PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431704

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431704

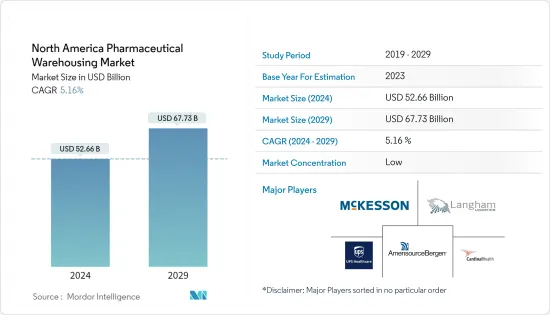

North America Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Pharmaceutical Warehousing Market size is estimated at USD 52.66 billion in 2024, and is expected to reach USD 67.73 billion by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

The market is seeing the emergence of new technologies such as the Internet of Things (IoT), blockchain, and data analytics to improve visibility, traceability, and overall supply chain performance.

The bulk of the industry's revenue comes from the warehousing of consumer goods. As a result, warehousing demand typically follows trends in pharmaceutical manufacturing production and consumer spending. Manufacturers that produce more goods to satisfy consumer demand need more pharmaceutical warehouse space.

Before the pandemic, lean pharmaceutical manufacturing was the go-to strategy for most manufacturers to keep working capital to a minimum. Getting products just in time for production kept inventory costs low and used facilities more efficiently. When the pandemic hit, this lean strategy caused many pharmaceutical manufacturers to experience inventory shortages and, in some cases, production to grind to a halt. To avoid inventory shortages in the future, manufacturers increased their on-hand inventory (known as buffer stock).

Outsourcing of logistics operations is on the rise for the past five years, and it's likely to remain a trend for the foreseeable future. Bigger companies leased more warehouses and distribution facilities to store more inventory as a hedge against increasing supply chain expenses. They also opened more warehouses across multiple locations to reduce delivery times.

In cold chain pharmaceuticals, the use of telematics, remote monitoring, and other cutting-edge technologies is revolutionizing cargo warehousing and transportation with improved safety and connectivity. Pharmaceutical manufacturing companies across North America are expanding their production capacities and operations. As a result, there is an increase in the need for logistics among retailers and distributors for storing raw materials and finished goods.

In the United States, the SNS (Strategic National Stockpile) was originally developed by the federal government in response to chemical or biological threats. Since then, the SNS is instrumental in responding to pandemic-related events, including the Ebola virus outbreak and the monkeypox pandemic (now known as MPox). However, it was not until the pandemic caused a dramatic shortage of essential medical supplies that officials began to recognize its usefulness.

In March 2023, Pharmascience Inc. opened a new USD 4 million distribution center on Dorval's 55th Avenue, surpassing the size of nine NHL rinks. The new center includes a total area of 156,000 sq ft. It meets or surpasses the Canadian and international standards for storing and handling medicinal products while increasing capacity compared to Pharmascience's two other centers.

North America Pharmaceutical Warehousing Market Trends

Rise in Aged Population in North America is Driving the Market

The United States includes a growing and aging population that is increasing the need for pharmaceuticals. As people get older, they become more likely to need medications to treat chronic conditions like diabetes, heart conditions, and arthritis. The COVID-19 pandemic affected the pharmaceutical markets around the world. It is expected that the pharmaceutical market will continue to grow in 2027, with vaccines leading the way.

Infectious diseases that spread from country to country were around for thousands of years. For example, the coronavirus pandemic of 2020 killed millions of people and caused billions of dollars in economic losses. One of the most important ways to manage the spread of viral diseases is through the discovery and development of vaccines. However, the biggest challenges for vaccination programs are related to vaccine cold chain and cold storage. Apart from the pharmaceutical market, North America's pharmaceutical consumption is also on the rise. It is partly due to an increasing demand for drugs to treat age-related and chronic conditions, as well as changes in clinical practice, all of which contribute to the warehousing trend.

As per the US Census Bureau, in 2022, about 17.3% of the American population was 65 years old or over and is expected to reach 22% by 2050. The number of people over the age of 65, who generally need the most care, is growing even faster. Hence, the demand for pharmaceutical warehousing is expected to increase over the study period.

Increasing Pharmaceutical Trade is Driving the Market

In 2022, North America represented 52.3% of global pharmaceutical sales, compared to 22.4% for Europe. According to IQVIA, the latest data shows that 64.4% of new medicines launched in the US between 2017 and 2022 were sold on the US market compared to 16.4% for the European market. With the development of new technologies and more cost-effective and efficient manufacturing processes, the industry is going through a major transformation. Market growth is also supported by increasing investment flows in this industry.

North America accounted for the major share of the global E-drug stores due to the development of programming innovations in the clinical industry. North America is the largest E-drug market in the world. The high number of users of app-based pharmacies, the growing presence of e-commerce pharmacies, and the growing web-dependency population are the major factors that fuel global e-drug stores. The pharmaceutical industry witnessed an increase in e-commerce sales. Distribution centers and warehouses must be well-positioned to deliver products quickly and efficiently to consumers.

The United States stood as the leading country of destination for Mexico's pharmaceutical exports in 2022. In 2022, pharma exports from Mexico into the US reached over USD 1 billion, according to Trade Map. France followed with around USD 141.37 million worth of pharmaceuticals exported from Mexico. Meanwhile, pharmaceutical exports originating in Mexico totaled about USD 2.18 billion in 2022. Thus, the growing pharmaceutical trade is expected to drive the North American pharmaceutical warehousing market.

North America Pharmaceutical Warehousing Industry Overview

The market is highly fragmented due to the presence of a large number of international and local pharma logistics companies. These companies are competing fiercely to provide secure supply chain functions as well as cloud-based solutions. Furthermore, the ever-changing nature of pharmaceutical products keeps manufacturers focused on expanding their product range. Several large pharma logistics companies are teaming up to extend their reach and pool their expertise. Big companies are acquiring new technologies and know-how, while smaller vendors are getting the financial and infrastructure support they need.

Some of the major players include Deutsche Post DHL, FedEx Corporation, UPS Healthcare, C.H. Robinson, American Airlines Cargo, McKesson Corporation, etc. Major players in the market are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to remain competitive in the market.

For instance, in September 2022, DHL Supply Chain acquired NTA (New Transport Applications), a company specializing in providing logistics services to the pharmaceutical and healthcare sectors. With more than 20 years of experience in the Mexican market, NTA is a recognized industry player serving more than 80 customers with services, including the storage and transportation of products that require refrigeration and temperature control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Market Definition

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services

- 4.2.1.2 Increasing Need for Pharmaceutical Products

- 4.2.2 Restraints

- 4.2.2.1 Lack of Efficient Logistics Support

- 4.2.2.2 Stringent Government Regulations

- 4.2.3 Oppurtunities

- 4.2.3.1 Increasing Pharmaceutical Product Innovation and Development

- 4.2.3.2 Development of Energy-efficient Warehouses

- 4.2.1 Drivers

- 4.3 Insights into Technological Developments

- 4.4 Industry Policies and Regulations

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Industry Attractiveness- Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouses

- 5.1.2 Non-Cold Chain Warehouses

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL

- 6.2.2 FedEx Corporation

- 6.2.3 UPS Healthcare

- 6.2.4 C.H Robinson

- 6.2.5 American Airlines Cargo

- 6.2.6 Cardinal Health

- 6.2.7 MD Logistics

- 6.2.8 McKesson Corporation

- 6.2.9 AmerisourceBergen Corp

- 6.2.10 Langham Logistics*

7 FUTURE OF THE MARKET

8 APPENDIX