PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693814

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693814

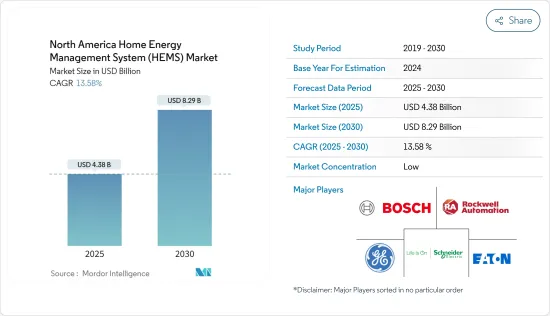

North America Home Energy Management System (HEMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Home Energy Management System Market size is estimated at USD 4.38 billion in 2025, and is expected to reach USD 8.29 billion by 2030, at a CAGR of 13.58% during the forecast period (2025-2030).

A home energy management system (HEMS) combines hardware and software components to manage home energy usage efficiently. Compatible appliances can also be connected to a HEMS, allowing the user to control when appliances operate, including manually turning appliances off or on and setting up scheduled running times.

Key Highlights

- Smart home technology has been gaining increasing popularity in recent years. A survey by Cinch Home Services during the second wave of the COVID-19 pandemic found that 77% of the respondents embraced the concept of smart home technology overall and had a positive sentiment. Smart home technologies present consumers with new ways to control and interact with their environments and unlock new opportunities for managing energy savings. Smart home solutions also continue to grow and have the potential to be more interconnected with HEMS systems within individual homes.

- There is a rapid transition towards smart grids due to the continuously growing electricity consumption and the need to provide a secure and sustainable power supply. Energy management systems are a vital part of the smart grids as they help to improve renewable energy consumption and energy efficiency. EMS is used to regulate and manage electric power so that it operates at its best. Utilizing a variety of sensors to obtain information in EMS may enhance the protection and safety of power infrastructure.

- The growing demand for energy across North America drives the investment in energy-efficient devices. For instance, as per the US Department of Energy, heating and cooling account for about 50% of a typical home's energy usage, which makes high-performance energy management systems such as HVAC controllers, Programmable Communicating Thermostats, Advanced Central Controllers systems critical to managing energy consumption and costs for homeowners as well as cumulatively across the nation.

- Installing a fully automated, state-of-the-art Energy Management System (EMMS) in a building comes with significant upfront costs. As homeowners want to reduce their energy consumption, they require energy management systems that track the energy consumption of various devices. The use of energy-efficient solutions and practices leads to substantial long-term cost savings and energy savings. However, it requires a large upfront investment, slowing down the adoption.

- The impact of current macroeconomic factors on the automation sector is a complex and dynamic issue that can affect economic growth and labor productivity. Rise in inflation may result in higher production costs, impacting the adoption of smart sensors. As governments combat inflation by increasing interest rates, new job creation would slow down and impact economic activity and growth.

North America Home Energy Management System (HEMS) Market Trends

Hardware Component is Expected to Hold the Major Market Share

- The hardware segment comprises sensors, thermostats, lighting panels, and other EMS components. The hardware of an energy management system comprises sensors and bridges. Energy Monitoring hardware is incorporated with the system, as the system is the energy source, and the devices consume it for operation. The power monitoring unit transmits the collected data into the system.

- EMS allows for continuous home monitoring and provides information on potential opportunities and risks. In addition to reading and controlling space temperatures, EMS thermostats collect data and transmit it to the server and the cloud for use in facility analytics. These analytics allow facility managers to monitor their locations remotely and reduce maintenance costs and energy consumption.

- Wired and wireless sensors such as space temperature, water heaters, and photocell sensors are widely used in the home to monitor data sets. The evolution of IoT sensors further helps market growth as integrating IoT sensors in energy management systems allows us to adjust energy usage automatically based on occupancy, climate conditions, and other factors. According to the US Department of Energy, including IoT sensors in buildings might result in up to 30% energy savings. The advancement in sensing technology further increases the capabilities of the sensors, which will increase its demand in the EMS market.

- Moreover, growing urbanization and the rising shift toward building urban lifestyles drive the expansion of the installation of smart home devices and technologies, which include automatic control of light, electricity, and energy to evade wastage.

- According to UN-HABITAT, 82.6% of the North American population lived in urban areas, this would increase to 89% in the future. Thus, the growing adoption of intelligent solutions such as smart meters, PV batteries, smart sensors, and technologies across homes is further likely to boost segment growth. A lighting control panel is usually installed with the EMS; relays and contactors are inside the control panel. These relays and contactors communicate with the lighting when it is required to be off and on. The advancement in the control panel further drives the segment growth.

