PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851277

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851277

North America LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

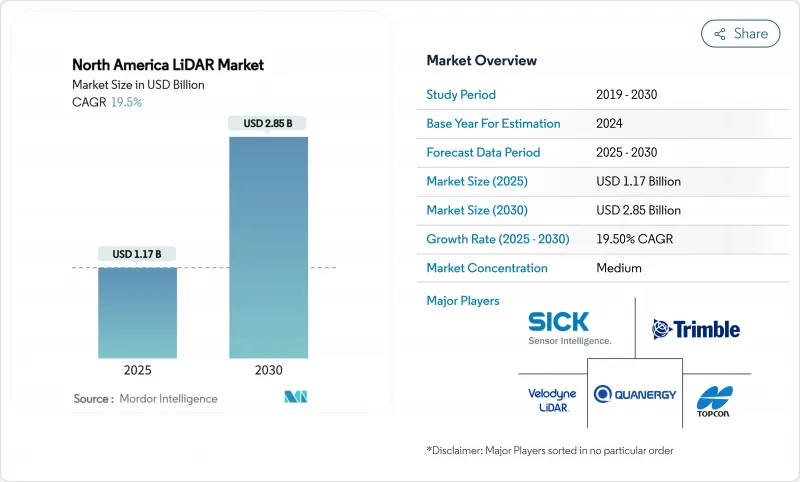

The North America LiDAR market is valued at USD 1.17 billion in 2025 and is forecast to reach USD 2.85 billion by 2030, advancing at a 19.5% CAGR.

Demand accelerates as solid-state breakthroughs shrink sensor size and cost, federal infrastructure programs mandate precise asset data, and BVLOS drone corridors expand aerial mapping. Automotive OEMs are locking LiDAR into Level 3 autonomy packages, while forestry and utility agencies adopt the technology for wildfire-risk modelling and grid inspections. Price declines, sensor-fusion innovation, and rising environmental monitoring needs collectively sustain double-digit growth. Competitive intensity rises as consolidated suppliers' pair bespoke software with chip-level hardware to protect margins amid falling average selling prices.

North America LiDAR Market Trends and Insights

Solid-State LiDAR Integration Accelerates Automotive Production Programs

Solid-state sensors are moving from limited pilots into mainstream production programs. Luminar's series supply on Volvo's EX90 confirms OEM confidence in higher reliability and reduced mechanical complexity. BMW's i7 and Volkswagen's ID.Buzz integrate Innoviz units for Level 3 capability, while Toyota reports chip-level cost reductions that open mid-segment adoption. Hesai's 37% global automotive share underscores how scale economics force price competition. As unit economics improve, the North America LiDAR market embeds sensors in electric pickups to satisfy forthcoming FMCSA automatic emergency braking rules for heavy vehicles.

BVLOS Drone Operations Transform Infrastructure Monitoring

Transport Canada's 2025 RPAS regulations authorize medium-sized drones for beyond-visual-line-of-sight operations, enabling cost-effective LiDAR corridor mapping in remote provinces. FAA Part 107 waivers mirror this flexibility south of the border, accelerating utility and rail inspections. NOAA's high-altitude BVLOS campaigns demonstrate operational maturity, while commercial operators deploy lightweight scanners on eVTOL craft to survey thousands of kilometres per flight. Resulting data reduces manual inspection costs and fuels cloud-based digital twins for asset managers.

Cost Competitiveness Challenges Limit Mass-Market Penetration

LiDAR units still cost three to five times more than radar alternatives, deterring inclusion in sub-USD 30,000 vehicles. Luminar's Halo roadmap targets a 50% price cut, yet mainstream parity remains elusive before 2028. Chinese suppliers such as Hesai pressure margins through lower labour costs and vertically integrated optics. North American factories respond with automation, but depreciation schedules constrain rapid price movements in the North America LiDAR market.

Other drivers and restraints analyzed in the detailed report include:

- Digital Twin Infrastructure Projects Drive Long-Term Demand

- Smart-Corridor Initiatives Leverage Federal Infrastructure Funding

- Workforce Development Gaps Constrain Project Execution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground-based systems held 42% of 2024 revenue in the North America LiDAR market. Continued demand for high-accuracy construction staking anchors sales, yet the segment's growth lags at low-double-digit rates. Contractors value tripod-mounted units for repeatable benchmarks during highway widening and bridge retrofits. However, rental models from ClearSkies Geomatics reduce ownership barriers, trimming manufacturer margins but enlarging the installed base.

Mobile and UAV platforms grow at 25% CAGR as agencies digitize linear assets. RIEGL-based VTOL drones cover transmission lines 10 times faster than terrestrial teams, supporting utilities facing wildfire liability. Phase One's integrated camera-laser pods cut flight hours 40%, enhancing ROI. As survey firms embed robust IMUs to stabilize data, fleet operators win multi-year inspection contracts, feeding sustained sensor orders. This migration boosts share for agile suppliers and elevate service revenues across the North America LiDAR market.

