Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693938

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693938

Europe Satellite Launch Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 161 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

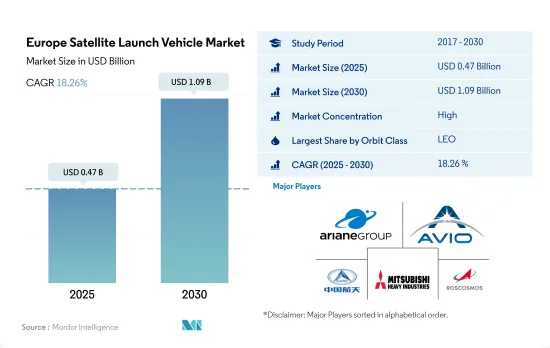

The Europe Satellite Launch Vehicle Market size is estimated at 0.47 billion USD in 2025, and is expected to reach 1.09 billion USD by 2030, growing at a CAGR of 18.26% during the forecast period (2025-2030).

Rising demand for orbital launch systems in Europe

- At launch, a satellite or spacecraft is usually placed into one of many special orbits around the Earth, or it can be launched into an interplanetary journey. Many weather and communication satellites tend to have high Earth orbits farthest from the surface. Satellites in the mean (medium) Earth orbit include navigational and specialized satellites that are designed to monitor a specific area. Most science satellites, including ESA's Earth Observation System team, are in low Earth orbit

- Light launchers differ from conventional heavy launchers in the vehicle's performance, which depends on the amount of payload the vehicle can lift to a particular orbit and the launch cost. With the expansion of the capabilities of small satellites, the space industry is developing strategic utility, which, in turn, leverages various stakeholders, including governments, space agencies, and private companies, to expand. Small satellite launchers are expected to be the future of the next generation. These types of launchers are essential for launching satellites, carrying out science missions, and resupplying the International Space Station. The increasing number of satellites being launched into orbit due to increased space activities is driving the demand for medium-range launch vehicles.

- In October 2022, the European Space Agency planned to test new navigation satellites that would orbit much closer to Earth than existing ones to provide more accurate position data for everyday devices. The Global Positioning Satellite System is typically placed in mid-Earth orbit about (10,000 to 20,000 km) from the Earth's surface. During 2017-2022, a total of 590+ satellites were launched in the region. The market is expected to witness a growth of 210% during the forecast period between 2023 and 2029.

There is a rising demand for low-cost launch systems aiding the market growth in the region

- The launch equipment industry is the second-largest space manufacturing activity in Europe after the development of commercial satellites, which is aiding the growth of the European market. Ariane 5, Soyuz, and Vega take off from Europe's spaceport in French Guiana. Europe benefits from this line of launchers with the ability and flexibility to meet all the needs of the European government and most of the commercial market, thereby increasing its socioeconomic benefits and access to space in Europe

- The European satellite launch vehicles market is characterized by the presence of several players. The major launch vehicles in this region are Ariane 5, Soyuz, and Vega, among others. Space organizations like EASA have partnered with private players like SpaceX in the production and launch of satellites in the field.

- The satellite launch vehicle industry is driven by demand for satellites for applications ranging from military surveillance, communications, and navigation to Earth observation. As a result, the demand for satellites from the civilian/government, commercial and military sectors is increasing. On this basis, during the period 2017-2022, a total of more than 570+ satellites were launched in the region. The growth in the number of satellites launched from 2020 to 2021 is 140% after the impact of the COVID-19 pandemic.

- In terms of the number of satellites operated by a country, the United Kingdom leads with more than 462 satellites launched between 2017 and 2022, followed by Russia and Germany with 65 and 34, respectively. Space agencies and private companies have tried to reduce the cost of satellite launch systems in recent years. Between 2023 and 2029, the market is expected to surge by 213% during the forecast period.

