PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687894

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687894

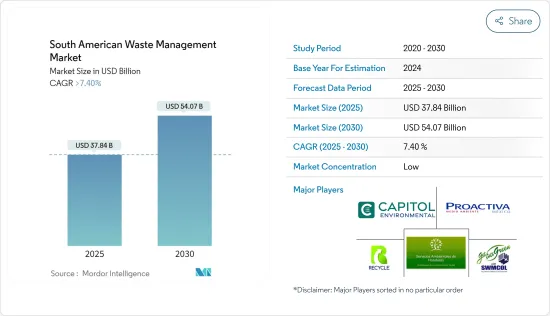

South American Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American Waste Management Market size is estimated at USD 37.84 billion in 2025, and is expected to reach USD 54.07 billion by 2030, at a CAGR of greater than 7.4% during the forecast period (2025-2030).

The increasing waste production in the region drives the market. Furthermore, the market is driven by the increasing awareness about the 3 R's of waste management, which intends to create a circular economy.

Latin America presents an intriguing case study for recyclers. It's an emerging market with great eventuality, indeed, though the region is facing several waste operation problems. Recycling rates generally don't exceed 10, with numerous open-air dumps in operation. Other issues include high situations of informality in the workplace and further than 40 of inaptly managed waste. Finding a result of these problems is imperative due to new transformative megatrends, similar to calls for sustainable business models and legislation in line with indirect frugality. The waste operation request in Latin America is expanding as it seeks to facilitate effectiveness, increase private participation to boost investment and incorporate digital results. Electronics recycling is a niche showing a significant pledge. However, our region is still dealing with the basics of scrap recycling in terms of setting up proper collection networks and environmentally sound establishments. While small-scale operations and homemade disassembly are still common across Latin America, Rosales notes that recyclers in Brazil and Mexico have been able to install more ' sophisticated technology.' This allows farther bracket of plastics, for example. The waste operation sector in Latin America has been growing and developing steadily over the last many times.

Latin America faces several waste operation problems, with recycling rates that are at most 10, a large number of open-air dumps, high levels of informality in the plant, and further than 40 of inaptly managed waste. Finding a result to this problem is imperative due to new transformative Mega Trends, similar to sustainability and indirect frugality. The waste operation market in Latin America is expanding as it seeks to improve effectiveness, increase private participation to boost investment and incorporate digital results. At a rough estimate, better waste operation could produce up to 4.8 million jobs across the region by 2030, the UN's Economic Development Division of the Economic Commission for Latin America and the Caribbean reported. By 2050, it would be suitable to generate 7.7 million new jobs and save up to 621 billion US- Dollars annually, a UN Environment Programme report states. Chile, for example, has set a target of creating further than 180,000 formal jobs in the circular economy by 2040. A secondary problem is the integration of waste selectors into a systematized waste operation system. The informal sector consists of around four million people, according to the Regional Initiative for Inclusive Recycling. The sector contributes roughly 25 to 50 percent of all external waste collection in the region.

In the current situation, overseeing waste presents a faultless chance to use the important materials that can be set up in multitudinous kinds of inclined widgets. On the off chance that reusing is not meetly done, precious means can be lost. In Latin America, nations both produce and import-waste, shaping the indigenous sluice that exists generally on the edges of the guideline. Because of the locale's quickened financial development and position of enhancement, the measure of-waste is getting more important quicker than in other regions. On ongoing occasions, e-waste has become an extremely conspicuous issue in public plans across Latin America. Private area and common society associations also have a developing enthusiasm for diving into waste issues. This is not just because of political weight and public worries about the dangerous corridor of waste but also because of the appealing industry openings that waste directors offer. Progressively Latin American nations are seeing waste on the board as a creator of new green endeavours and business. Of specific solicitude in Latin America is the sneaking and casual assortment and destroying of waste, which prompts unreasonable contest and unusual pitfalls. These difficulties can be tended to by having the correct framework set up, including approaches and guidelines, e-waste specialist-ops, sound backing and meetly working business sectors, suitable innovation and abilities, social orders that are very important educated and aware, and obviously great observing, control, and authorization bodies.

South American Waste Management Market Trends

Increasing demand for recycling driving the market

- Argentinian recycler Reciclar has improved its capacity of over 600 million plastic bottles per time thanks to TOMRA's outfit. TOMRA and Reciclar set an example of accelerating an indirect treatment of precious coffers in Latin America. The Argentinian factory, with a face area of further than 22,000 m2, features the rearmost generation of TOMRA Recycling Sorting outfit and ministry. AUTOSORT (TM) and AUTOSORT (TM) FLAKE allow the recycler business to sort and recover further than 30,000 tons/ time of PET holders by color and material type and produce demitasse, green, or light blue PET flakes and HDPE flakes of different sizes and colors. Also, Reciclar produces food-grade PET recyclates from post-consumer PET bottles.

