PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644974

North America Low Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

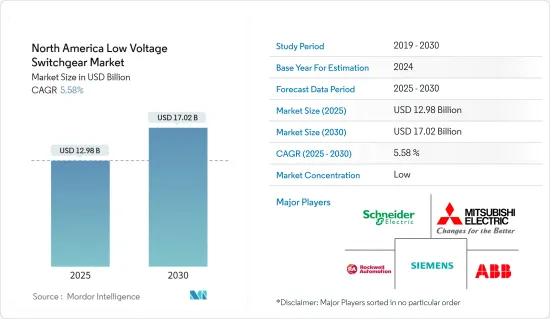

The North America Low Voltage Switchgear Market size is estimated at USD 12.98 billion in 2025, and is expected to reach USD 17.02 billion by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing installation of renewable energy and rising construction activities are the significant growth driving factors for this market. The rising number of distribution systems across North America significantly increases the demand for the low-voltage switchgear market.

- On the other hand, high installation costs, as well as delays in the project execution, restrains the growth of the market.

- Nevertheless, the low-voltage switchgear demand across primary and secondary distribution networks will likely create lucrative opportunities for market growth.

North America Low Voltage Switchgear Market Trends

Distribution Segment to Witness a Significant Growth

- The distribution system includes a network of power lines, substations, transformers, and other equipment to transport and deliver electrical power to the end users. The distribution system is divided into two categories primary and secondary distribution. The primary distribution refers to transmitting high-voltage electricity from the power plant to the local substations. The secondary distribution refers to the delivery of lower-voltage electricity to end-users.

- North America is witnessing a rapid increase in industrialization and urbanization, leading to the emergence of numerous commercial and industrial entities. This led to substantial growth in data centers, manufacturing, and other industries. This trend is anticipated to increase the demand for various transmission and distribution equipment such as switchgear, etc.

- The rapid transition from conventional sources of electricity generation to renewable sources further bolsters the demand for distribution network expansion across the region. In 2022, around 817.8 TWh of electricity has been generated from renewable energy sources.

- Along with industrialization and urbanization, the electricity demand has increased. Thus, increasing the demand for distribution systems in the United States and Canada.

- According to U.S. Energy Information Administration (EIA), total electricity consumption in the United States in 2022 was about 4.05 trillion kWh. Direct electricity use by the industrial and commercial sectors in the United States was about 3% of total electricity end-use consumption in 2022.

- Therefore owing to the above points, the distribution system is expected to hold a significant market share during the forecasted period.

United States to Dominate the Market

The United States is anticipated to dominate the low-voltage switchgear market during the forecast period. The transition from fossil fuel-based electricity generation to clean sources-based energy generation increases the transmission and distribution infrastructure demand.

The country's transition towards cleaner sources of energy generation, such as solar, wind, bioenergy, biomethane, and others. The increasing installation of such electricity-generating sources increases the demand for the expansion of the distribution networks, which further increases the installation of low-voltage switchgear. According to IRENA, the country's installed renewable energy capacity was around 351.67 GW in 2022,

In addition, the investment in upgrading the distribution systems is also increasing in the country. Establishing smart grid technology and rapidly growing industrialization within the country is also responsible for driving growth in the low-voltage switchgear market.

The key market players are also expanding their distribution networks within the country, and several foreign players are also entering the U.S. distribution market. For instance, In April 2021, Enel, an Italy-based energy company, announced its plans to expand its energy distribution business into the U.S. market. The company planned to invest around USD 19.52 billion in distribution networks over the next two years, and it has prepared to invest around USD 72.23 billion by 2030.

The factors mentioned above are likely to drive growth in the low-voltage switchgear market in the United States during the forecast period.

North America Low Voltage Switchgear Industry Overview

The low voltage switchgear market is fragmented. Some of the key players in this market (not in a particular order) include ABB Ltd., Mitsubishi Electric Corporation, Schneider Electric, Rockwell Automation, and Toshiba Corporation, among others.

According to the Toshiba Corporation, the company's strategic methods include, expaning company's manufacturing facilities that act as catalysts for the organic growth by increasing its solutions and high-value services offerings and capabilities. For instance, in March 2023, Siemens invested USD 32.61 million to expand its switchgear plant in Frankfurt-Fechenheim. A smart, fully automated high-speed warehouse and a 1,200 square-meter extension to an existing hall are being built on the 160,000 square-meter site.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Installation of Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Substation

- 5.1.2 Distribution

- 5.2 Installation

- 5.2.1 Outdoor

- 5.2.2 Indoor

- 5.3 Voltage Range

- 5.3.1 Below 250 V

- 5.3.2 250 V - 750V

- 5.3.3 750V - 1000 V

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Mitsubishi Electric Corporation

- 6.3.3 Schneider Electric

- 6.3.4 Rockwell Automation

- 6.3.5 Siemens AG

- 6.3.6 WEG

- 6.3.7 Fuji Electric

- 6.3.8 Hitachi

- 6.3.9 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Low-voltage Switchgear Demand across Primary and Secondary Distribution Networks