size growth rate and highlighting demand for hospital beds, rehab seating, and elderly-care fixtures. Home furniture still contributed the bulk of 2025 revenue at 57.62%, yet aging demographics and institutional investment propel specialized suppliers such as Paramount Bed and France Bed. The premiumization effect manifests clearly here because medical facilities and affluent seniors pay for durability, infection control, and sensor integration. Contract wins for new long-term-care facilities are likely to sustain momentum through 2031. Meanwhile, office and hospitality categories remain sensitive to remote-work trends and post-Expo inventory adjustments, keeping their trajectories below the overall market pace.

The healthcare surge elevates ancillary product lines like over-bed tables and anti-decubitus mattresses, encouraging modular designs that simplify after-sales maintenance. Digital monitoring solutions underpin product differentiation, with sensor-equipped frames transmitting real-time patient data to nursing stations. Government reimbursement programs for assistive devices make these technologies accessible beyond high-end private clinics. Continuous R&D by domestic firms protects market share against low-cost imports. Altogether, healthcare contributes a growing proportion of incremental revenue and mitigates cyclicality in the Japan furniture market.

Wood retained 60.72% of 2025 revenue, underscoring its cultural resonance and subsidy-backed supply, yet plastic and polymer furniture clocked the fastest 3.55% CAGR, outpacing the overall Japan furniture market share leader. Lightweight polymers suit compact apartments, reduce shipping costs, and facilitate recyclable content, aligning with ESG targets of leading retailers. Material suppliers collaborate with universities to create bio-composite resins using food-industry waste, improving strength and lowering carbon footprints. Metal remains vital for office and contract segments that prioritize durability under high-traffic conditions. Engineered bamboo and hybrid laminates occupy niche positions in premium artisanal lines.

Supply-chain dynamics favor domestic processors who qualify for Forestry Agency grants when substituting imported hardwoods with local cedar cores clad in polymer veneer. Consumers respond positively to scratch-resistant, easy-clean coatings that extend product lifespan. Circular economy pilots led by major chains collect post-use polymer pieces for closed-loop recycling, reinforcing brand loyalty. Although polymers begin from a smaller base, their speed of expansion ensures a rising contribution to the Japan furniture market size.

The Japan Furniture Market Report is Segmented by Application (Home Furniture, Office Furniture, Hospitality Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Other Materials), Price Range (Economy, Mid-Range, Premium), Distribution Channel (B2C/Retail, B2B/Project), and Geography (Hokkaido, Tohoku, Kanto, Chubu, Kansai, Chugoku, Shikoku, Kyushu & Okinawa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nitori Holdings Co., Ltd.

- IKEA Japan K.K.

- Ryohin Keikaku Co., Ltd. (MUJI)

- Okamura Corporation

- Kokuyo Co., Ltd.

- Itoki Corporation

- Karimoku Furniture Inc.

- Maruni Wood Industry Inc.

- Hida Sangyo Co., Ltd.

- IDC Otsuka Furniture

- Francfranc Corporation

- Tokyo Interior Furniture Co., Ltd.

- Shimachu Homes Co., Ltd.

- Actus Corporation

- UNICO (ACME Co., Ltd.)

- NOCE (Shirakawa Co., Ltd.)

- Dinos Cecile Co., Ltd.

- Sanwa Company Ltd.

- Iwata Co., Ltd. (bedding)

- Kashiwa Mokko Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid ageing population driving demand for senior-friendly & ergonomic furniture

- 4.2.2 Urban downsizing boosting space-saving modular products

- 4.2.3 Government subsidies for domestic wood utilisation

- 4.2.4 Subscription/rental furniture models gaining traction among millennials

- 4.2.5 Integration of IoT in care-oriented furniture (e.g., smart beds)

- 4.2.6 Osaka-Kansai Expo 2025 hospitality build-out

- 4.3 Market Restraints

- 4.3.1 Yen-driven spikes in imported timber costs

- 4.3.2 Decline in new rural housing starts

- 4.3.3 Stricter 2025 fire-safety standard for upholstered items

- 4.3.4 Post-Expo FF&E liquidation glut

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for the Furniture Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Home Furniture

- 5.1.1.1 Chairs

- 5.1.1.2 Tables (side, coffee, dressing, etc.)

- 5.1.1.3 Beds

- 5.1.1.4 Wardrobe

- 5.1.1.5 Sofas

- 5.1.1.6 Dining Tables/Dining Sets

- 5.1.1.7 Kitchen Cabinets

- 5.1.1.8 Other Home Furniture (bathroom, outdoor, etc.)

- 5.1.2 Office Furniture

- 5.1.2.1 Chairs

- 5.1.2.2 Tables

- 5.1.2.3 Storage Cabinets

- 5.1.2.4 Desks

- 5.1.2.5 Sofas & Other Soft Seating

- 5.1.2.6 Other Office Furniture

- 5.1.3 Hospitality Furniture

- 5.1.4 Educational Furniture

- 5.1.5 Healthcare Furniture

- 5.1.6 Other Applications (public places, retail malls, govt offices, etc.)

- 5.1.1 Home Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 B2C / Retail

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Furniture Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B / Project

- 5.4.1 B2C / Retail

- 5.5 By Region

- 5.5.1 Hokkaido

- 5.5.2 Tohoku

- 5.5.3 Kanto

- 5.5.4 Chubu

- 5.5.5 Kansai

- 5.5.6 Chugoku

- 5.5.7 Shikoku

- 5.5.8 Kyushu & Okinawa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Nitori Holdings Co., Ltd.

- 6.4.2 IKEA Japan K.K.

- 6.4.3 Ryohin Keikaku Co., Ltd. (MUJI)

- 6.4.4 Okamura Corporation

- 6.4.5 Kokuyo Co., Ltd.

- 6.4.6 Itoki Corporation

- 6.4.7 Karimoku Furniture Inc.

- 6.4.8 Maruni Wood Industry Inc.

- 6.4.9 Hida Sangyo Co., Ltd.

- 6.4.10 IDC Otsuka Furniture

- 6.4.11 Francfranc Corporation

- 6.4.12 Tokyo Interior Furniture Co., Ltd.

- 6.4.13 Shimachu Homes Co., Ltd.

- 6.4.14 Actus Corporation

- 6.4.15 UNICO (ACME Co., Ltd.)

- 6.4.16 NOCE (Shirakawa Co., Ltd.)

- 6.4.17 Dinos Cecile Co., Ltd.

- 6.4.18 Sanwa Company Ltd.

- 6.4.19 Iwata Co., Ltd. (bedding)

- 6.4.20 Kashiwa Mokko Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Rising Demand for Minimalist, Space-Saving Urban Furniture Solutions

- 7.2 Premium Traditional Craftsmanship Blending with Modern Aesthetics