PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644403

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644403

Latin America Mobile Gaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

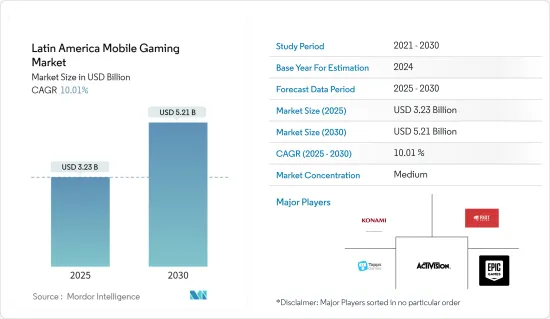

The Latin America Mobile Gaming Market size is estimated at USD 3.23 billion in 2025, and is expected to reach USD 5.21 billion by 2030, at a CAGR of 10.01% during the forecast period (2025-2030).

Key Highlights

- Moreover, the growing Internet penetration rate and smartphone users are fuelling the growth of this market. Additionally increasing trend of 5G adoption is also supporting the development of mobile games in this market. According to a survey of PagBrasil Pagamentos Eletronicos LTDA, the mobile gaming market in Brazil generated revenue of USD 1,650 million in the previous year.

- According to the Ericsson Mobility Report, Latin American mobile subscriptions in the current year are 710 million, smartphone subscriptions are 570 million, LTE subscriptions are 520 million, 5G subscriptions are 19 million, Data traffic per smartphone is 10.5 Units GB/month, and Mobile data traffic 5.3 EB/month.

- Moreover, Latin American powerhouse Brazil is ranked 13th worldwide and first in the region. Estimates show that 70% of Brazilians play video games, primarily on mobile devices. According to Pesquisa Games Brasil (PGB), almost half (51%) of Brazilian gamers spend more than 20 hours per week playing.

- The Ministry of Culture of Argentina reported that 70% of new users play video games, with over 60% preferring to do so on smartphones. Additionally, the number of mobile gamers rose due to the lockdown scenario during the COVID-19 pandemic. Hence this considerable demand can create a substantial market potential for the major vendors.

- According to Brazilian Games Export Program by Abragames (Brazilian Games Companies Association), this year, the Game Developers Conference (GDC), in partnership with ApexBrasil (Brazilian Trade and Investment Promotion Agency), will display 25 studios. The Brazil Games group is prepared to highlight some excellent items and draw attention to the thriving Brazilian gaming market. Puzzlers, roguelikes, single-player, multiplayer, and all other types of video games fall under this category.

Latin America Mobile Gaming Market Trends

Growing Number of Smartphone users will drive the demand in the Market

- Based on the Ericsson Mobility Report, by the end of this year, 72% of all regional subscriptions will be on 4G, the leading radio access technology. With more than 56 million new 4G subscriptions added in the current year, 4G subscription growth is robust. However, as people switch to 4G and 5G, 3G subscriptions are falling. In the next two years, several service providers will discontinue their 3G networks to allow for the repurposing of radio spectrum for 4G deployments.

- More than ten countries now provide commercial 5G. To encourage 5G subscription acceptance, service providers are speeding up 5G deployments in the mid-band (3.5 GHz) and low-band. By the end of this year, around 19 million 5G subscribers are anticipated, and a more significant uptake is expected next year.

- The affordability of data plans and the cheapest Internet-enabled handsets across Latin America is influencing the growth of this market in Brazil and other regions. Mobile subscriptions will increase by a CAGR of 2%, and smartphone subscriptions will grow by 3%.

- Additionally, the increasing trend of 5G adoption also supports the growth of mobile games in this market. Global System for Mobile Communications Association (GSMA) expected Latin America to have a 7% 5G connection within the forecast period. Many mobile games, such as Pubg mobile, and Call of duty mobile, require a high-speed internet connection to enjoy a unique gaming experience. Moreover, mobile gaming hardware also focuses on 5G adoption. For instance, the Asus ROG phone, Black Shark 2, changed its equipment to suit the gamer's needs. Hence this 5G adoption will enable the growth of multiplayer mobile games within this region.