- The solar capacity in the United States experienced significant growth over the last decade, encompassing large utility-scale solar farms with a capacity of one megawatt or more, as well as small-scale solar installations. The majority of small-scale solar installations consist of residential rooftop solar panels.

United States is Expected to Hold the Major Market Share

- The increase in residential users and the growing demand for energy efficiency goals, renewable energy integration, cost savings, smart home integration, and environmental concerns are driving the expansion of the country's home energy management system market.

- With the increasing adoption of renewable energy sources like solar panels in residential properties, there is a growing need for home energy management systems to monitor, manage, and optimize energy production and consumption. These systems can help homeowners take full advantage of renewable energy resources and ensure efficient utilization.

- As per the Solar Energy Industries Association, the capacity of utility-scale solar photovoltaic systems reached almost 100 GW of direct current in the United States. Meanwhile, residential solar systems accounted for over 32 GW of direct current.

- Home energy management systems provide homeowners with detailed insights into their energy usage patterns, which allows them to identify areas of inefficiency and make necessary adjustments. By effectively managing energy consumption, homeowners can reduce energy waste, resulting in cost savings over time. These systems facilitate budgeting by providing real-time energy usage data and enabling users to set energy consumption goals.

- For instance, according to IEA, the US retail price for electricity increased almost every year since 1990. Hawaii is the state with the maximum household electricity price in the United States. In September 2023, the average retail price of electricity for Hawaiian residences amounted to 42.69 US cents (USD 0.000855) per kilowatt-hour.

- Inflation Reduction Act of 2022 offers households a tax credit equal to 30% of the installation costs for products in the highest efficiency tier, up to a maximum of USD 600 for qualified air conditioners and furnaces and USD 2,000 for qualified heat pumps. New federal income tax credits are available through 2032, providing up to USD 3,200 each year to reduce the cost of energy-efficient home modifications by up to 30%. The tax credits cover modifications such as installing heat pumps, heat pump water heaters, insulation, doors, and windows, upgrading electrical panels, conducting home efficiency audits, and more, which can help households cut their energy costs every month for years to come.

- The modified and extended Residential Clean Energy credit, which offers a 30% income tax credit for clean energy equipment like rooftop solar, wind energy, and geothermal heat pumps, be reduced to 26 and 22% in the coming years, is another option available to homeowners in addition to the energy efficiency credits. Such government initiatives are anticipated to drive the market in the region, benefiting homeowners and home builders by promoting the installation of home energy management systems.

- Rising disposable income, rising construction activity in emerging markets, and shifting weather patterns drive industry expansion. Smart home and smart city projects are being implemented significantly in the United States, fueling the market's expansion. The region's government is also promoting the use of smart cities, accelerating the development of the market under study.

North America Home Energy Management System (HEMS) Market Overview

The North American home energy management system market is fragmented, with the presence of major market players like Robert Bosch GMBH, Rockwell Automation Inc., General Electric Company, Schneider Electric SE, and Eaton Corporation PLC. Market players are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Honeywell launched Advance Control for Buildings. It is designed to automate building management and provide the foundation for a building's energy efficiency strategy. Advance Control combines the latest technologies with decades of innovation and domain expertise. As part of this rollout, Honeywell recently announced strategic alliances with two semiconductor manufacturers, NXP Semiconductors NV and Analog Devices Inc., to streamline the transition to intelligent edge processing.

- December 2023 - ABB announced a new US manufacturing facility to support the electric utility sector and transition to clean energy. ABB's investment in the manufacturing facility will expand its production capabilities and double its capacity to support utilities in revitalizing the US energy infrastructure and tackling climate solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 After-effects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Smart Grids and Smart Meters

- 5.1.2 Rising Investments in Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Management Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Product Type

- 6.2.1 Lighting Controls

- 6.2.2 Self-Monitoring Systems and Services

- 6.2.3 Programmable Communicating Thermostats

- 6.2.4 Advanced Central Controllers

- 6.2.5 Intelligent HVAC Controllers

- 6.3 By Technology

- 6.3.1 ZigBee

- 6.3.2 Wi-Fi

- 6.3.3 Internet

- 6.3.4 Z-Wave

- 6.3.5 Other Technologies

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GMBH

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 General Electric Company

- 7.1.4 Schneider Electric SE

- 7.1.5 Eaton Corporation PLC

- 7.1.6 Enel X North America, Inc. (ENEL SPA)

- 7.1.7 SAP SE

- 7.1.8 Siemens AG

- 7.1.9 ABB Limited

- 7.1.10 Oracle Corporation

- 7.1.11 Honeywell International Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS