Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693889

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693889

South America Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 259 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

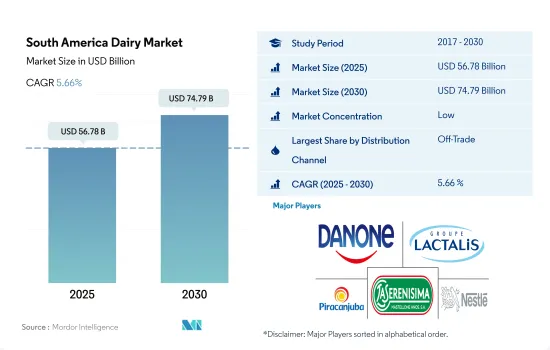

The South America Dairy Market size is estimated at 56.78 billion USD in 2025, and is expected to reach 74.79 billion USD by 2030, growing at a CAGR of 5.66% during the forecast period (2025-2030).

Widespread adoption of distribution channels, led by remarkable sales through supermarkets and hypermarkets is propelling the growth

- The off-trade segment dominates the distribution channels of the South American dairy market. In the off-trade segment, consumers prefer buying dairy products majorly from convenience stores, as people get discount coupons for bulk shopping. As a result, convenience stores are considered the primary sales channel for the sales of dairy products, as they hold more than 48.5% of the overall sales across the country.

- Supermarkets and hypermarkets are the second most widely preferred off-trade distribution channels after convenience stores for purchasing dairy products in South America. In 2022, supermarkets and hypermarkets accounted for 43.9% of the value share.

- Different supermarket and hypermarket chains like Grupo Exito, Carrefour, Walmart, and Jumbo offer different loyalty benefits to retain consumers. The growth of these retail formats, along with factors like business expansion and the increase in supermarkets and hypermarkets, has positively impacted the purchase of dairy products in South America. In 2021, Grupo Exito stood in the top place with more than 2,600 locations across South America. Carrefour stood in second place and operated more than 1,200 outlets across the region.

- Dairy products are commonly used in South American restaurants and foodservice channels, which is further boosting the market growth. Major restaurant chains in South America add milk, yogurt, and cheese to their menus. Dairy sales in the on-trade channel are anticipated to grow by 9% in 2025 compared to 2022. The growth is expected to be aided by consumers preferring dining out or ordering takeout.

Brazil and Argentina are the major dairy producing countries of the South America which boost the overall region's volume sales

- The dairy industry in South America witnessed a growth of 3.24% in 2022. The growth was due to the rising consciousness about health, as dairy products offer a significant volume of essential nutrients. One cup of milk offers 3.4 grams of protein, 5 grams of carbohydrates, 0.6 grams of saturated fat, and other nutrients. This has led to an increased interest in dairy products as people seek to maintain a healthy diet. Thus, the dairy industry is expected to grow by 3.51% during the forecast period.

- Brazil holds the major share in the South American dairy industry. The rise of long-life milk has transformed the fresh milk industry in Brazil. Nowadays, rather than buying fresh milk every day, consumers purchase 12-liter packs and store them. The fact that many places in Brazil lack refrigeration has also boosted the geographical distribution of long-life milk across the country. In 2021, Brazil imported whey, milk albumin, and casein products worth USD 149 million. However, due to the challenges like high production costs and unpredictable weather and economic conditions, the dairy industry may face some hindrances during the forecast period.

- Demand for healthy dairy variants such as no or reduced sugar, low-fat content, grass-fed, and organic is anticipated to drive market growth in the region during the forecast period. Between 2018 and 2022, fresh dairy product consumption in Brazil rose by around 7%, reaching almost 76.8 kg per person in 2021. High production of raw milk, rising consumer preference for quality dairy products and adequate industry regulation to facilitate the manufacturing of these products are identified as the key driving factors.

South America Dairy Market Trends

Rising health consciousness among consumers who actively seek protein-rich food products has largely impacted the segment

- The South American dairy market is primarily driven by rising health consciousness among consumers who actively seek protein-rich food products. Factors such as increasing government-run health and wellness campaigns designed to combat obesity-related problems (diabetes, high blood pressure, and heart disease) encourage consumers to purchase healthier products, directly boosting the consumption of dairy products.

- Cheese is one of the highest consumed dairy products due to its widespread usage in sandwiches, burgers, pizzas, pasta, etc., Thus, demand for higher-quality, better-tasting, and healthier, wholesome quality cheese has become a point of concern among consumers. For example, Argentine cheese is by far the most-produced dairy product in the country. Argentina is also the prominent Latin American country that consumes the most cheese. Thus, the per capita consumption of cheese is estimated to increase by 2.87% during 2023-2024.

- Within the South American region, Brazil dominates the overall dairy market with the highest consumption. There are currently an estimated 1,822 dairies in Brazil. In recent years, the production of cheese has increased mainly due to strong demand from household consumers and foodservice/restaurant sectors. In 2023, Brazilians consumed around 6.07 kilograms of cheese per person/year, which is almost more than 30% below the global average (according to the UN Food and Agriculture Organization - FAO), meaning there is much potential for consumption growth.

- The consumption of dairy products in countries like Peru, Paraguay, Ecuador, and Uruguay is expected to increase at a higher rate during the forecast period due to favorable initiatives from the government.

South America Dairy Industry Overview

The South America Dairy Market is fragmented, with the top five companies occupying 21.46%. The major players in this market are Danone SA, Groupe Lactalis, Laticinios Bela Vista Ltda, Mastellone Hermanos SA and Nestle SA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000760

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Butter

- 4.2.2 Cheese

- 4.2.3 Milk

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Category

- 5.1.1 Butter

- 5.1.1.1 By Product Type

- 5.1.1.1.1 Cultured Butter

- 5.1.1.1.2 Uncultured Butter

- 5.1.2 Cheese

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Natural Cheese

- 5.1.2.1.2 Processed Cheese

- 5.1.3 Cream

- 5.1.3.1 By Product Type

- 5.1.3.1.1 Double Cream

- 5.1.3.1.2 Single Cream

- 5.1.3.1.3 Whipping Cream

- 5.1.3.1.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 By Product Type

- 5.1.4.1.1 Cheesecakes

- 5.1.4.1.2 Frozen Desserts

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Mousses

- 5.1.4.1.5 Others

- 5.1.5 Milk

- 5.1.5.1 By Product Type

- 5.1.5.1.1 Condensed milk

- 5.1.5.1.2 Flavored Milk

- 5.1.5.1.3 Fresh Milk

- 5.1.5.1.4 Powdered Milk

- 5.1.5.1.5 UHT Milk

- 5.1.6 Sour Milk Drinks

- 5.1.7 Yogurt

- 5.1.7.1 By Product Type

- 5.1.7.1.1 Flavored Yogurt

- 5.1.7.1.2 Unflavored Yogurt

- 5.1.1 Butter

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 Convenience Stores

- 5.2.1.2 Online Retail

- 5.2.1.3 Specialist Retailers

- 5.2.1.4 Supermarkets and Hypermarkets

- 5.2.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alpina Productos Alimenticios SA BIC

- 6.4.2 Danone SA

- 6.4.3 Groupe Lactalis

- 6.4.4 Lacteos Betania SA

- 6.4.5 Laticinios Bela Vista Ltda

- 6.4.6 Mastellone Hermanos SA

- 6.4.7 Nestle SA

- 6.4.8 SanCor Cooperativas Unidas Limitada

- 6.4.9 Sucesores de Alfredo Williner SA

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.