PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851180

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851180

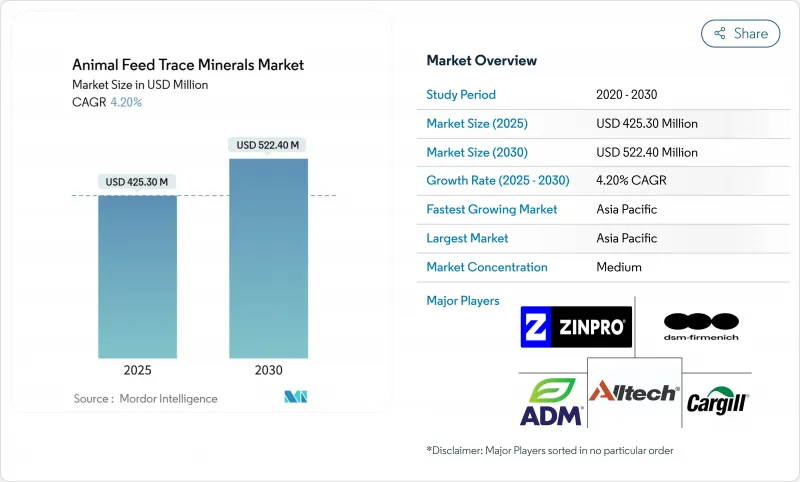

Animal Feed Trace Minerals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The feed trace minerals market is valued at USD 425.3 million in 2025 and is projected to reach USD 522.4 million by 2030, growing at a CAGR of 4.20% during the forecast period.

The market is shifting from traditional volume-based supplementation to data-driven programs that enhance mineral bioavailability, reduce waste, and meet stricter environmental regulations. The market growth is driven by increasing global demand for animal protein, expanding antibiotic-free production requirements, and improved absorption efficiency of 20-40% through chelation chemistry compared to sulfate salts. The Asia-Pacific region leads market demand, supported by intensive livestock operations and aquaculture expansion that maximize feed conversion benefits. Organic chelates are growing faster than inorganic salts as agricultural operations focus on performance improvements to justify higher formulation costs. Environmental regulations limiting heavy-metal excretion and requiring precise dosing continue to support the premium status of highly bioavailable mineral sources.

Global Animal Feed Trace Minerals Market Trends and Insights

Rising Global Meat and Dairy Demand

Global protein consumption is increasing by 1.2% annually until 2030, while livestock herds across multiple regions are decreasing due to disease outbreaks and rising costs. Producers are addressing this gap by enhancing feed conversion through optimized mineral programs that improve performance despite stagnant herd numbers. In China, a 5% reduction in milk production during late 2024 increased focus on precise mineral delivery systems that reduce waste. This trend extends to beef and broiler operations globally, driving the feed trace minerals market as operators pursue efficient productivity solutions amid supply fluctuations.

Shift Toward Highly Bioavailable Organic Trace Minerals

Organic chelates demonstrate 20-40% higher absorption rates compared to sulfate forms, resulting in 3-5% improved feed efficiency and 15-25% reduced fecal mineral output in commercial trials. The premium pricing becomes advantageous in regions with strict heavy-metal runoff regulations and for aging animals with reduced digestive capabilities. Large-scale beef trials indicate that organic zinc correlates with enhanced immune response markers, extending its benefits beyond growth performance measures.

Volatility in Key Mineral Prices

Zinc and copper prices fluctuated between 15% and 25% in 2024 due to supply disruptions in major mining regions, affecting feed budgets of smallholders unable to secure long-term contracts.Import tariffs on Mexican and Canadian materials implemented in April 2025 created additional cost pressures, potentially delaying transitions from inorganic to organic sources among price-sensitive buyers.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Chelation and Micro-encapsulation

- Regulatory Push for Antibiotic-Free, Fortified Feed

- Stricter Inclusion Limits Over Environmental Runoff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Zinc dominates the feed trace minerals market with a 32% share in 2024, driven by its essential functions in immune system support and reproductive health. Its importance grows as climate-related challenges increase disease risks, particularly in humid environments. Selenium shows the highest growth rate with a projected 4.9% CAGR through 2030, primarily due to its antioxidant properties, crucial in intensive livestock production. These two minerals constitute over 50% of the feed trace minerals market value in 2025, highlighting their fundamental role in animal nutrition.

Copper and iron maintain consistent demand levels due to their vital roles in oxygen transportation and enzymatic functions. Manganese usage increases in broiler feed formulations, as research demonstrates enhanced tibia strength at optimal supplementation levels. Cobalt and iodine fulfill specific nutritional requirements, with particular significance in regions where soil iodine deficiency necessitates feed fortification for dairy cattle.

The poultry segment accounted for 38% of the feed trace minerals market size in 2024. The high stocking densities in poultry operations necessitate trace mineral optimization to maintain egg shell quality and broiler daily weight gain. The aquaculture segment is projected to grow at a 5.0% CAGR through 2030, driven by increasing global fish production and the adoption of species-specific premixes to improve feed conversion efficiency in recirculating aquaculture systems.

