PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849891

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849891

France Contraceptive Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

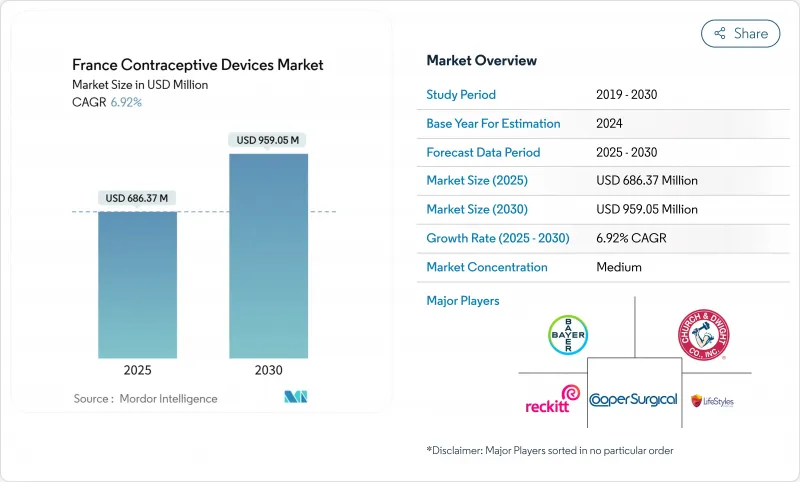

The France contraceptive devices market is valued at USD 686.37 million in 2025 and is forecast to reach USD 959.05 million in 2030, advancing at a 6.92% CAGR.

Momentum is shifting as male-focused products expand at a 9.01% CAGR while female-oriented devices hold steady share gains. Free condom distribution for residents under 26 years, AI-enabled fertility platforms, and tighter European Medical Device Regulation (MDR) oversight combine to reshape purchasing behavior and product design. Latex supply disruptions since the pandemic spur non-latex research, and digital pharmacies accelerate device availability by bypassing traditional retail bottlenecks. Companies with hormone-free portfolios and strong regulatory compliance capabilities are positioned to capture demand created by safety concerns surrounding hormonal pills and implants.

France Contraceptive Devices Market Trends and Insights

High burden of STIs coupled with increased awareness

France records rising syphilis and gonorrhea notifications that galvanize demand for dual-protection barrier devices. A 2024 survey showed 60% of clinicians felt under-trained on STI counselling, leaving a knowledge gap that condom brands fill with education initiatives. The government's January 2023 policy of free condoms for people under 26 immediately broadens reach to cost-sensitive users. Brands integrating educational content into packaging and digital apps tap into an evidence-based narrative that condoms prevent both infection and pregnancy. Social marketing around World AIDS Day 2024 further normalised condom use on university campuses. The combination of policy incentives and public campaigns positions barrier devices as essential public-health tools within the France contraceptive devices market.

High number of unintended pregnancies and delayed family planning

France registered 243,623 abortions in 2023, equal to 1 procedure for every 3 live births. Abortions are most common among women aged 25-34, who increasingly delay childbirth due to career planning and economic caution. This demographic trend accelerates uptake of long-acting reversible contraceptives that reduce user error. Health insurers reimburse 65% of IUD and implant costs, making them financially attractive for women seeking set-and-forget protection. Manufacturers emphasise real-world effectiveness data to convince sceptical users after several high-profile product recalls. Delayed family planning thus pushes innovation toward user-independent devices with robust clinical backing.

Side-effects and litigation around hormonal devices

Legal action by Androcur users alleging meningiomas underscores safety anxieties that dampen hormonal category growth. June 2024 guidance restricts 3rd and 4th generation pills due to thrombotic risk, and ANSM intensifies pharmacovigilance for related implants. These measures lengthen approval cycles and inflate compliance costs, prompting manufacturers to pivot toward hormone-free platforms. Insurers also reassess reimbursement thresholds, potentially raising patient costs. Such dynamics curb the France contraceptive devices market expansion of hormonal sub-segments.

Other drivers and restraints analyzed in the detailed report include:

- Growing popularity of LARC

- E-pharmacy and tele-consult prescription surge

- Cultural resistance among migrant sub-populations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Condoms command 41.62% of the France contraceptive devices market share in 2024 due to policy-backed free distribution and dual-protection messaging. The France contraceptive devices market size for subdermal implants is projected to climb at 7.91% CAGR as women seek hassle-free long-term efficacy. Condoms benefit from cost efficiency and widespread retail reach, yet user error and breakage concerns spur interest in LARC solutions. Diaphragms and cervical caps serve niche hormone-free demand but lack large-scale promotions. Vaginal sponges show modest sales because of lower effectiveness, whereas vaginal rings maintain stable growth through Organon's NuvaRing portfolio that generated USD 1.7 billion global women's health revenue in 2024.

Innovation pipelines target user comfort and eco-friendly packaging. ANSM requires pre-market notification and post-market incident reporting that lengthen go-to-market timelines but raise consumer confidence. Implants tout three-year protection with single clinical insertion, drawing busy professionals. Spermicidal films integrate with barrier methods for enhanced efficacy but remain secondary purchases. Permanent contraception trends pivot toward male procedures as vasectomies now outnumber female sterilisation since 2021, challenging tubal-clip sales trajectories.

Female devices hold 72.22% share but male solutions are set for a 9.01% CAGR through 2030, redefining responsibility expectations. Vasectomy procedures scaled from 1,940 in 2010 to 30,288 in 2022 following broader insurance coverage and better surgical training. The France contraceptive devices market size for male products is therefore expanding from a low base yet capturing headlines through start-ups such as Thoreme's Andro-Switch ring that achieved 99.5% efficacy in trials. Hormonal gel NES/T nears late-phase data readout with 200 volunteers enrolled, underpinning investor confidence.

Female segment growth continues due to reimbursement and medicalisation traditions dating back to the 1975 Veil Law. Safety vigilance remains high, illustrated by 2024 retrieval of a migrated Nexplanon implant via endovascular technique that underscored surveillance needs. Emergency contraception became free for women under 26 in 2025, reinforcing public-funded access. The immigrant fertility differential highlights untapped opportunities for culturally adapted messaging to bolster female device penetration.

The French Contraceptive Devices Market Report is Segmented by Product Type (Condoms, Diaphragms and Cervical Caps, Vaginal Sponges, and More), Gender (Male and Female), Material (Latex and Non-Latex) and Distribution Channel (Retail Pharmacies & Drug Stores, Hospital & Specialty Clinics and More). The Report Offers the Value (in USD Million) for the Above Segments. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer

- Reckitt Benckiser Group

- The Cooper Companies

- Ansell

- Church & Dwight Co.

- LifeStyles Healthcare

- Veru

- Thoreme

- Lelo

- LABORATOIRE MAJORELLE

- Dujardin International

- Doetsch Grether AG

- HRA Pharma

- Mona Lisa N.V.

- DKT International

- Merck Co & Inc

- SAGER PHARMA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of STIs Coupled with Increased Awareness for STIs

- 4.2.2 High Number of Unintended Pregnancies and Delayed Family Planning

- 4.2.3 Growing popularity of LARC

- 4.2.4 E-pharmacy & tele-consult prescription surge

- 4.2.5 Men's thermal contraception R&D momentum

- 4.2.6 AI-enabled fertility tracking integrating with devices

- 4.3 Market Restraints

- 4.3.1 Side-effects & litigation around hormonal devices

- 4.3.2 Cultural resistance among migrant sub-populations

- 4.3.3 Supply chain shocks for latex & nitrile

- 4.3.4 Slow CE-mark update pathway for next-gen male devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Condoms

- 5.1.2 Diaphragms and Cervical Caps

- 5.1.3 Vaginal Sponges

- 5.1.4 Vaginal Rings

- 5.1.5 Intra-Uterine Devices (IUD)

- 5.1.6 Subdermal Implants

- 5.1.7 Spermicidal Devices

- 5.1.8 Tubal Sterilization Clips

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Material

- 5.3.1 Latex

- 5.3.2 Non-Latex

- 5.4 By Distribution Channel

- 5.4.1 Retail Pharmacies & Drug Stores

- 5.4.2 Hospital & Specialty Clinics

- 5.4.3 Online Pharmacies & D2C Platforms

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Bayer AG

- 6.3.2 Reckitt Benckiser Group plc

- 6.3.3 Cooper Surgical Inc.

- 6.3.4 Ansell Ltd

- 6.3.5 Church & Dwight Co.

- 6.3.6 LifeStyles Healthcare

- 6.3.7 Veru Inc.

- 6.3.8 Thoreme

- 6.3.9 Lelo

- 6.3.10 LABORATOIRE MAJORELLE

- 6.3.11 Dujardin International

- 6.3.12 Doetsch Grether AG

- 6.3.13 HRA Pharma

- 6.3.14 Mona Lisa N.V.

- 6.3.15 DKT International

- 6.3.16 Merck Co & Inc

- 6.3.17 SAGER PHARMA

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment