Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693770

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693770

India Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 137 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

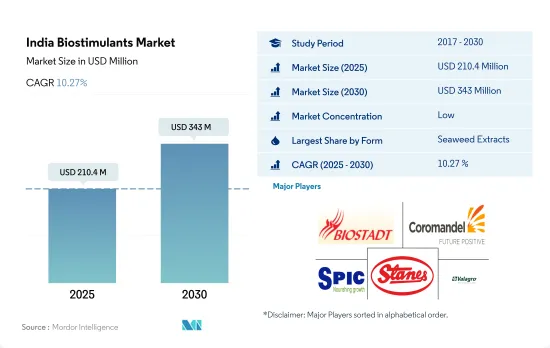

The India Biostimulants Market size is estimated at 210.4 million USD in 2025, and is expected to reach 343 million USD by 2030, growing at a CAGR of 10.27% during the forecast period (2025-2030).

- Many biostimulants as active ingredients are used in the Indian biostimulants market, including humic acid, fulvic acid, amino acids, protein hydrolysates, seaweed extracts, chitosan, biopolymers, and other biostimulants such as plant and animal derivatives. The Indian biostimulants market was valued at USD 153.2 million in 2022 and grew by 15.7% between 2017 and 2022.

- Seaweed extract biostimulants have the largest market share in the Indian biostimulants market, accounting for 37.4% in 2022, with a market value of USD 57.3 million in 2022. This is due to their ability to improve the overall health of the plant, as well as their ability to improve stress tolerance, root growth, nutrition and water intake, plant growth, and crop yield.

- Row crops accounted for 86.2% of the biostimulants market value in 2022. This is because row crops accounted for approximately 82.3% of the total organic crop area in the country in 2022. Cash crops and horticultural crops account for 11.2% and 2.6% of the biostimulants market, respectively, in 2022.

- As the demand for organic food items is on the rise, the Indian government is promoting the production of organic crops, fruits, and vegetables through various schemes, like National Horticulture Mission, Horticulture Mission for North East and Himalayan States, Rashtriya Krishi Vikas Yojana, National Project on Management of Soil Health and Fertility, National Project on Organic Farming, Network Project on Organic Farming under Indian Council of Agricultural Research, and Paramparagat Krishi Vikas Yojana. These initiatives will boost the Indian biostimulants market.

- The Indian biostimulants market value is anticipated to grow between 2023 and 2029 by 81.2%, with a CAGR of 10.4%.

India Biostimulants Market Trends

Growing number of organic producers helping the increase in area under organic cultivation, primarily in row crops

- India is the largest country, in terms of the total number of certified organic producers in the world, with 1.3 million organic producers in 2019. Despite having a large number of organic producers, organic cultivation areas in the country account for around 2.0% of the total agriculture area in the country. In 2021, the organic area in the country was recorded as 711,094.0 hectares, which increased by about 3.4% compared to 2017. Organic farming in the country is concentrated in only a few states. The top ten organic farming states in the country account for about 80.0% of the total organic crop area. A few states have taken the lead in improving organic farming coverage, like Madhya Pradesh, Rajasthan, and Maharashtra, which are the top three organic farming states in the country. Madhya Pradesh alone accounted for about 27.0% of India's total organic cultivation area in 2019.

- Organic cultivation of row crops is dominant in the country, which accounted for about 59.7% of the total organic crop area in 2021. Cereal crop production is dominant rice, wheat, millet, and maize are the major cereals produced. Most cereal crops are grown in the kharif season (June - September). The crops grown in this season are mainly rain dependent or require more water, like rice, maize, cotton, and soybean.

- The overall organic cash crop cultivation area increased from 0.27 million hectares in 2017 to 0.28 million hectares in 2021. The major cash crops produced in the country are cotton, sugarcane, tea, and spices. There is a limited growth of organic horticultural crops currently in the country. The increasing demand for organic products and Indian government initiatives to go organic are anticipated to increase organic crop area between 2023 and 2029.

Growing demand and their easy accessibility through e-commerce channels, rising the per capita spending on organic food

- India's per capita spending on organic products is relatively low at USD 0.23 compared to the average per capita spending on organic products in Asia-Pacific. However, in recent years, shifting consumer demand has increased toward organic products as more customers perceive these items offer better immunity, higher quality, and more accessibility through e-commerce channels. India is a promising and developing market for organic foods and beverages. India's domestic organic food and beverage industry is expected to be worth USD 138.0 million by 2024, rising at a compound annual growth rate of 13% between 2019 to 2024.

- In 2022, the total combined organic food and beverages worth USD 108.0 million consumed in the country. The consumption value of organic products in the country increased from USD 45 million in 2016 to USD 96.0 million in 2021. Organic food sales have seen an increasing trend mainly due to increasing consumer awareness, and high-income consumers are propelling organic food and beverage consumption. Categories that gained the most demand included essential foods, such as organic eggs, dairy, and fruits and vegetables.

- Organic beverage consumption dominated the market and accounted for about 85.2% of the total combined organic food and beverages market value in 2022. The organic beverages segment includes organic packaged food and beverages that are certified by the approved certification body. Organic beverage consumption value increased at a CAGR of 14% between 2020 to 2022. The price premium associated with organic products hampers lower-income consumer access and is the major limiting factor for organic food consumption. However, organic products' active promotion and advantages drive the organic food market during the forecast period.

India Biostimulants Industry Overview

The India Biostimulants Market is fragmented, with the top five companies occupying 10.77%. The major players in this market are Biostadt India Limited, Coromandel International Ltd, Southern Petrochemical Industries Corporation, T.Stanes and Company Limited and Valagro (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 500030

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Biostadt India Limited

- 6.4.2 Coromandel International Ltd

- 6.4.3 Corteva Agriscience

- 6.4.4 GrowTech Agri Science Private Limited

- 6.4.5 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.6 Indian Farmers Fertiliser Cooperative Limited

- 6.4.7 Rallis India Ltd

- 6.4.8 Southern Petrochemical Industries Corporation

- 6.4.9 T.Stanes and Company Limited

- 6.4.10 Valagro

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.