Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693988

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693988

South America Pet Diet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 209 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

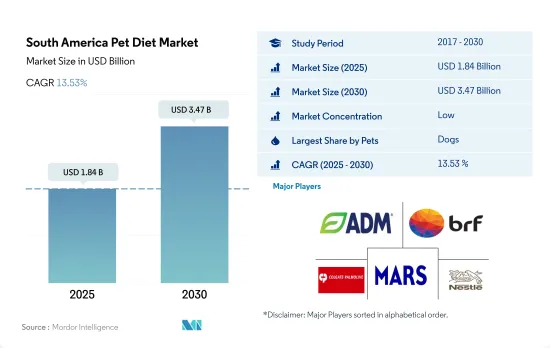

The South America Pet Diet Market size is estimated at 1.84 billion USD in 2025, and is expected to reach 3.47 billion USD by 2030, growing at a CAGR of 13.53% during the forecast period (2025-2030).

Dogs dominated the veterinary diets market owing to the increasing prevalence of diseases among dogs

- Veterinary diets are specialized pet food products formulated to address specific health conditions in pets. In the South American market, the value of pet veterinary diets witnessed a significant increase of 73.7% between 2017 and 2021. This growth can be attributed to advancements in pet nutrition science and research, leading to the development of more specialized diets capable of addressing a wider range of health issues in pets. As a result, pet veterinary diets accounted for 10.6% of the South American pet food market in 2022.

- The South American pet veterinary diet market is dominated by dogs, and they accounted for a share of 57.1% in 2022. The higher share of the dog segment is mainly due to the large population of dogs in the region compared to other pets and the increased incidence of various diseases in dogs. The value of the dog segment of the veterinary diet market is anticipated to register a CAGR of 15.6% during the forecast period.

- Other pet animals hold the second-largest market share, reflecting the diverse requirements for veterinary diets to prevent potential health problems. The veterinary diet market for other pet animals reached a value of USD 298.1 million in 2022. It is anticipated to experience steady growth, registering a CAGR of 7.9% during the forecast period.

- Cats held a market share of 18.6% in 2022. The cat segment of the veterinary diet market is witnessing an increasing trend, driven by the rising cat population in the region. The cat segment of the veterinary diets is projected to be the fastest-growing in the region, registering an expected CAGR of 16.1% during the forecast period.

- The growing pet population and veterinary diets' ability to support various health conditions are anticipated to drive the market during the forecast period.

Brazil dominated the pet veterinary diets market owing to its large pet population and increasing incidence of pet diseases

- Veterinary diets play a crucial role in addressing and managing specific diseases and infections in pets, serving both preventive and curative purposes. With the growing importance of pet health and well-being, veterinary diets have gained significant importance in the region's pet food market. In 2022, veterinary diets accounted for 10.6% of the South American pet food market.

- The South American pet veterinary diets market witnessed a steady increase of more than 50% between 2017 and 2022. This surge can be attributed to factors such as increased pet adoption during the COVID-19 pandemic and the availability of a wider range of dietary options for pets' specific needs.

- Brazil has the largest country-wise veterinary diets market, with a value of USD 693.4 million in 2022, followed by Argentina, with a value of USD 220.7 million in 2022. Brazil has the largest regional market share because of its high pet population compared to other countries, well-established manufacturing facilities, and growing premiumization. For instance, in 2022, the pet population in Brazil was 156.4 million, whereas the pet population in Argentina was only 46.3 million.

- Specialty stores have become a prominent distribution channel, accounting for 32.6% of the South American veterinary diets market in 2022. Petz, a leading specialty store brand in Brazil, rapidly expanded its presence throughout the country with 138 stores and 116 veterinary clinics in 2021.

- The availability of a diverse range of veterinary diets specifically formulated to treat various pet infections, along with pet owners' willingness to invest more in improving the health of their pets, is driving the veterinary diets market in South America, which is projected to register a CAGR of 14.2% during the forecast period.

South America Pet Diet Market Trends

Brazil accounted for the largest cat population in the region due to their advantages of adaptability to smaller living spaces and lower maintenance

- The pet cat population in South America has been steadily growing, increasing by 13.3% between 2019 and 2022. This upward trend can be attributed to the higher adoption rates of cats as companions during the extended periods of home confinement brought on by the COVID-19 pandemic. Among the countries in the region, Brazil holds the largest cat population, accounting for about 55.5% of the total cat population as of 2022. In South America, cats comprised 19.3% of the overall pet population in 2022. This relatively lower proportion of cats can be attributed to cultural perceptions wherein dogs are considered more practical and valued pets. The number of cats represents only 50.0% of the total dog population in the region.

- The adaptability of cats to smaller living spaces without feeling confined, coupled with their lower maintenance costs compared to dogs, contributed to an increasing preference for cat ownership. This trend has led to a significant rise in the pet cat population across the region. In Brazil alone, as of 2020, about 14.3 million households owned cats as pets. In Argentina, the rate of cat ownership was even higher, with 31.4% of households, which is 4.6 million households with cats as pets.

- An important emerging trend in the region is the establishment of cat cafes. As of 2021, there were around 20 cat cafes in Brazil, providing customers with a unique opportunity to enjoy a drink while interacting with cats in a comfortable setting. This growing trend of cat cafes, coupled with the cat's ability to adapt to smaller living spaces, has the potential to further enhance the adoption of cats as popular pets in the region.

Higher consumption of premium pet veterinary diets and growing pet humanization have increased pet expenditure

- Pet expenditure in South America has shown consistent growth, with an increase of about 18.1% between 2019 and 2022. This upward trend can be attributed to the rising number of pet owners across the region. In Brazil, the number of households owning a pet grew in the same period, registering a CAGR of 1.3%. In Argentina, pet ownership increased, registering a CAGR of 1.4% between 2016 and 2020.

- Pet owners in the region are increasingly focused on pet humanization, with higher-income individuals driving sales growth by opting for products made with natural ingredients, driving pet product premiumization. The expenditure on pet veterinary diets accounted for about 15.7% of the total pet expenditure per pet in 2022. The pet nutraceutical expenditure per pet in the country increased from USD 158.4 in 2017 to USD 200.2 in 2022. From 2017 to 2022, the number of pet owners spending on pet veterinary diets increased by about 39.6% for dogs, 18.7% for cats, and 14.7% for other pet animals annually. Among South American countries, Brazil had the highest pet expenditure per animal, reaching USD 88.4, followed closely by Argentina at USD 65.1 in 2022. This higher pet expenditure in Brazil is mainly due to the country's increased spending on pet health.

- Among distribution channels, offline retail channels such as pet shops, vet clinics, and supermarkets are the preferred distribution channels for pet veterinary diet products in the region. However, during the COVID-19 pandemic, the adoption of e-commerce for pet veterinary diets increased.

- The higher consumption of premium pet veterinary diets and growing pet humanization are anticipated to drive pet expenditure in the region during the forecast period.

South America Pet Diet Industry Overview

The South America Pet Diet Market is fragmented, with the top five companies occupying 29.54%. The major players in this market are ADM, BRF Global, Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), Mars Incorporated and Nestle (Purina) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001470

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Product

- 5.1.1 Diabetes

- 5.1.2 Digestive Sensitivity

- 5.1.3 Oral Care Diets

- 5.1.4 Renal

- 5.1.5 Urinary tract disease

- 5.1.6 Other Veterinary Diets

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Alltech

- 6.4.3 BRF Global

- 6.4.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 6.4.5 FARMINA PET FOODS

- 6.4.6 General Mills Inc.

- 6.4.7 Mars Incorporated

- 6.4.8 Nestle (Purina)

- 6.4.9 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.