Mechanical architectures still command 63% share of the North America LiDAR market size in 2024 thanks to proven range and established supply chains. Rotating mirror designs service highway mapping vans and airborne bathymetric surveys where 360-degree coverage outweighs durability concerns. Yet maintenance intervals and assembly complexity inflate lifecycle costs.

Solid-state variants post 22% CAGR as wafer-level optics deliver fewer moving parts. Kyocera's fusion sensor merges camera and LiDAR layers for parallax-free perception, attractive to OEMs demanding slimmer housings. Hexagon's single-photon module pushes 14 million points per second, enabling fast corridor scans from mid-altitude aircraft. As volume scales, per-unit cost is projected to reach parity with mechanical peers by 2028, shifting design wins toward chip-integrated suppliers within the North America LiDAR market.

North America LiDAR Market Segmented by Product (Aerial LiDAR, Ground-Based LiDAR), Type (Mechanical LiDAR, Solid-State LiDAR), Range, Component (Laser Scanners, GPS/GNSS Receiver and More), Application (Corridor Mapping and Surveying, ADAS and Autonomous Vehicles, and More), End-User (Automotive, Engineering and Construction Firms, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ouster Inc. (incl. Velodyne)

- Teledyne Optech

- Trimble Inc.

- Leica Geosystems AG (Hexagon)

- Innoviz Technologies

- Sick AG

- Topcon Corporation

- LeddarTech Inc.

- Faro Technologies Inc.

- DENSO Corporation

- RoboSense (USA)

- AEye Inc.

- Luminar Technologies Inc.

- Valeo SA

- Quanergy Systems Inc.

- Hesai Technology (NA operations)

- Phoenix LiDAR Systems

- Geo-SLAM Ltd.

- RIEGL Laser Measurement Systems

- MicroVision Inc.

- Neptec Technologies Corp.

- Phantom Intelligence Inc.

- Continental AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid integration of solid-state LiDAR in Level-3 autonomous vehicle programs by U.S. OEMs

- 4.2.2 FAA BVLOS waivers accelerating commercial drone corridor mapping demand in Canada

- 4.2.3 Surging investments in digital-twin projects for aging U.S. transportation infrastructure

- 4.2.4 LiDAR-enriched Smart-Corridor initiatives under U.S. IIJA funding (2024-2028)

- 4.2.5 Early-mover adoption of LiDAR-embedded ADAS by electric-truck makers to meet stricter FMCSA safety mandates

- 4.2.6 North-American forestry and environmental agencies pivoting to LiDAR for wildfire-risk modelling post-2023 mega-fires

- 4.3 Market Restraints

- 4.3.1 Persistent price-premium vs. radar/vision in mass-produced L2+ vehicles

- 4.3.2 Skilled-talent scarcity in LiDAR data processing delaying state-DOT projects

- 4.3.3 Export-control restrictions on high-performance lasers limiting Canadian aerospace suppliers

- 4.3.4 Post-merger procurement uncertainty after Velodyne-Ouster consolidation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Aerial LiDAR

- 5.1.2 Ground-based LiDAR

- 5.1.3 Mobile and UAV LiDAR

- 5.2 By Type

- 5.2.1 Mechanical LiDAR

- 5.2.2 Solid-state LiDAR

- 5.3 By Range

- 5.3.1 Short-range (<100 m)

- 5.3.2 Medium-range (100-300 m)

- 5.3.3 Long-range (>300 m)

- 5.4 By Component

- 5.4.1 Laser Scanners

- 5.4.2 GPS/GNSS Receiver

- 5.4.3 Inertial Measurement Unit (IMU)

- 5.4.4 Camera and Other Sensors

- 5.5 By Application

- 5.5.1 Corridor Mapping and Surveying

- 5.5.2 ADAS and Autonomous Vehicles

- 5.5.3 Engineering and Construction

- 5.5.4 Environmental and Forestry

- 5.5.5 Security and Law Enforcement

- 5.6 By End-User

- 5.6.1 Automotive

- 5.6.2 Engineering and Construction Firms

- 5.6.3 Industrial and Utilities

- 5.6.4 Aerospace and Defense

- 5.6.5 Federal and State Government Agencies

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ouster Inc. (incl. Velodyne)

- 6.4.2 Teledyne Optech

- 6.4.3 Trimble Inc.

- 6.4.4 Leica Geosystems AG (Hexagon)

- 6.4.5 Innoviz Technologies

- 6.4.6 Sick AG

- 6.4.7 Topcon Corporation

- 6.4.8 LeddarTech Inc.

- 6.4.9 Faro Technologies Inc.

- 6.4.10 DENSO Corporation

- 6.4.11 RoboSense (USA)

- 6.4.12 AEye Inc.

- 6.4.13 Luminar Technologies Inc.

- 6.4.14 Valeo SA

- 6.4.15 Quanergy Systems Inc.

- 6.4.16 Hesai Technology (NA operations)

- 6.4.17 Phoenix LiDAR Systems

- 6.4.18 Geo-SLAM Ltd.

- 6.4.19 RIEGL Laser Measurement Systems

- 6.4.20 MicroVision Inc.

- 6.4.21 Neptec Technologies Corp.

- 6.4.22 Phantom Intelligence Inc.

- 6.4.23 Continental AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment