PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431560

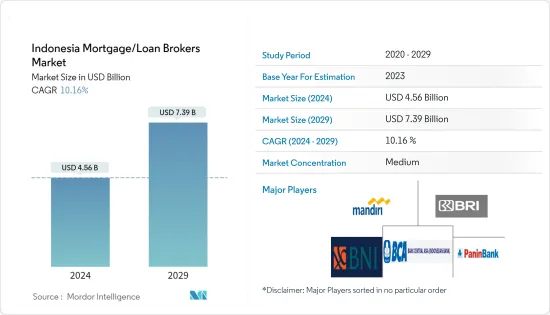

Indonesia Mortgage/Loan Brokers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia Mortgage/Loan Brokers Market size is estimated at USD 4.56 billion in 2024, and is expected to reach USD 7.39 billion by 2029, growing at a CAGR of 10.16% during the forecast period (2024-2029).

Indonesia is a nation with an overall population of 272.25 million, and it has a population growth rate of around 1.03%. During the last few years, Indonesia has continuously declined its monthly year-on-year growth. Further, it dropped to a negative level afterward, showing a recessionary and hard impact on the loan market.

Indonesia's per capita income growth declined a little with COVID-19 disruptions but attained its growth quickly during the previous year. The prime lending rate for a mortgage loan in Indonesia ranges from 5.3% to 16.5%, making an average mortgage rate of around 8% during previous years, creating a wide range of diversity for mortgagees. With all this happening, commercial and residential property price indexes observed positive growth, creating more demand for mortgage loans.

Indonesia observed a continuous recovery in its GDP, reaching a level of 5% last year and is further expected to continue with this. For this growth to take place, credit plays a major role in promoting growth and investment and stable interest rate; increasing residential and commercial estate prices creates a suitable environment for it.

Indonesia Mortgage/Loan Brokers Market Trends

Change in Real Estate price affecting Mortgage loan market.

Indonesia's residential property price index observed continuous growth, reaching 218.76 in 2022 from around 209 in the COVID-19 period; other than this, the Commercial property price index is almost at a stable level with nominal growth of 100 basis points.

This trend shows the growing importance of home loans compared to commercial property loans, with an increase in the mortgage value of house loans. The ownership rate of housing units has grown in the past few years, with a maximum share of households owning under household member names. All these trends create a positive impact on the mortgage market in Indonesia.

With further increases in mortgage prices, it is expected banks will not be increasing their interest rate much, as in case of default by the customer, they would be able to receive higher prices through the sale of assets/houses.

Access to Banking System affecting Indonesia Mortgage/Loan Broker Market.

Increased access to the banking system will be helping Indonesian population easily get loan facilities offered by banks. The total population of Indonesia is observing a positive population growth with an addition of an average of 1.5 million inhabitants annually. This increase in population growth requires banks to expand their reach and reach to the population providing all their facilities from providing credit to deposits.

Reaching a large population with a certain customer base interested in taking loans through a mortgage will help the growth of the mortgage loan market. During the previous year, almost half of the population base in Indonesia owned an account at a financial institution, with another half without access to the service of a bank or similar organizations. Access to the bank in Indonesia observed continuous growth, helping create a market for Mortgage loan providers.

Indonesia Mortgage/Loan Brokers Industry Overview

Bank of Tokyo-Mitsubishi UFJ, Citibank Indonesia, HSBC, Bank Tabungan Pensiunan Nasional, Bank Danamon Indonesia, Bank Central Asia, Panin Bank, Bank Mandiri, Bank Rakyat Indonesia are among the major banks in Indonesia with a higher value of Capital Adequacy ratio. All these banks provide various interest rates on mortgage loans ranging from 6% to 15% with an approach towards attracting customers. Before COVID-19, Indonesia observed positive loan growth. Still, with COVID-19, as the purchasing power of inhabitants declined, spending was mainly limited to necessities for most of the population, and a decline in interest rates with accommodative policies of governments worldwide loan-providing companies and mortgage loan companies suffered a setback. As the economy is recovering, the current focus of banks is on making a stand for those factors affected by COVID-19, of which loan growth is a component.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in demand for Financial Home Loan Solutions

- 4.2.2 Increasing Penetration rate among investors

- 4.3 Market Restraints

- 4.3.1 Lack of Risk Valuation Capabilities

- 4.3.2 High level of Brokerage Service Charges and Commission

- 4.4 Market Opportunities

- 4.4.1 Fintechs Innovative products expanding the Market

- 4.4.2 Partnership between fintech and traditional Banks driving the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Insights on various regulatory landscape

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type of Mortgage Loan

- 5.1.1 Conventional Mortgage Loan

- 5.1.2 Jumbo Loans

- 5.1.3 Government-insured Mortgage Loans

- 5.1.4 Other Types of Mortgage Loan

- 5.2 By Mortgage Loan Terms

- 5.2.1 30- years Mortgage

- 5.2.2 20-year Mortgage

- 5.2.3 15-year Mortgage

- 5.2.4 Other Mortgage Loan Terms

- 5.3 By Interest Rate

- 5.3.1 Fixed-Rate

- 5.3.2 Adjustable-Rate

- 5.4 By Provider

- 5.4.1 Primary Mortgage Lender

- 5.4.2 Secondary Mortgage Lender

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mandiri

- 6.2.2 BRI

- 6.2.3 Bank Central Asia

- 6.2.4 BNI

- 6.2.5 Panin Bank

- 6.2.6 Citibank Indonesia

- 6.2.7 HSBC

- 6.2.8 Bank Danamon Indonesia

- 6.2.9 Mitsubishi UFJ Financial Group

- 6.2.10 Bank Rakyat Indonesia*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US