PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644976

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644976

South America Low Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

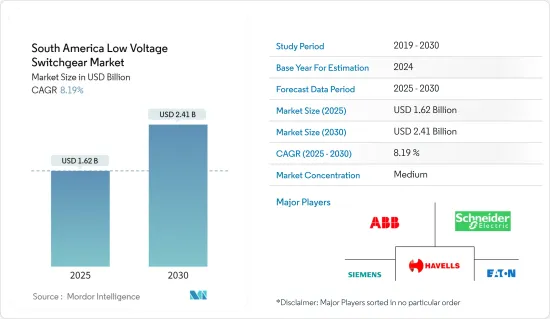

The South America Low Voltage Switchgear Market size is estimated at USD 1.62 billion in 2025, and is expected to reach USD 2.41 billion by 2030, at a CAGR of 8.19% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the South America Low Voltage Switchgear Market is expected to grow considerably due to the government plans for the energy transition in the region, including power distribution networks and growing microgrid trends in the region.

- On the other hand, the increasing adoption of self-generated renewable power in the residential and commercial sectors can dampen the demand for power distribution networks and, consequently, the low-voltage switchgear market.

- Nevertheless, developing smart grids in the region creates a golden opportunity for the growth of the low-voltage switchgear market in the South American region.

South America Low Voltage Switchgear Market Trends

Distribution Segments to dominate the market

- The South American region has abruptly become the focus of many regional and foreign electricity generation and transmission companies due to the recently popped-up plans to generate and transmit electricity in many new places. In countries like Peru and Brazil, governments are eager to have an energy transition based on renewables and the installation of power distribution networks.

- The South American region is expected to be a significant market for low-voltage switchgear systems in the coming years. This is due to the increasing penetration of renewable energy sources, rising power consumption, growing access to electricity, and expanding & enhancing the power grid infrastructure. Countries like Brazil, Argentina, and Chile are expected to be the key contributing nations in the region.

- Furthermore, Argentina has set a goal to generate 20% of its electricity from renewable sources by 2025, a significant increase from the current share of approximately 11.27% as of 2021. In 2022, Argentina's electricity generation reached 150.83 TWh.

- Similarly, Chile's government presented a coal-phase-out plan in 2019 that aims to completely turn off its 5.5 GW of coal-fired generation capacity by 2040, with 1.04 GW set to retire by 2025, which is expected to be replaced through renewable additions, storage technology, and low-emission natural gas plants. They aim to achieve a 60% share of renewable energy by 2035 and increase it to 70% by 2050.

- In May 2022, electricity distribution companies from five countries - Brazil, Chile, Peru, Colombia, and Argentina collaborated to deliver energy to more than 70 million businesses and homes to promote regional energy integration. They created a new association called ADELAT (Association of Latin American Electricity Distributors) to promote power distribution networks for the energy transition.

- In conclusion, the region has a significant potential for the low voltage switchgear market owing to increasing diversification of the electricity generation mix, investments in the transmission and distribution sector, and developments in the power sector.

Brazil Expected to Witness Significant Growth

Among all the South American countries, Brazil is anticipated to pick up the steam in the low-voltage switchgear market, basically due to the escalating power distribution investments in the region and the growing electricity consumption in the country.

The commercial sector witnessed the highest increase in electricity consumption. It was recorded that in 2022, the electricity consumption in the commercial sector was 61.2TWh, from 56.7TWh in the year 2021, the highest increase among all the sectors. The power distribution sector was continually expanding and rejuvenating to meet customer demand. The country has even more plans to improve the power distribution sector.

In November 2022, one of the representatives of Abradee, a local association for the power sector in Brazil, disclosed that the power discoms in the country are expected to invest around USD 20 billion between 2023 and 2026, keeping in sight the resumption of economic growth and technological evolution in the country. It will be utilized to expand, improve, and renew power distribution grids in Brazil.

Moreover, in March 2023, the same association announced that the power distribution concessions would get renewals, as many of them are about to expire by 2031. The companies like EDP, Enel, Elektro, Celpe, CPFL Piratininga, and CPFL Paulista, Energisa, will resume the distribution activity again with new network establishments and brownfield developments.

Such developments are expected to bolster the country's low-voltage switchgear market.

South America Low Voltage Switchgear Industry Overview

The South America Low Voltage Switchgear Market is moderately consolidated. Some key players (in no particular order) include ABB Ltd., Siemens AG, Havells Group, Eaton Corporation Plc., and Schneider Electric, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Several Government Plans for the Energy Transition in the Region

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Substation

- 5.1.2 Distribution

- 5.1.3 Utility

- 5.2 Installation

- 5.2.1 Outdoor

- 5.2.2 Indoor

- 5.3 Voltage Rating

- 5.3.1 Less Than 250 V

- 5.3.2 250 V - 750 V

- 5.3.3 750 V - 1000 V

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Schneider Electric

- 6.3.3 Eaton Corporation Plc.

- 6.3.4 Havells Group

- 6.3.5 Siemens AG

- 6.3.6 WEG Electric

- 6.3.7 Noja Power

- 6.3.8 Toshiba Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Smart Grids in the Region