PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431567

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431567

France Car Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

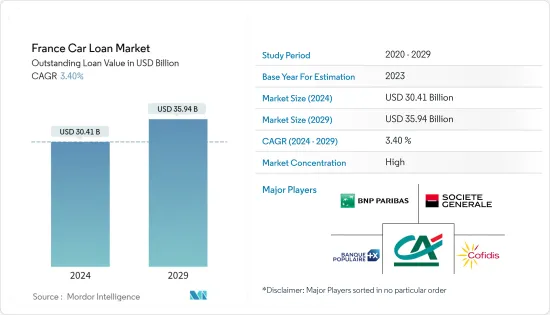

The France Car Loan Market size in terms of outstanding loan value is expected to grow from USD 30.41 billion in 2024 to USD 35.94 billion by 2029, at a CAGR of 3.40% during the forecast period (2024-2029).

Key Highlights

- The car loan market in France is a significant segment of the overall consumer credit market. Car loans are widely used by individuals to finance the purchase of a new or used car. In France, car loans are typically offered by banks, credit unions, and specialized financial companies. The loans can be secured or unsecured, with the former requiring collateral such as the car itself. The loan terms can vary depending on the lender and the borrower's creditworthiness but typically range from 12 to 72 months.

- The interest rates on car loans in France can also vary depending on market conditions, the lender, and the borrower's credit score. In the present year, the average interest rate on a car loan in France was around 2.5% for a new car and 3.5% for a used car, according to the French Banking Federation.

- The French government has also implemented measures to promote the purchase of low-emission vehicles, such as electric and hybrid cars. These measures include incentives for individuals who purchase such vehicles, as well as regulations limiting the circulation of high-emission vehicles in certain areas.

- The COVID-19 pandemic had a significant impact on the car loan market in France. The pandemic and associated economic downturn led to a decrease in demand for car loans. Many people lost their jobs or experienced a decline in income, making them less likely to take out a loan to buy a car.

- The economic impact of the pandemic also led to an increase in loan defaults. Some borrowers who lost their jobs or experienced financial difficulties struggled to keep up with their car loan payments, leading to defaults and repossessions. The pandemic also led to changes in car buying patterns, with more people opting for used cars or delaying purchases altogether. This affected the market for new car loans, in particular.

France Car Loan Market Trends

Growing Sales of Used Cars are Driving the Market

- The used car market is an important driver of the car loan market in France. Many consumers in France opt to purchase used cars instead of new ones, as they can be more affordable and offer good value for money.

- Used cars are generally cheaper than new cars, which means that consumers may require a smaller loan amount to finance their purchases. This can make car loans more accessible to a wider range of consumers who may not be able to afford a new car. Because used cars are generally cheaper than new cars, consumers may be able to purchase a used car with a longer loan term. This can make the monthly payments more affordable and within the budget of many consumers.

- The availability of used cars can drive up demand for car loans in France. For example, consumers who would not have considered purchasing a new car may be more willing to take out a loan to finance a used car purchase. The used car market in France offers a wide range of vehicles at different price points, which means that consumers have more options to choose from. This can make the car loan market more competitive, as lenders may need to offer more favorable loan terms to attract borrowers.

- The quality of used cars in France has improved over the years, and many used cars now come with warranties and a detailed history report. This has made purchasing a used car a more attractive option for many consumers, which can drive up demand for car loans to finance these purchases.

Increase in Vehicle Price is Driving the Market

- The increase in vehicle prices is driving the car loan market in France by making it more difficult for consumers to purchase a car outright. As vehicle prices continue to rise, more consumers are turning to car loans to finance their purchases. As vehicle prices increase, the amount of money that consumers need to borrow to finance their purchases also increases. This can make car loans more attractive to consumers who may not have the funds to purchase a car outright.

- To make monthly payments more affordable, consumers may opt for longer loan terms. This can result in higher interest charges, but it can also make car loans more accessible to a wider range of consumers. With higher vehicle prices, lenders may offer more loan options to attract borrowers. For example, they may offer longer loan terms, lower interest rates, or more flexible repayment options.

- The increase in vehicle prices can lead to increased competition among lenders as they try to attract borrowers with more favorable loan terms. This can benefit consumers by driving down interest rates and making car loans more affordable. To encourage consumers to purchase cars despite the higher prices, the French government offers incentives such as tax credits or subsidies. These incentives can make car loans more attractive to consumers who may not have considered purchasing a car otherwise.

France Car Loan Industry Overview

The market for France car loans is relatively concentrated, with a few large players dominating the industry. Major players like Credit Agricole, Societe Generale, BNP Paribas Personal Finance, Banque Populaire, and Cofidis dominate the market. However, due to product innovation and technology developments, mid-sized and smaller businesses such as Banque Postale, Credit Mutuel, and Sofinco are growing their market share by winning new businesses and entering untapped sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Used Cars are Driving the Market

- 4.2.2 Increase in Vehicle Price is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Changing Mobility Trends is Restraining the Market

- 4.3.2 Increase in Car Loan Interest Rates is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Collaborations Between Car Manufacturers and Lenders

- 4.4.2 Increasing Popularity of Electric Vehicles (EVs)

- 4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Used Cars (Consumer Use & Business Use)

- 5.1.2 New Cars (Consumer Use & Business Use)

- 5.2 By Provider Type

- 5.2.1 Banks

- 5.2.2 Non-Banking Financial Services

- 5.2.3 Original Equipment Manufacturers

- 5.2.4 Other Provider Types (Fintech Companies)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Credit Agricole

- 6.2.2 Societe Generale

- 6.2.3 BNP Paribas Personal Finance

- 6.2.4 Banque Populaire

- 6.2.5 Cofidis

- 6.2.6 Banque Postale

- 6.2.7 Credit Mutuel

- 6.2.8 Sofinco

- 6.2.9 Franfinance

- 6.2.10 AXA Banque*

7 FUTURE TRENDS

8 DISCLAIMER AND ABOUT US