Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693874

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693874

United Kingdom Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 251 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

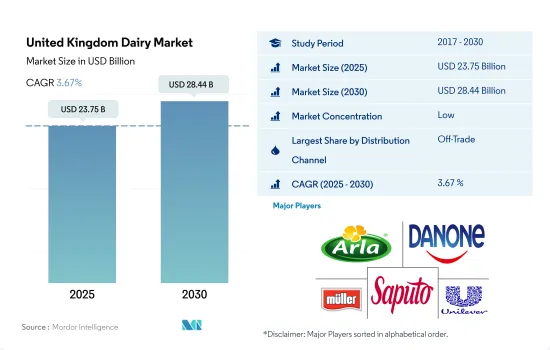

The United Kingdom Dairy Market size is estimated at 23.75 billion USD in 2025, and is expected to reach 28.44 billion USD by 2030, growing at a CAGR of 3.67% during the forecast period (2025-2030).

Strong penetration of organized retail channels fueling the market growth

- In the United Kingdom, the off-trade distribution channel is the primary channel through which dairy products are more consumed in the country. Of all the sub-types of the off-trade channel, supermarkets and hypermarkets are the major channels. The growth of these retail formats, along with factors like business expansion and the increase in supermarkets and hypermarkets, positively impacted the dairy products market in the United Kingdom. As of 2022, Tesco has a total of 2,823 supercenter stores throughout the country.

- Different supermarket and hypermarket chains, like Tesco, Sainsbury, Asda, Morrisons, and Lidi, offer loyalty benefits to retain consumers. Tesco and Sainsbury's had the largest share, with a 43% share of the grocery market in 2021.

- The United Kingdom is the leading market in Europe when it comes to online shopping. Online retail stores as a sales channel are gaining popularity across the country. In 2021, the overall revenue of e-commerce in the United Kingdom reached a total of USD 156 billion from USD 135 billion in 2020.

- In 2020, there was a sudden fall in the growth trend of dairy products for the on-trade distribution channel in the United Kingdom due to the decline in the demand for foodservice channels. Post-COVID-19, the market has witnessed a speedy recovery. This is due to the increasing frequency of restaurants offering various ethnic foods, such as Asian, American, Chinese, Japanese, and Thai cuisines, coupled with a growing expat population. Spending on restaurants and cafes in the United Kingdom reached USD 111.34 billion in 2021 compared to USD 78.16 billion in 2020.

United Kingdom Dairy Market Trends

The rising demand for baked foods, including pizza, baked macaroni with mozzarella, and other cheese and butter-based products, is driving cheese consumption

- In 2022, the per capita consumption of dairy products in the United Kingdom witnessed a growth of 2% compared to 2021. The growth was attributed to the rising demand for bakery products among consumers. Some of these bakery products are dairy desserts (mousses and cheesecakes). The per capita consumption of cheesecakes in the United Kingdom was estimated at 0.93 kg. Considering the demand for dairy desserts and other products, the country increased its dairy imports in the last three years. In 2022, the country imported 11.71 million metric tons of dairy products, a growth rate of 4.35% compared to 2021.

- With the rising demand for baked foods, including pizza, baked macaroni with mortadella, and other cheese-based products, the demand for cheese is rising in the region. Due to the rising demand for cheese among consumers, consistent fluctuation in the prices of cheese was observed in 2022. In 2022, cheese prices observed a growth rate of 32.35% compared to 2021.

- Consumers in Europe are moving toward the consumption of butter-based snack products, such as cookies and crunchies. As a result, the import volume of butter has increased. With the growing demand for butter, there was a significant fluctuation in butter prices, which reached GBP 207.99 per kg. The average price for a tonne is USD 288,456.87 in Birmingham and London. In 2023, the approximate price range for butter in the United Kingdom is between USD 288.46 and USD 5.88 per kilogram or between USD 130.84 and USD 2.67 per pound (lb).

United Kingdom Dairy Industry Overview

The United Kingdom Dairy Market is fragmented, with the top five companies occupying 19.77%. The major players in this market are Arla Foods, Danone SA, Muller Group, Saputo Inc. and Unilever PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000743

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Butter

- 4.2.2 Cheese

- 4.2.3 Milk

- 4.3 Regulatory Framework

- 4.3.1 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Category

- 5.1.1 Butter

- 5.1.1.1 By Product Type

- 5.1.1.1.1 Cultured Butter

- 5.1.1.1.2 Uncultured Butter

- 5.1.2 Cheese

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Natural Cheese

- 5.1.2.1.2 Processed Cheese

- 5.1.3 Cream

- 5.1.3.1 By Product Type

- 5.1.3.1.1 Double Cream

- 5.1.3.1.2 Single Cream

- 5.1.3.1.3 Whipping Cream

- 5.1.3.1.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 By Product Type

- 5.1.4.1.1 Cheesecakes

- 5.1.4.1.2 Frozen Desserts

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Mousses

- 5.1.4.1.5 Others

- 5.1.5 Milk

- 5.1.5.1 By Product Type

- 5.1.5.1.1 Condensed milk

- 5.1.5.1.2 Flavored Milk

- 5.1.5.1.3 Fresh Milk

- 5.1.5.1.4 Powdered Milk

- 5.1.5.1.5 UHT Milk

- 5.1.6 Sour Milk Drinks

- 5.1.7 Yogurt

- 5.1.7.1 By Product Type

- 5.1.7.1.1 Flavored Yogurt

- 5.1.7.1.2 Unflavored Yogurt

- 5.1.1 Butter

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 Convenience Stores

- 5.2.1.2 Online Retail

- 5.2.1.3 Specialist Retailers

- 5.2.1.4 Supermarkets and Hypermarkets

- 5.2.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arla Foods

- 6.4.2 Bel Group

- 6.4.3 Dale Farm Cooperative Limited

- 6.4.4 Danone SA

- 6.4.5 Glanbia PLC

- 6.4.6 Kingcott Dairy

- 6.4.7 Muller Group

- 6.4.8 Ornua Co-Operative Limited

- 6.4.9 Saputo Inc.

- 6.4.10 Unilever PLC

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.