- Thanks to the chastity situations achieved, recyclers can further reuse them into high-quality PET and HDPE recyclates for the product of new packaging and bottles with increased recycled content, thus supporting an environmentally friendly resource operation and product in Argentina. The plastic recycling challenge is a global problem in which all are involved, and in Latin America, the task isn't a minor bone.

- For this reason, TOMRA Recycling Sorting and Reciclar, S.A., two important companies in the recycling sector, are joining forces to contribute to environmental conduct in the region to extend the life cycle of plastics. Both companies seek to maximize the use of recycled plastic through commitment, invention, and fidelity. According to this charge, Reciclar recently installed fresh TOMRA outfits to meet the recycling challenges in Argentina. An ECOPLAS report estimates that the total volume of plastic reclaimed in 2021 amounted to 307,000 tonnes of plastics, an increase of 11 compared to 2020.

- The factory innovated by Marcelino Casella, which has specialized in collecting, sorting, and recovering waste for the last 28 times, only recently added 2 new AUTOSORT (TM) FLAKE units to its operation to produce demitasse, green or light blue PET flakes and HDPE flakes of different sizes and colors. Thanks to TOMRA Recycling Sorting's advanced PET bottle and PET packaging sorting outfit and technology, the Argentinean company has reached a processing capacity of 600 million plastic bottles and a product of 18,000 tons of plastic pallets per time, becoming the leading company in Argentina in PET waste processing.

Increasing waste production driving the market

- Latin America is inestimable for global food production. Yet it's no stranger to the food waste issue. Latin America accounts for about a quarter of global exports in agricultural and fisheries products. According to the OECD data, 38 of its available area is used for agriculture, out of which 9.5 is devoted to crops and 28.5 to pasturage. The agricultural sector is crucial for Latin American livelihoods, contributing to a normal of 4.7 of GDP and employing at least 14 of the region's population. Precluding food loss and waste is one of the topmost remaining global challenges.

- This challenges enterprises also Latin America. The FAO estimates that 6 of global food losses occur in Latin America and the Caribbean, and the region loses and/ or wastes each time about 15 of its food each. The Pan American Health Organization estimates that " in 2030, hunger will affect 67 million people in the region, a figure that doesn't take into account the impacts of the COVID-19 epidemic ". In addition, this figure represents the global food supply lapses caused by the war in Ukraine. So, indeed, advanced shameful hunger data are anticipated.

South American Waste Management Industry Overview

The South American waste management market is fragmented in nature, with a lot of regional and local players and a few global players. Some of the major players include RECYCLE S. DE R.L, Proactiva Medio Ambiente, Honduras Environmental Services, Capitol Environmental Services, Inc., The Trinidad and Tobago Solid Waste Management Company Limited (SWMCOL), and many more. The South American waste management market is highly competitive, with newer laws being implemented by the governments for effective waste management and the development of better waste recycling initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 The rapid urbanization and population growth in South America have led to increased municipal waste generation.

- 4.3.1.2 The need to reduce landfill usage and generate clean energy has led to investments in waste-to-energy facilities.

- 4.3.2 Restraints

- 4.3.2.1 Informal Waste Sector

- 4.3.2.2 Limited Financial Resources

- 4.3.3 Opportunities

- 4.3.3.1 International Trade and Waste Import/Export

- 4.3.3.2 Public-private partnerships and private sector investments in waste management infrastructure and services are helping to address the growing waste management needs

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on the Logisitcs support and development in the waste management industry in Latin America

- 4.7 Insights on the strategies of the rising startups venturing into the Latin American waste management industry

- 4.8 Technological advancement and innovation in the effective waste management

5 MARKET SEGMENTATION

- 5.1 By Waste type

- 5.1.1 Industrial waste

- 5.1.2 Municipal solid waste

- 5.1.3 E-waste

- 5.1.4 Plastic waste

- 5.1.5 Bio-medical waste

- 5.2 By Disposal methods

- 5.2.1 Collection

- 5.2.2 Landfill

- 5.2.3 Incineration

- 5.2.4 Recycling

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 RECYCLE S. DE R.L

- 6.2.2 Proactiva Medio Ambiente

- 6.2.3 Honduras Environmental Services

- 6.2.4 The Trinidad and Tobago Solid Waste Management Company Limited (SWMCOL)

- 6.2.5 Capitol Environmental Services, Inc

- 6.2.6 Inciner8 Limited

- 6.2.7 Casella Waste Systems, Inc.

- 6.2.8 US Ecology, Inc.

- 6.2.9 Waste Management, Inc:

- 6.2.10 Covanta Holding Corporation

- 6.2.11 Republic Services, Inc*

7 FUTURE GROWTH PROSPECTS OF LATIN AMERICAN WASTE MANAGEMENT INDUSTRY

8 APPENDIX

- 8.1 Statistics on the state-wise solid waste generation in urban areas

- 8.2 Latin America size of population (million)

- 8.3 Latin America GDP

- 8.4 Latin America inflation

- 8.5 Latin America Consumer Price Index (absolute)

- 8.6 Latin America exchange rate