PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644973

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644973

Europe High Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

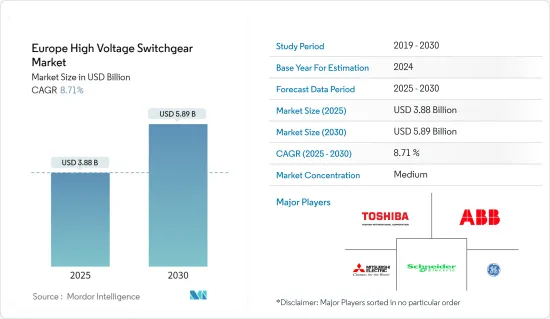

The Europe High Voltage Switchgear Market size is estimated at USD 3.88 billion in 2025, and is expected to reach USD 5.89 billion by 2030, at a CAGR of 8.71% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, increasing electricity generation and consumption, along with the changing power generation industry dynamics, are expected to be the major drivers for the T&D network growth, which, in turn, is expected to drive the high-voltage switchgear market during the forecast period.

- On the other hand, stringent environmental and safety regulations related to the high-voltage switchgear market are restraining factors. Also, increasing competition from the unorganized sector of the overall switchgear market is expected to restrain the high-voltage switchgear market in the coming years.

- Nevertheless, the expansion of power transmission and distribution (T&D) infrastructure to achieve high electricity access rates in both developing and underdeveloped nations is expected to create significant opportunities for the high age switchgear manufacturers.

Europe High Voltage Switchgear Market Trends

Gas-Insulated Switchgear is Expected to Witness a Significant Growth

The gas-insulated switchgear (GIS) is a metal-enclosed device with high-voltage components like disconnectors and circuit breakers. The device is more reliable, environment-friendly, and flexible than air-insulated switchgear (AIS). Fostered by better space optimization, low maintenance cost, and enhanced protection against external elements, the demand for gas-insulated switchgear will likely increase during the forecast period.

The primary use of switchgear is to provide safety to the distribution system by disengaging in hazardous conditions. The gas-insulated switchgear is commonly used in high or ultra-high-voltage systems. In the gas-insulated switchgear, sulfur hexafluoride (SF6) gas is used for insulation, and vacuum technology is used for circuit breaking. SF6 gas is chemically stable, non-flammable, and highly electronegative, with a dielectric property making it suitable for the gas-insulated switch gears.

Gas-insulated switchgear is generally used in power transmission applications, integrating renewable power generation units toward the grid, substations, railways, industrial complexes, etc., where the gas-insulated switchgear plays a vital role in protecting and controlling electrical devices.

According to the European Commission, in its offshore renewable energy plan, the EU's climate change targets require 60 GW of offshore wind by 2030 and 300 GW by 2050, which is a five-fold increase by 2030 and a 25-fold increase by 2050 from the current offshore wind capacity of 12 GW. Expanding offshore renewable energy will likely require an investment worth nearly EUR 800 billion (USD 946 billion) by 2050 to build vast new wind farms at sea and scale-up promising technology like floating turbines. Additionally, the EU plans to propose rules better to coordinate the countries' power grids at sea and enable offshore bidding zones for wind farms that supply power to multiple countries.

Additionally, in 2022, according to International Renewable Energy Statistics, the total renewable energy installed capacity for the Europe region accounted for 708.58 GW. The use of renewable energy is expected to increase. As gas-insulated switchgear is safe in the use of renewable projects, thus, demand for this segment is expected to grow in the forecast period.

Therefore, owing to the above points, the demand for gas-insulated switchgear is expected to grow significantly during the forecast period.

Germany is Likely to Dominate the Market

The EU power generation mix is expected to change considerably in favor of renewables over the next few years, with countries such as Germany, Spain, Belgium, and France increasingly moving toward a low-carbon economy.

Besides, with the falling cost of renewables-based power generation, T&D infrastructure's requirement is expected to increase with several investment plans that are likely to come up to achieve its 2050 target. As per the World Economic Forum, Europe as a region would require USD 3.8 trillion in investment in renewable energy to achieve the 2050 target. Thus, favorable renewable energy targets will significantly boost the growth of the renewable energy market, integrating the renewables into the national grids, which is expected to drive the high-voltage switchgear market.

Germanymarket's growth, one of the leading European countries, plans to phase out coal and nuclear power plants, and is likely to move towards renewable energy by 2035. The country is phasing out its remaining three nuclear reactors in January 2022 and is planning to phase out coal power plants by 2030. Hence, with such a transitional phase, Germany is likely to build 7783 kilometers (Km) of high-voltage transmission lines and likely to invest around EUR 55 billion by 2030.

According to International Renewable Energy Statistics, the total renewable energy capacity of Germany accounted for 148.4 GW in 2022, which was greater than 138.5 GW in 2021. Thus, the increasing renewable energy capacity will create demand for power transmission networks, which, in turn, will support the completely in the forecast period.

Therefore, owing to the above points, Germany is expected to witness significant growth during the forecast period.

Europe High Voltage Switchgear Industry Overview

The Europe high voltage switchgear market is semi-consolidated. Some of the key players in this market (not in a particular order) include ABB Ltd, Schneider Electric SE, General Electric Company, Toshiba International Corporation, and Mitsubishi Electric Corporation, among others.

General Electric Company is focused on addressing the challenges of the energy transition by enabling the safe and reliable connection of renewable and distributed energy resources to the grid. The company has developed a range of products which help improve safety, and flexibility. As a part of its strategy, the company developed products like, Hybrid Gas-Insulated Switchgear and Mobile station.

The B105 & T155 H-GIS Hybrid Gas-Insulated Switchgear that focuses on 550 kV in power generation, transmission, and heavy industry applications, is environmentally friendly and features one of the lowest gas weights on the market and an advanced SF6 sealing system. Complete digital monitoring control and protection capabilities enable the B105 & T155 to be readily integrated into the smart grid.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in Transmission & Distribution Infrastructure

- 4.5.2 Restraints

- 4.5.2.1 Strict Environmental Regulations and Concerns Regarding the Use of SF6 Gas

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Air-insulated

- 5.1.2 Gas-insulated

- 5.1.3 Other Types

- 5.2 Geography

- 5.2.1 Europe

- 5.2.1.1 Germany

- 5.2.1.2 United Kingdom

- 5.2.1.3 Italy

- 5.2.1.4 France

- 5.2.1.5 Rest of the Europe

- 5.2.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 General Electric Company

- 6.3.3 Siemens AG

- 6.3.4 Toshiba International Corporation

- 6.3.5 Mitsubishi Electric Corporation

- 6.3.6 SGC SwitchGear Company

- 6.3.7 Larson & Turbo Limited

- 6.3.8 KOHL Gmbh

- 6.3.9 Hitachi Energy Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Commercializing Alternatives to SF6