Europe Satellite Launch Vehicle Market Trends

Growing demand and competition in the European launch vehicle market

- European launch vehicles are known for their versatility, capable of launching a wide range of payloads into various orbits. A key factor driving the demand for European launch vehicles is the growing commercial space industry. As more and more companies seek to launch satellites and other space-based assets into orbit, they are turning to European launch vehicles as a reliable and cost-effective solution. European launch companies are investing in new technologies, such as reusable launch vehicles, electric propulsion systems, and artificial intelligence, to improve their launch capabilities and stay competitive in the market. For example, ArianeGroup is developing the Ariane Next reusable rocket, and Airbus is developing the Adeline concept, which involves a reusable first stage for the Ariane rocket.

- Additionally, the demand for small satellite launches is increasing, which is driving the development of smaller launch vehicles by European companies. For example, PLD Space is developing the Miura 1 and Miura 5 rockets for small satellite launches, while Isar Aerospace is developing the Spectrum rocket for the same purpose. There is a growing trend toward international collaboration in the space industry, with European launch vehicle manufacturers partnering with companies and organizations across the world. This is driven by the increasing complexity of space missions, as well as the need to share resources and expertise. On this note, Arianespace has partnerships with the European Space Agency and the French Space Agency, and PLD Space is working with the European Space Agency and the Spanish government.

Increasing investment opportunities in the European satellite launch vehicle market is the driver

- European countries are recognizing the importance of various investments in the space domain. They are increasing their spending on various space programs to stay competitive and innovative in the global space industry. In November 2022, the European Space Agency (ESA) announced that it requested its 22 nations to back a budget of EUR 18.5 billion for 2023-2025. Europe plans to launch the first Ariane 6 rocket, its next-generation space launcher, in the fourth quarter of 2023. Developed at a cost of just under USD 3.9 billion and originally set for an inaugural launch in July 2020, the project has been hit by a series of delays. The governments of France, Germany, and Italy announced that they had signed an agreement on "the future of launcher exploitation in Europe" to enhance the competitiveness of European vehicles while also ensuring independent European access to space.

- In September 2022, the French government announced that it is planning to allocate more than USD 9 billion to space activities, an increase of about 25% over the past three years. In November 2022, Germany announced that about EUR 2.37 billion was allocated for various space-related projects. The country mentioned that from the end of 2023, Ariane 6 is expected to be the new European launcher to carry payloads into space. Germany is contributing a total of EUR 162 million to the further development of Ariane 6 and its market introduction. The country is investing around EUR 52 million in the optional LEAP (Launchers Exploitation Accompaniment) program, which also includes the operation of DLR's test facility for rocket engines in Lampoldshausen.

Europe Satellite Launch Vehicle Industry Overview

The Europe Satellite Launch Vehicle Market is fairly consolidated, with the top five companies occupying 99.01%. The major players in this market are Ariane Group, Avio, China Aerospace Science and Technology Corporation (CASC), Mitsubishi Heavy Industries and ROSCOSMOS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001250

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Owner Of Launch Vehicle

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 France

- 4.4.2 Germany

- 4.4.3 Russia

- 4.4.4 United Kingdom

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Orbit Class

- 5.1.1 GEO

- 5.1.2 LEO

- 5.1.3 MEO

- 5.2 Launch Vehicle Mtow

- 5.2.1 Heavy

- 5.2.2 Light

- 5.2.3 Medium

- 5.3 Country

- 5.3.1 Russia

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Ariane Group

- 6.4.2 Avio

- 6.4.3 Blue Origin

- 6.4.4 China Aerospace Science and Technology Corporation (CASC)

- 6.4.5 Indian Space Research Organisation (ISRO)

- 6.4.6 Mitsubishi Heavy Industries

- 6.4.7 Rocket Lab USA, Inc.

- 6.4.8 ROSCOSMOS

- 6.4.9 Space Exploration Technologies Corp.

- 6.4.10 The Boeing Company

- 6.4.11 Virgin Orbit

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.