Brazil will have the substantial market share for this market

- Brazil is one of the promising markets in the Latin American region due to its rapid growth of urbanized population and the rising demand for mobile games among its young people. According to the Organisation for Economic Co-operation and Development (OECD) data, 21.3% of the total population represents the young population in Brazil, which is higher than in the United States, Canada, and the United Kingdom. Hence this rapidly growing young population will create substantial market potential for the significant vendors of this market.

- Different government initiatives in this region also support the growth of mobile games for this market. For instance, the Brazilian government has already invested USD 35.25 million to produce and market electronic games for this region. Moreover, the events and different festivals are raising the demand for mobile games in this country. In Brazil's Independent Games (BIG) festival held the previous year, 330 companies were registered to attend the show, whereas 120 came from abroad.

- Furthermore, during the past two years, the gaming population of Brazil is increased by 28% due to the massive growth of smartphone users and increased Internet penetration rates for this country. However, the previous year's Ministry of Science, Technology, Innovation, and Communications announced postponing the 5G spectrum due to the interference issue with the 3.5GHz band and the recent COVID-19 pandemic. Hence this can create a market restraint on mobile gaming in this market.

Latin America Mobile Gaming Industry Overview

The mobile gaming market in this region is competitive due to the presence of a few dominant players such as Activision, Konami Holdings, Riot Games, etc. Moreover, significant companies focus on developing advanced technology to differentiate them from their competitors.

In June 2022, Green Man Gaming Limited launched the comedic space combat adventure game "The Galactic Junkers" with all new features such as mine, salvage, steal, and trade, and others for PlayStation 4 and XBOX.

In June 2022, Konami Corporation launched the mobile version of Football PES 2021, which has now been updated to football 2022. In addition, various in-game events and campaigns featuring the theme of Season 2 have also started on console and mobile. This new version added finesse dribble, a dynamic dribbling technique for this mobile game.

In October 2022, Riot games completed its acquisitions with Wargaming Sydney, a gaming software development studio. The studio produced the software architecture and game development tools necessary to construct multiplayer games like massively multiplayer online games (MMOGs). After being acquired by Riot, Wargaming Sydney will take the name Riot Sydney and work with Riot to create games like League of Legends and Valorant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID19 on Mobile Gaming Market in Latin America

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Mobile Gaming Players and In-game Purchases

- 5.2 Market Restraints

- 5.2.1 Unstable political landscape, internet infrastructure, local payment solutions and also alternative payments etc

6 KEY DEMOGRAPHIC INFORMATION - LATIN AMERICA

- 6.1 Smartphone Penetration and Ecosystem (Preferred Brands, Major Operating Systems, etc.)

- 6.2 Internet Penetration

- 6.3 Gaming Population (By Age and Gender)

- 6.4 Gaming Preferences (Genre, Platform, etc.)

- 6.5 Top 10 Games, By Platform And Publishers

7 MARKET SEGMENTATION

- 7.1 Geography

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Chile

- 7.1.4 Columbia

- 7.1.5 Rest of Latin America(Peru, Bolivia etc.)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Tapps Games

- 8.1.2 TFG Games

- 8.1.3 Dynamic Games (Dynamic Games Entretenimento)

- 8.1.4 PlayKids Inc,

- 8.1.5 Media Design and Creative Entertainment S.A. de C.V.(Ennui Studio)

- 8.1.6 Focka Games

- 8.1.7 HyperBeard, Inc

- 8.1.8 WASHAWASHA SA DE CV

- 8.1.9 Konami Holdings Corporation

- 8.1.10 Activision Publishing, Inc.

- 8.1.11 Riot Games Inc.

- 8.1.12 Abstract Digital Works

- 8.1.13 AmnesiaGames, Inc.

- 8.1.14 Epic Games, Inc.

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MAREKET