Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693940

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693940

Europe Space Propulsion - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 139 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

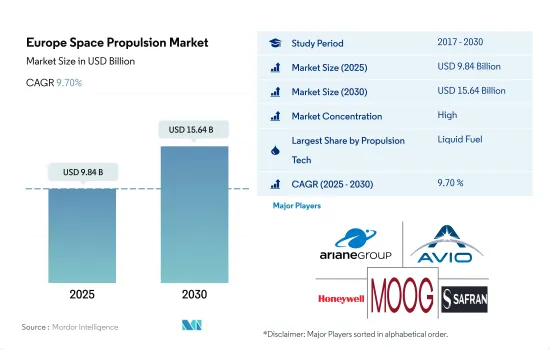

The Europe Space Propulsion Market size is estimated at 9.84 billion USD in 2025, and is expected to reach 15.64 billion USD by 2030, growing at a CAGR of 9.70% during the forecast period (2025-2030).

The utilization of gas-based propulsion is expected to surge during the forecast period

- In the European space propulsion market, gas-based propulsion systems continue to be widely used for small to medium-sized satellites, where simplicity, reliability, and quick response times are crucial. They are widely utilized in various satellite missions, including telecommunications, Earth observation, and scientific research.

- Electric propulsion systems have gained prominence in the European satellite market due to their fuel efficiency and extended operational lifespan. This technology provides higher specific impulses, enabling satellites to carry more payload while utilizing less propellant. In addition, electric propulsion systems offer the capability for long-duration missions and precise orbital maneuvers. They are well-suited for geostationary satellites, deep space missions, and satellite constellations for global coverage.

- Liquid propulsion systems, predominantly based on bipropellants like hydrazine and nitrogen tetroxide, have been widely employed in European satellites for primary propulsion and large orbital maneuvers. Liquid propulsion systems offer the flexibility to perform complex orbital transfers and rendezvous maneuvers. However, they require careful handling of toxic and corrosive propellants and necessitate a higher propellant mass compared to electric or gas-based systems. Between 2023 and 2029, the market is expected to surge by 81%, and gas-based propulsion is expected to dominate the market.

The product innovation in propulsion technology is expected to boost the growth

- Space propulsion is a method used to accelerate spacecraft or artificial satellites. The current space propulsion system includes two main solutions. Uses of an electric motor (EP) accelerates the ionized propellant, and chemical repulsion (CP) uses the propeller itself as the power source for thrust force.

- The space manufacturing industry is a niche sector, accounting for EUR 7.25 billion in final revenue and creating 38,000 highly qualified jobs. Despite its small size, the space sector enables a wide range of services and applications and is highly strategic for governments and businesses in the region.

- ESA's Future Space Transport Program identifies key launch system technologies to address the challenges and deliver solutions through technology-ready maturity for propulsion systems. Key technologies are designed at both the component and subsystem levels before being integrated into the propulsion demonstration engine and tested in the right environment. Due to the presence of many governmental, commercial, and other players in the region, demand in the satellite manufacturing industry witnessed positive growth. Based on this, during 2017-2022, more than 570 satellites were launched in the area. Of the more than 570 satellites produced and launched, nearly 90% are for commercial use.

Europe Space Propulsion Market Trends

Investment opportunities in the European space propulsion market is driving the demand

- European countries are recognizing the importance of various investments in the space domain. They are increasing their spending on space programs and innovation to stay competitive and innovative in the global space industry. In November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services and remain a partner in exploration with the United States. The ESA has asked its 22 nations to support a budget of EUR 18.5 billion from 2023 to 2025. Likewise, in September 2022, the French government announced that it plans to allocate more than USD 9 billion to space activities, an increase of about 25% over the past three years.

- In November 2022, Germany announced that about EUR 2.37 billion were allocated for various space-related activities. In April 2023, Dawn Aerospace was awarded a contract to conduct a feasibility study with DLR (German Aerospace Center) to increase the performance of a nitrous-oxide-based green propellant for satellites and deep-space missions. In December 2022, the UK Space Agency announced EUR 2.7 million for 13 early-stage technology projects. European Astrotech received EUR 54,000 for a propellant loading cart (GSE) to service satellites with electric propulsion systems using xenon or krypton. SmallSpark Space Systems received EUR 76,000 for the development and maturation of SmallSpark's dual-firing mode propulsion system, the S4-NEWT-A2, which will form part of the architecture of its S4-SLV in-space logistics vehicle and as a candidate system for upper-stage launch vehicles.

Europe Space Propulsion Industry Overview

The Europe Space Propulsion Market is fairly consolidated, with the top five companies occupying 77.76%. The major players in this market are Ariane Group, Avio, Honeywell International Inc., Moog Inc. and Safran SA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001252

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Spending On Space Programs

- 4.2 Regulatory Framework

- 4.2.1 France

- 4.2.2 Germany

- 4.2.3 Russia

- 4.2.4 United Kingdom

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Propulsion Tech

- 5.1.1 Electric

- 5.1.2 Gas based

- 5.1.3 Liquid Fuel

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Russia

- 5.2.4 United Kingdom

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Ariane Group

- 6.4.2 Avio

- 6.4.3 Honeywell International Inc.

- 6.4.4 Moog Inc.

- 6.4.5 OHB SE

- 6.4.6 Safran SA

- 6.4.7 Sitael S.p.A.

- 6.4.8 Space Exploration Technologies Corp.

- 6.4.9 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.