The ruminant segment maintains steady demand as balanced mineral ratios support rumen microbes essential for milk production. In the swine segment, producers are adapting early-phase diets with butyrate and organic zinc following the EU ban on high-dose zinc oxide, maintaining mineral demand despite lower inclusion rates. The equine and companion animal segments, though smaller in market share, demonstrate consistent demand for premium chelated products, reflecting pet owners' focus on animal wellness.

The Animal Feed Trace Minerals Market Report is Segmented by Mineral Type (Zinc, Copper, Iron, and More), by Livestock (Poultry, Ruminants, and More), by Source Type (Inorganic, and Organic), by Chelate Type (Amino Acid Chelates, Proteinates, and More), by Form (Dry and Liquid), and by Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounts for 41% of global revenue in 2024 and maintains a 5.4% CAGR. The transformation of China's dairy industry and the growth in India's broiler production create sustained demand for high-performance chelated minerals that improve feed conversion. The expansion of aquaculture operations across Vietnam and Indonesia drives the need for specialized mineral formulations. Government policies promoting nutrient-efficient feeds support market growth in the region.

North America shows consistent growth due to regulations promoting antibiotic-free meat production and requirements to reduce heavy metal content in manure. The recurring threat of avian influenza has prompted producers to integrate mineral supplementation into their immunity management programs. In Canada, initiatives to reduce Lake Erie nutrient pollution encourage the adoption of precision mineral dosing technologies, expanding beyond conventional sulfate supplements.

Europe maintains its position as a mature market with a focus on innovation, particularly as strict mineral inclusion limits and new tariffs on Russian and Belarusian imports increase reliance on local chelate manufacturers. The region leads in developing micro-encapsulated products that combine minerals and functional additives in single particles, improving feed efficiency. South America, the Middle East, and Africa represent smaller but growing markets as commercial farms expand and implement proven methods to improve productivity.

- Alltech

- Phibro Animal Health

- Archer Daniels Midland (ADM)

- Cargill, Inc.

- Kemin Industries, Inc.

- Novus International, Inc.

- Biochem Pharma

- Zinpro

- DSM-Firmenich

- BASF SE

- SHV (Nutreco NV)

- Evonik Industries

- Ridley Corporation

- AB Vista

- Vamso Biotec Pvt. Ltd.

- Balchem Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Meat and Dairy Demand

- 4.2.2 Shift Toward Highly Bioavailable Organic Trace Minerals

- 4.2.3 Technological Advances in Chelation and Micro-encapsulation

- 4.2.4 Regulatory Push for Antibiotic-Free, Fortified Feed

- 4.2.5 Manure Heavy-Metal Caps Driving Precision Mineral Inclusion

- 4.2.6 Aquaculture Boom Requiring Species-Specific Mineral Premixes

- 4.3 Market Restraints

- 4.3.1 Volatility in Key Mineral Prices

- 4.3.2 Stricter Inclusion Limits Over Environmental Runoff

- 4.3.3 Competing Precision-Nutrition Tech Reducing Dosage Needs

- 4.3.4 Specialty Chelator Supply Bottlenecks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Mineral Type

- 5.1.1 Zinc

- 5.1.2 Copper

- 5.1.3 Iron

- 5.1.4 Manganese

- 5.1.5 Selenium

- 5.1.6 Cobalt

- 5.1.7 Iodine

- 5.1.8 Others

- 5.2 By Livestock

- 5.2.1 Poultry

- 5.2.2 Ruminants

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Pets

- 5.2.6 Equine

- 5.2.7 Others

- 5.3 By Source Type

- 5.3.1 Inorganic

- 5.3.2 Organic

- 5.4 By Chelate Type

- 5.4.1 Amino Acid Chelates

- 5.4.2 Proteinates

- 5.4.3 Polysaccharide Chelates

- 5.4.4 Propionates

- 5.4.5 Others

- 5.5 By Form

- 5.5.1 Dry

- 5.5.2 Liquid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Russia

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alltech

- 6.4.2 Phibro Animal Health

- 6.4.3 Archer Daniels Midland (ADM)

- 6.4.4 Cargill, Inc.

- 6.4.5 Kemin Industries, Inc.

- 6.4.6 Novus International, Inc.

- 6.4.7 Biochem Pharma

- 6.4.8 Zinpro

- 6.4.9 DSM-Firmenich

- 6.4.10 BASF SE

- 6.4.11 SHV (Nutreco NV)

- 6.4.12 Evonik Industries

- 6.4.13 Ridley Corporation

- 6.4.14 AB Vista

- 6.4.15 Vamso Biotec Pvt. Ltd.

- 6.4.16 Balchem Corp.

7 Market Opportunities and Future Outlook