Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693872

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693872

Germany Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 257 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

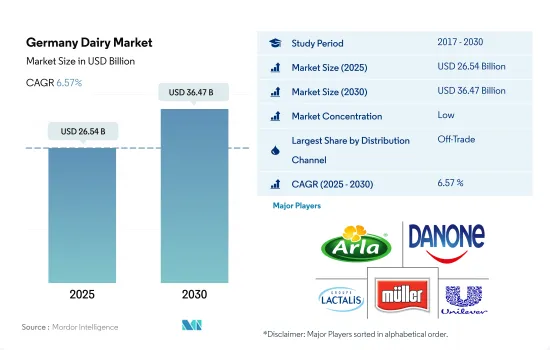

The Germany Dairy Market size is estimated at 26.54 billion USD in 2025, and is expected to reach 36.47 billion USD by 2030, growing at a CAGR of 6.57% during the forecast period (2025-2030).

Easy availability of dairy products through wide retail sector is boosting the growth.

- In Germany, the sales of dairy products in the overall distribution channels increased by 9.2% in 2022 compared to 2021. The growth was attributed to the popularity and availability of clean-label products in dairy segments, such as cheese, yogurt, and milk. These clean-label dairy products are free from artificial ingredients, including artificial colors, flavors, and preservatives.

- The off-trade distribution channel is the primary channel through which dairy products are mainly consumed in the country. Among the off-trade channels, convenience stores are the largest distribution channels in the German dairy market. The proximity factor of these channels, especially in large and developed cities, gives them an added advantage of influencing the consumer's decision to purchase among the large variety of products available in the market. In 2022, convenience stores accounted for more than 39.8% of the value share compared to other retail channels.

- Dairy sales in the on-trade channel are anticipated to grow by USD 2,588.64 million in 2024, up from USD 2,164.86 million in 2021. The growth in the segment is attributed to consuming food at a restaurant or ordering takeout, which is a prevailing aspect of German dietary habits. Eating out is a popular pastime in Germany, with almost 52 million people doing so in 2022 and more than 10 million Germans stating they often did so.

- Among all dairy products, cheese accounted for the majority share in the overall retail channels. In 2022, the sales value of cheese in the overall retail channels increased by 5.8% from 2021, accounting for 41.3% of the value share compared to other dairy products in the country.

Germany Dairy Market Trends

Increasing demand for dairy-based desserts and milk-based ingredients and rising out-of-home consumption of baked products driving dairy consumption in Germany

- In 2022, the per capita consumption of the German dairy industry grew by 2.20% compared to 2021, attributed to the rising demand for dairy-based desserts among the population. Some of these desserts are cheesecakes, mousses, cakes, and other dairy desserts. In Germany, the per capita consumption of cheesecakes was estimated at 0.97 kg. Consumers also prefer milk because of its nutritional profile. The total milk solid components of ice cream include both fat and other solids. These milk solids consist of protein and lactose in milk and range from 9% to 12% in ice cream. Considering the growing demand for dairy products in Germany, the per capita consumption is expected to grow by 8.75% in 2025 from 2022.

- In the last four years, the German population preferred out-of-home consumption of baked products. Therefore, the country's demand for baked goods, such as pizza and cheese-based snacks, significantly rose. This growth also affected the cheese market in Germany. Owing to the increasing demand for cheese among consumers, there has been a continuous fluctuation in cheese prices. In 2022, the prices of gouda cheese in Germany grew by 35.06% compared to 2021, as the prices in 2022 and 2021 were EUR 4.16 per kg and EUR 3.08 per kg, respectively.

- German consumers are shifting toward butter-based snack products like cookies and crunchies. As a result, the import volume of butter has increased. Owing to the demand for butter among the population, butter prices in Germany increased in the last four years. Compared to 2018, butter prices in the country grew by 41.35% in the year 2019.

Germany Dairy Industry Overview

The Germany Dairy Market is fragmented, with the top five companies occupying 15%. The major players in this market are Arla Foods amba, Danone SA, Groupe Lactalis, Muller Group and Unilever PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000738

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Butter

- 4.2.2 Cheese

- 4.2.3 Milk

- 4.3 Regulatory Framework

- 4.3.1 Germany

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Category

- 5.1.1 Butter

- 5.1.1.1 By Product Type

- 5.1.1.1.1 Cultured Butter

- 5.1.1.1.2 Uncultured Butter

- 5.1.2 Cheese

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Natural Cheese

- 5.1.2.1.2 Processed Cheese

- 5.1.3 Cream

- 5.1.3.1 By Product Type

- 5.1.3.1.1 Double Cream

- 5.1.3.1.2 Single Cream

- 5.1.3.1.3 Whipping Cream

- 5.1.3.1.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 By Product Type

- 5.1.4.1.1 Cheesecakes

- 5.1.4.1.2 Frozen Desserts

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Mousses

- 5.1.4.1.5 Others

- 5.1.5 Milk

- 5.1.5.1 By Product Type

- 5.1.5.1.1 Condensed milk

- 5.1.5.1.2 Flavored Milk

- 5.1.5.1.3 Fresh Milk

- 5.1.5.1.4 Powdered Milk

- 5.1.5.1.5 UHT Milk

- 5.1.6 Sour Milk Drinks

- 5.1.7 Yogurt

- 5.1.7.1 By Product Type

- 5.1.7.1.1 Flavored Yogurt

- 5.1.7.1.2 Unflavored Yogurt

- 5.1.1 Butter

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 Convenience Stores

- 5.2.1.2 Online Retail

- 5.2.1.3 Specialist Retailers

- 5.2.1.4 Supermarkets and Hypermarkets

- 5.2.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arla Foods amba

- 6.4.2 Bayernland eG

- 6.4.3 Danone SA

- 6.4.4 DMK Deutsches Milchkontor GmbH

- 6.4.5 Frischli Milchwerke GmbH

- 6.4.6 Groupe Lactalis

- 6.4.7 Hochland Holding GmbH & Co. KG

- 6.4.8 Kruger Group

- 6.4.9 Muller Group

- 6.4.10 Saliter Milchwerk GmbH & Co. KG

- 6.4.11 Unilever PLC

- 6.4.12 Zott SE & Co. KG

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.