Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686244

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686244

Asia-Pacific Pet Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 255 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

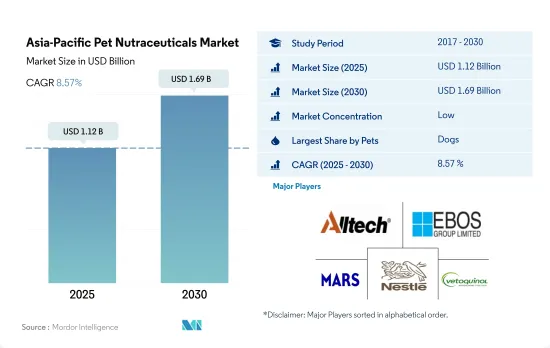

The Asia-Pacific Pet Nutraceuticals Market size is estimated at 1.12 billion USD in 2025, and is expected to reach 1.69 billion USD by 2030, growing at a CAGR of 8.57% during the forecast period (2025-2030).

The increase in the demand for preventive healthcare solutions for pets and the increasing pet population in the country are driving the market's growth

- Nutraceuticals play an important role in providing essential nutrition to pets as they improve the health and well-being of pets. In 2022, pet nutraceuticals accounted for 2.9% of the Asia-Pacific pet food market. Nutraceuticals increased by 33.2% between 2017 to 2022, primarily driven by the increasing awareness among pet owners about the potential benefits of nutraceuticals and the importance of preventive healthcare for their pets.

- Among pets, dogs held a major share of the Asia-Pacific pet nutraceutical market, with a value of USD 494.5 million in 2022. The higher share of the dog segment is due to the region's higher dog population, which accounted for 34.4% of the pet population in 2022. The segment grew by 33.0% between 2017 and 2022, driven by a rising number of pet owners who are seeking ways to improve the health and well-being of their dogs using nutraceutical products.

- The cats segment is projected to be the fastest-growing in the region, with a CAGR of 11% during the forecast period. This growth is primarily driven by the increasing cat population, which grew by 28.5% between 2017 and 2022, and the growing popularity of cats as pets due to their low maintenance and cost-effectiveness.

- The other animals include birds, small mammals, rodents, and others. These animals also have significant requirements for nutraceuticals to prevent potential health problems. As a result, the other animal nutraceuticals market was valued at USD 94.8 million in 2022.

- The increasing awareness among pet owners and the growing population of pets in the region is expected to drive the pet nutraceuticals market during the forecast period.

Growing focus on pet health and rising wellness and urbanization trends are driving the pet nutraceuticals market in the region

- Asia-Pacific has one of the largest pet nutraceutical markets globally. The market has witnessed significant growth and is expected to continue this trend during the forecast period due to the increased use of commercial pet food products, humanization of pets, and premiumization.

- China dominated the market, and it accounted for a market value of USD 259.2 million in 2022. The dominance of China was mainly due to its higher pet population in the country, with 275.7 million pets in 2022, which accounted for 53.9% of the region. The country has a well-established pet food industry and a growing distribution network. The growing urbanization and increasing number of millennials and Gen Z individuals adopting pets increased the usage of commercial pet foods.

- Japan and Australia are the other countries with higher market value for nutraceuticals in the region, amounting to USD 165.9 million and USD 108.8 million, respectively, in 2022. This is mainly due to the higher pet population and higher penetration of commercial pet food, including nutraceuticals, in these countries. For instance, the population of pets in Japan amounted to 22.6 million and 28.7 million in Australia in 2022.

- However, Vietnam and Malaysia's pet nutraceuticals market are expected to grow faster in the region, registering CAGRs of 12.7% and 12.4%, respectively, during the forecast period. It will be due to an increase in the pet population and increased awareness of the benefits associated with the usage of pet nutraceuticals in maintaining pets' health and well-being.

- The growing premiumization, pet humanization, and growing pet population are anticipated to be factors helpful in the growth of the pet nutraceuticals market in the region during the forecast period.

Asia-Pacific Pet Nutraceuticals Market Trends

A new purchase ecosystem is evolving in the region, such as pet cafes and pet stores assisting in purchasing to take care of the animals through a wide variety of cat food products and services, driving the population of cats

- In Asia-Pacific, cats have a lower share compared to dogs. They accounted for 26.1% of the pet population in 2022. Countries such as China, India, and Australia witnessed an increase in pet ownership due to health benefits such as feeling relaxed and less stressed and considering them as their companions. Therefore, the cat population as a pet increased by 0.28% between 2017 and 2022.

- Cat parents are higher than dog parents in countries such as Indonesia and Malaysia. In Indonesia and Malaysia, they accounted for 47% and 34%, respectively, in 2021. Due to the religious culture of these countries, they prefer to adopt cats as pets than dogs. This is expected to help the companies to invest more in cat food in these countries than dog food. In China, there was an increase in the number of pets, including cats, in urban areas and the pet population, including cats. This number of pets increased by 10.2% between 2018 and 2020 to reach a pet population of 100.8 million in urban areas in 2020. The cat population increased from 74.4 million in 2020 to 82.5 million in 2022 because of a rise in companionship during the pandemic. It is likely to have long-term effects as the life span of cats is more than 20 years.

- A new pet adoption and purchase ecosystem is evolving in the region as there are pet cafes and pet stores providing assistance from purchasing to taking care of the animals through a wide variety of pet food products and services. For instance, in Vietnam, The Meow House by R House is a cat cafe that serves vegetarian and vegan food and is a home for cats. Factors such as the rise in the adoption of cats due to health benefits, the culture of the Asia-Pacific, and changes in the pet ecosystem are helping to enhance cat adoption in the region.

Increased demand for high-quality and specialized diets due to growing awareness among pets about preventive health care is increasing pet expenditure

- In Asia-Pacific, there has been a rise in pet expenditure because of factors such as an increase in pet humanization leading to the feeding of pets with commercial pet food, availability of different types of pet diets, and pet parents preferring good quality premium pet food as they are willing to pay premium prices. Pet dogs have a higher expenditure share as they accounted for 39.6% of the pet expenditure in 2022 because dog owners feed them high-quality pet food. There is a higher consumption of food by dogs compared to other pets. For instance, in Australia, dogs are most popular in Australia, and about 40% of households had a pet dog in 2022, which increased the demand for preventive care and demand for specialized diets.

- China, India, and South Korea are the major pet markets in the region, as there has been growth in pet expenditure. These countries witnessed a high number of pets being fed good quality premium pet food, especially after the pandemic, as they were more aware of the nutritional requirement for their pet's good health. For instance, in Hong Kong's cat food market, the premium pet food segment accounted for 75% of the pet food sales in 2022. There are high online sales of pet food, especially in China, due to the vast number of products available on the website, and they are easy to order. For instance, in 2022, China's pet nutraceutical sales from online channels were 58.3% compared to the pet stores channel's contribution of 28.1%.

- The rising demand for pet food and growing awareness about good quality food for their pets has increased the pet expenditure by pet parents in the region during the study period.

Asia-Pacific Pet Nutraceuticals Industry Overview

The Asia-Pacific Pet Nutraceuticals Market is fragmented, with the top five companies occupying 23.30%. The major players in this market are Alltech, EBOS Group Limited, Mars Incorporated, Nestle (Purina) and Vetoquinol (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51041

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Product

- 5.1.1 Milk Bioactives

- 5.1.2 Omega-3 Fatty Acids

- 5.1.3 Probiotics

- 5.1.4 Proteins and Peptides

- 5.1.5 Vitamins and Minerals

- 5.1.6 Other Nutraceuticals

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

- 5.4 Country

- 5.4.1 Australia

- 5.4.2 China

- 5.4.3 India

- 5.4.4 Indonesia

- 5.4.5 Japan

- 5.4.6 Malaysia

- 5.4.7 Philippines

- 5.4.8 Taiwan

- 5.4.9 Thailand

- 5.4.10 Vietnam

- 5.4.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Alltech

- 6.4.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.4 EBOS Group Limited

- 6.4.5 Mars Incorporated

- 6.4.6 Nestle (Purina)

- 6.4.7 Nutramax Laboratories Inc.

- 6.4.8 Vafo Praha, s.r.o.

- 6.4.9 Vetoquinol

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.