PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907003

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907003

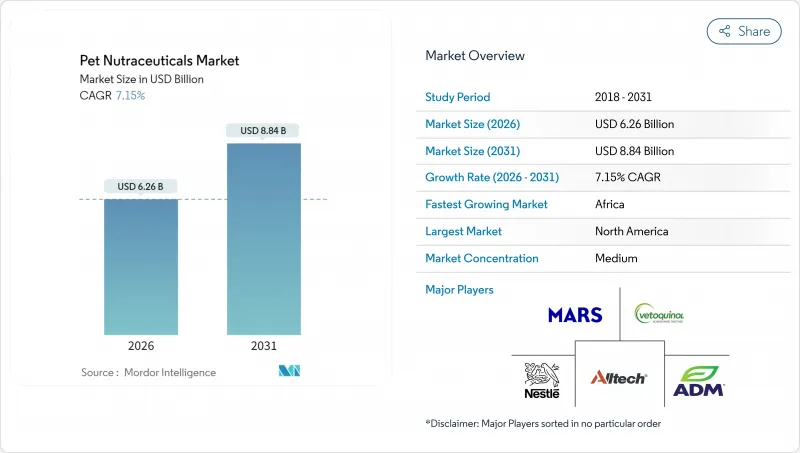

Pet Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pet nutraceuticals market size in 2026 is estimated at USD 6.26 billion, growing from 2025 value of USD 5.84 billion with 2031 projections showing USD 8.84 billion, growing at 7.15% CAGR over 2026-2031.

Robust gains stem from the ongoing humanization of pets, expanding veterinary endorsement of functional ingredients, and growing consumer willingness to treat preventive care as an essential household expense. Demand rises most sharply for premium formulations that target joint mobility, weight management, cognitive health, and digestive balance. Supply-side momentum stems from ingredient innovation, particularly algae-based omega-3 oils, and from digital subscription models that enhance dosing compliance. Competitive intensity remains moderate and consolidated as established pet food majors expand their wellness lines, while niche supplement specialists drive rapid product development cycles.

Global Pet Nutraceuticals Market Trends and Insights

Humanization of Pets Drives Functional Nutrition Demand

Pet owners increasingly apply human health paradigms to their animals, creating demand for nutraceuticals that mirror trends in human functional foods and dietary supplements. This behavioral shift is evident in purchasing decisions, as 41% of United States consumers purchased pet supplements in 2022. The humanization trend extends beyond basic nutrition to targeted wellness solutions, with owners seeking products that address specific health concerns, such as joint mobility, cognitive function, and digestive health. Premium positioning becomes less price-sensitive when framed as preventive healthcare rather than optional treats. The trend accelerates as millennials and Gen Z consumers, who grew up with pets as family members, enter peak pet ownership years with higher disposable incomes and a willingness to invest in pet wellness.

Rising Incidence of Pet Obesity and Chronic Diseases

Veterinary data show increasing prevalence of obesity-related conditions in companion animals, creating clinical demand for nutraceuticals that support weight management and metabolic health. The Association for Pet Obesity Prevention reports that over 50% of dogs and cats in developed markets are overweight or obese, driving veterinary recommendations for supplements that support healthy metabolism and joint function in 2022. Chronic conditions like arthritis, diabetes, and digestive disorders create ongoing treatment protocols where nutraceuticals complement pharmaceutical interventions. This medical necessity positioning differentiates functional supplements from discretionary treats, enabling premium pricing and repeat purchase patterns.

Fragmented Regulatory Definitions Across Regions

The absence of harmonized global standards for pet nutraceutical classification creates compliance complexity that constrains multi-region product launches and increases regulatory costs. The FDA's (Food and Drug Administration) recent guidance documents aim to clarify the boundary between pet foods and drugs, but significant gaps remain in defining functional ingredients and health claims. The European Food Safety Authority (EFSA) maintains different approval pathways for pet food additives compared to pet food to supplements, whereas Asia-Pacific markets each have distinct regulatory frameworks that require separate dossier preparation. This fragmentation particularly impacts smaller companies that lack resources for multiple regulatory submissions, creating barriers to entry and limiting innovation.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization Elevates Spend on Wellness Products

- Tele-Veterinary Platforms Push Nutraceutical Subscriptions

- Premium Pricing Limits Uptake in Developing Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vitamins and minerals capture the largest pet nutraceuticals market size at 26.35% in 2025, reflecting their established safety profiles and broad veterinary acceptance across multiple health applications. This segment benefits from decades of research in human nutrition that translates readily to companion animal applications, creating consumer familiarity and professional confidence in recommending these supplements. This segment's leadership position is primarily driven by pets' specific daily requirements for vitamins and minerals to support their growth, energy production, and overall well-being.

The vitamins and minerals segment also demonstrates the fastest growth at 7.90% CAGR through 2031, suggesting that broad-spectrum nutritional support remains the primary entry point for pet owners exploring functional nutrition. Hill's Pet Nutrition's ActivBiome technology exemplifies innovation in this space, combining traditional vitamins with prebiotic fibers to support digestive health . The segment has gained significant traction due to increasing awareness among pet owners regarding the importance of these essential nutrients in maintaining optimal pet health.

The Pet Nutraceuticals Market Report is Segments by Sub Product (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, and Other Nutraceuticals), Pets (Cats, Dogs, and Other Pets), Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels), and Region (Africa, Asia-Pacific, Europe, North America, and South America).

Geography Analysis

North America dominates the global landscape, holding a 44.10% market share in 2025, driven by high pet ownership rates, established veterinary infrastructure, and consumer willingness to invest in preventive pet healthcare. The region benefits from advanced regulatory frameworks that provide clear guidance for manufacturers while building consumer confidence in product safety and efficacy.

Europe captures a significant market share in 2025, with regulatory leadership from EFSA (European Food Safety Authority) creating pathways for novel ingredients, such as postbiotics, which subsequently gain acceptance in other markets. The region's emphasis on sustainability drives the adoption of algae-based omega-3 alternatives and environmentally responsible packaging, setting trends that influence global product development. Growth prospects remain solid as pet humanization trends accelerate across Western Europe, while Eastern European markets offer opportunities for expansion as disposable incomes rise.

Africa demonstrates the highest growth rates at 8.75% CAGR through 2031, reflecting early-stage market development where basic pet ownership trends intersect with growing awareness of nutritional health benefits. The region benefits from a robust distribution network, including veterinary clinics, pet specialty stores, and online retail channels, which has significantly improved product accessibility for pet owners.

- Mars, Incorporated

- Vetoquinol

- ADM

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- Nestle (Purina)

- Virbac

- Alltech

- Vafo Praha s.r.o.

- Nutramax Laboratories, Inc.

- Dechra Pharmaceuticals PLC

- Zesty Paws LLC

- Blue Buffalo (General Mills Inc.)

- Kemin Industries, Inc.

- DSM-Firmenich

- Healthy Pets Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Humanization of pets drives functional nutrition demand

- 5.5.2 Rising incidence of pet obesity and chronic diseases

- 5.5.3 Premiumization elevates spend on wellness products

- 5.5.4 Tele-veterinary platforms push nutraceutical subscriptions

- 5.5.5 Algae-derived Omega-3 adoption amid sustainability mandates

- 5.5.6 EFSA (European Food Safety Authority) approvals spur inclusion of postbiotics

- 5.6 Market Restraints

- 5.6.1 Fragmented regulatory definitions across regions

- 5.6.2 Premium pricing limits uptake in developing markets

- 5.6.3 Krill-oil supply volatility from conservation quotas

- 5.6.4 E-commerce claim scrutiny leads to product delistings

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Sub Product

- 6.1.1 Milk Bioactives

- 6.1.2 Omega-3 Fatty Acids

- 6.1.3 Probiotics

- 6.1.4 Proteins and Peptides

- 6.1.5 Vitamins and Minerals

- 6.1.6 Other Nutraceuticals

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

- 6.4 Region

- 6.4.1 Africa

- 6.4.1.1 By Country

- 6.4.1.1.1 South Africa

- 6.4.1.1.2 Rest of Africa

- 6.4.1.1 By Country

- 6.4.2 Asia-Pacific

- 6.4.2.1 By Country

- 6.4.2.1.1 Australia

- 6.4.2.1.2 China

- 6.4.2.1.3 India

- 6.4.2.1.4 Indonesia

- 6.4.2.1.5 Japan

- 6.4.2.1.6 Malaysia

- 6.4.2.1.7 Philippines

- 6.4.2.1.8 Taiwan

- 6.4.2.1.9 Thailand

- 6.4.2.1.10 Vietnam

- 6.4.2.1.11 Rest of Asia-Pacific

- 6.4.2.1 By Country

- 6.4.3 Europe

- 6.4.3.1 By Country

- 6.4.3.1.1 France

- 6.4.3.1.2 Germany

- 6.4.3.1.3 Italy

- 6.4.3.1.4 Netherlands

- 6.4.3.1.5 Poland

- 6.4.3.1.6 Russia

- 6.4.3.1.7 Spain

- 6.4.3.1.8 United Kingdom

- 6.4.3.1.9 Rest of Europe

- 6.4.3.1 By Country

- 6.4.4 North America

- 6.4.4.1 By Country

- 6.4.4.1.1 Canada

- 6.4.4.1.2 Mexico

- 6.4.4.1.3 United States

- 6.4.4.1.4 Rest of North America

- 6.4.4.1 By Country

- 6.4.5 South America

- 6.4.5.1 By Country

- 6.4.5.1.1 Argentina

- 6.4.5.1.2 Brazil

- 6.4.5.1.3 Rest of South America

- 6.4.5.1 By Country

- 6.4.1 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 Vetoquinol

- 7.6.3 ADM

- 7.6.4 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.5 Nestle (Purina)

- 7.6.6 Virbac

- 7.6.7 Alltech

- 7.6.8 Vafo Praha s.r.o.

- 7.6.9 Nutramax Laboratories, Inc.

- 7.6.10 Dechra Pharmaceuticals PLC

- 7.6.11 Zesty Paws LLC

- 7.6.12 Blue Buffalo (General Mills Inc.)

- 7.6.13 Kemin Industries, Inc.

- 7.6.14 DSM-Firmenich

- 7.6.15 Healthy Pets Inc.

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS