PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435922

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435922

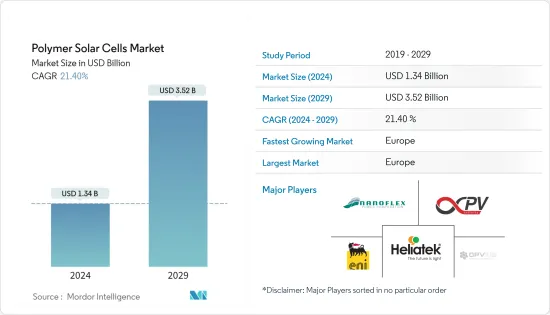

Polymer Solar Cells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Polymer Solar Cells Market size is estimated at USD 1.34 billion in 2024, and is expected to reach USD 3.52 billion by 2029, growing at a CAGR of 21.40% during the forecast period (2024-2029).

Key Highlights

- Over the long term, technological advancements in polymer solar cell technology aimed at increasing conversion efficiency are expected to drive the market during the forecast period.

- On the flip side, the lower efficiency of polymer solar cells as compared to silicon solar cells is expected to hinder market growth during the forecasting period.

- Nevertheless, research and development into the development of new polymers with higher conversion efficiencies is expected to be a significant growth opportunity for the market beyond the forecast period.

Polymer Solar Cells Market Trends

Technological Advancements to Drive the Market

- Polymer solar cells, also called organic photovoltaic (OPV), are third-generation PV cells that use an organic polymer layer to convert light into electricity. Polymer solar cells are lightweight, flexible, customizable, and have a less adverse environmental impact.

- In 2022, global solar PV technology had a total installed capacity of around 1046.61 GW, growing by nearly 167.7% from 390.87 GW in 2017. With rapid improvements in PV technology in recent years, polymer solar cells achieved an efficiency of 18.42% in 2022 under lab conditions. In order to further increase efficiency, various organizations with different molecular structures are performing intensive research and are expected to penetrate the solar PV market in the near future.

- Polymer solar cells have a few advantages over silicon solar cells, like being lighter in weight, cheaper in cost, transparent, and having a longer lifetime (greater than 5000 hrs), but due to their low energy conversion, efficient commercial applications are very limited.

- As per Solarmer Energy Inc., the present efficiency of polymer solar cells is estimated to improve over time due to technological improvement, which is expected to provide efficient polymer molecular structure and make polymer solar cells more competitive in the market with silicon-based solar cells and other alternative solar cell technologies, driving the market during the forecast period.

Europe is Likely to Dominate the Market

- Europe was one of the largest markets for solar PV technology, with around 225.47 GW of solar PV installations as of 2022, up from 109.98 GW in 2017. With technological advancements, the region is doing various research projects to achieve cheaper and more flexible solar panels that can be installed on multiple surfaces.

- Companies like Heliatek GmbH and OPVIUS GmbH are developing polymer solar cells and have demonstrated a few projects in the region.

- The largest polymer or organic solar cell project was in France. It is called the BiOPV (Building Integrated Organic Photovoltaic). The project includes the installation of organic photovoltaics on the roof of around 500 square meters that generate nearly 23.8 MWh of electricity.

- As of 2023, a few other R&D projects were going on in the region. In October 2023, a French-Spanish research team developed organic photovoltaic modules embedded into plastic parts through high throughput injection molding. The researchers injected thermoplastic polyurethane into the modules and found it enhanced their mechanical stability while keeping a high flexibility. The researchers first created modules in roll-to-roll printing using a photoactive blend known as P3HT: O-IDTBR. This blend was chosen due to its morphological and thermal stability, which are relevant to the later injection molding process. The completion of R&D in various sectors and applications is expected to expand the market in the region during the forecast period.

Polymer Solar Cells Industry Overview

The polymer solar cells market is consolidated. Some of the key players in the market (in no particular order) include Eni SpA, NanoFlex Power Corporation, Infinity PV, OPVIUS GmbH, and Heliatek GmbH, among others.

Eni's research developed a technology that widens the horizons of integrated photovoltaics. Together with organic photovoltaic cells, perovskite cells can be made in semi-transparent thin film with reduced material costs and production techniques, enabling applications that have hitherto been impossible for conventional solar cells, such as embedding on building facades. Among other things, this application is promoted by recent international and EU directives in the area of energy efficiency for buildings. It is, therefore, destined to have an extensive range of uses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 France

- 5.1.2.3 United Kingdom

- 5.1.2.4 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Japan

- 5.1.3.4 South Korea

- 5.1.3.5 Rest of Asia-Pacific

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Rest of South America

- 5.1.5 Middle-East and Africa

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.5.3 South Africa

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Solarmer Energy Inc.

- 6.3.2 NanoFlex Power Corporation

- 6.3.3 Infinity PV

- 6.3.4 OPVIUS GmbH

- 6.3.5 Heliatek GmbH

- 6.3.6 Eni SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS