Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687044

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687044

South America Feed Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 205 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

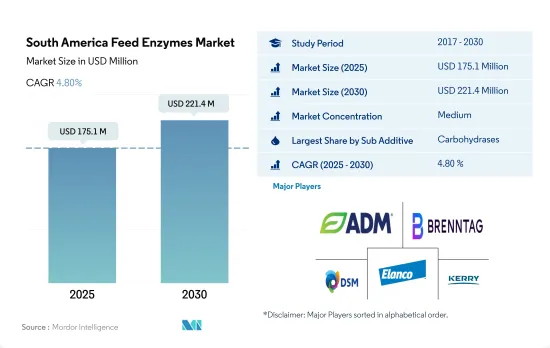

The South America Feed Enzymes Market size is estimated at 175.1 million USD in 2025, and is expected to reach 221.4 million USD by 2030, growing at a CAGR of 4.80% during the forecast period (2025-2030).

- Enzymes are an important type of feed additive used in animal nutrition. In South America, enzymes held a market share of 3.8% in the total feed additives market in 2022. Enzymes are crucial in many metabolic reactions, including the breakdown of starch, protein, and fat in the animal body.

- Among enzymes, carbohydrases are the most commonly consumed in South America, with a market value of USD 70.7 million. Carbohydrases are important in reducing animal feed costs by increasing energy and degrading starch, which releases molecules that form a usable source of energy for the animal. They also enhance the intake of protein, minerals, and lipids from animal feed.

- Poultry birds were the largest animal type segment for feed carbohydrases, accounting for 52.1% of the market share value in 2022. This is associated with the higher consumption of cereal with high non-starch polysaccharide content in poultry feed.

- Phytases, on the other hand, accounted for 33.6% of the South American feed enzymes market in terms of value in 2022, making it the second-largest segment in the feed enzymes market. The rising demand for animal protein, the increasing animal population, and the benefits of enzymes are the driving factors in the positive trend of the feed enzymes market.

- Brazil is the largest market for feed enzymes in South America, accounting for 57.2% of the market share in 2022. The higher share is due to the increased headcount of poultry by 9.1% in the country between 2017 and 2022. Thus, the market for feed enzymes is expected to grow during the forecast period with a CAGR of 4.8%, owing to the importance of feed enzymes in animal nutrition.

- The South American feed enzymes market is dominated by Brazil, which held a market value of USD 87.6 million in 2022, attributed to an 8.5% increase in Brazil's overall livestock population from 2017 to 2022, coupled with rising meat and meat product exports and a transformation from disorganized to organized livestock production. In Brazil, the poultry segment is the largest consumer of feed enzymes, accounting for 55.9% in 2022, followed by swine and ruminant segments, with market shares of 21.6% and 18.2%, respectively. The major driving factors are large grassland areas and a favorable climate for grain production.

- Argentina has the second-largest feed enzymes market in South America. It is anticipated to record a CAGR of 4.7% during the forecast period. In terms of value, the ruminant sector accounted for 50.0% of the Argentinian feed enzymes market in 2022, while the poultry segment accounted for 29.9%.

- Chile's market grew by 32.3% from 2017 to 2022, driven by the growing awareness of the health benefits of enzymes in animal feed, such as better nutrient absorption. In 2022, carbohydrases were the most widely used enzymes in animal feed in Chile, accounting for 52.3% of the overall feed enzymes market value, with swine having the most consumption by animal type.

- The Rest of South America accounted for 19.9% of South America's total feed enzymes market in 2022. The poultry segment held the largest market share of 66.9% in 2022, followed by swine at 14.1%.

- Overall, the market for feed enzymes is expected to grow during the forecast period due to the increasing usage of enzymes in the feed to supplement animals' nutritional requirements and the rapid growth of meat production.

South America Feed Enzymes Market Trends

Broilers and layers dominate the poultry production as the poultry farming gained popularity due to high Return on Investment (ROI) and increased demand for poultry products

- Poultry farming is a vital industry in South America, with its poultry sector experiencing an impressive growth rate of 10.1% in 2022, compared to 2017. This growth can be attributed to the increased consumption of poultry meat and its products, both domestically and internationally. In 2022, the consumption of poultry meat in Brazil alone was around 10.3 million metric tons, a significant increase from 9.6 million metric tons in 2018. This trend is set to continue as the poultry sector continues to grow and industrialize across many parts of South America.

- The production of broilers and layers is a major contributor to the region's poultry segment, accounting for around 97.3% of the total poultry production in 2022. Brazil is the largest producer of poultry products in South America, which produced around 14.6 million metric tons of chicken meat in 2021. The region is also a major poultry exporter globally, with Brazil exporting over 70% of the region's poultry meat exports. In 2021, Brazil exported about one-third of its chicken production to over 150 countries, with China being the largest destination export hub for the region.

- Poultry farming is gaining importance in the region, particularly in Brazil, due to its high yield and quick return on investment. As a result, the poultry farming industry in South America, particularly in Brazil, is experiencing steady growth due to increasing demand for poultry meat and its products, both domestically and internationally. With an increasing focus on industrialization and the benefits it offers, the poultry farming sector in the region is poised for continued growth in the coming years.

Freshwater cultivation account for 90% of aqua production and expansion of aquaculture industry is contributing to increasing aqua feed production

- The aquaculture feed production in South America has been rapidly increasing since 2017, with a 57.5% rise in 2022, producing about 5 million metric tons of compound feed for aquatic species. Brazil and Chile have been the major contributors to the growth in feed production for aquaculture, with both countries accounting for 1.4 and 1.2 million metric tons, respectively, in 2022. This growth is primarily attributed to the rise in freshwater cultivation of aquaculture species in these countries, with freshwater cultivation accounting for 90% of the aquaculture production in Brazil on average after 2020.

- Fish feed production in South America has been on the rise and accounted for 80.4% of the total aquaculture feed production in 2022. This increase in fish feed production can be attributed to the rising fish farming in countries, like Brazil and Chile, with a 56% increase in production compared to 2017. This trend is expected to continue in the next few years as the potential for the expansion of the fisheries and aquaculture sector in the region is enormous.

- Tilapia farming is one of the major contributors to the expansion of the aquaculture industry in the region, and this has led to increased demand for compound feed. Shrimp feed production has also witnessed a significant increase of 51.4% in 2022 compared to 2019, driven by the rising demand for high-profit-margin white-leg shrimp species. This trend is expected to continue in the next few years, driven by increasing shrimp production and export demand. In conclusion, the aquaculture feed production in South America is projected to continue to increase in the next few years, driven by the expansion of the fisheries and aquaculture sector, rising demand for high-quality protein, and increasing export demand.

South America Feed Enzymes Industry Overview

The South America Feed Enzymes Market is moderately consolidated, with the top five companies occupying 46.25%. The major players in this market are Archer Daniel Midland Co., Brenntag SE, DSM Nutritional Products AG, Elanco Animal Health Inc. and Kerry Group Plc (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54059

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Carbohydrases

- 5.1.2 Phytases

- 5.1.3 Other Enzymes

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Archer Daniel Midland Co.

- 6.4.3 Brenntag SE

- 6.4.4 Cargill Inc.

- 6.4.5 DSM Nutritional Products AG

- 6.4.6 Elanco Animal Health Inc.

- 6.4.7 IFF(Danisco Animal Nutrition)

- 6.4.8 Kemin Industries

- 6.4.9 Kerry Group Plc

- 6.4.10 Novus International, Inc.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.