PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436137

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436137

United States Electric Vehicle Charging Systems and Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

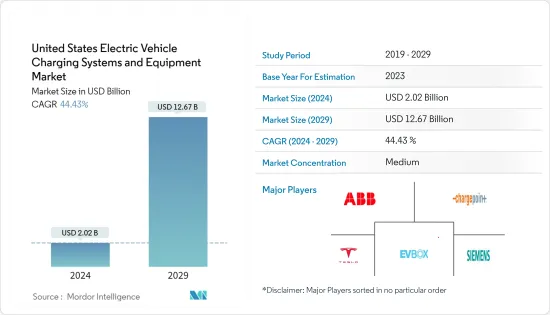

The United States Electric Vehicle Charging Systems and Equipment Market size is estimated at USD 2.02 billion in 2024, and is expected to reach USD 12.67 billion by 2029, growing at a CAGR of 44.43% during the forecast period (2024-2029).

The COVID-19 pandemic had limited domestically produced electric vehicles and their production declined due to the shutdown of manufacturing facilities and lockdowns. However, as restrictions eased EVs witnessed optimistic growth as consumers inclined toward affordable eco-friendly transportation supported by government incentives. The substantial demand for hybrid, electric, and fuel cell electric vehicles had driven the demand for charging systems and equipment for electric vehicles across the United States.

Over the medium term, the enactment of stringent emission and fuel economy norms, government incentives, and the increasing sales of electric vehicles, is generating a demand for charging stations. However, high cost and compatibility issues associated with installing charging infrastructure are anticipated to act as major challenges for players in the market.

In addition, as various players in the market are working on developing technologies such as wireless charging and autonomous charging robots, market players likely to witness lucrative opportunities during the forecast period. Furthermore, to keep up with the high demand from buyers for electric vehicles, several OEMs are also introducing vehicles with fast charging technologies, aimed at reducing the charging time.

US EV Charging Systems Market Trends

Increasing Investments in EV Charging Systems to Drive Demand in the Market

With growing EV sales across the United States, the demand for EV Charging equipment tends to rise, which in turn is driving investments by key players in the market. For instance, In 2021, around 21,700 fast electric vehicle chargers publically available across the United States. In 2020, there were around 16,700 publicly available fast electric vehicle chargers (EVSE) in the United States. Such an increase in electric vehicle chargers across the country is likely to increase the demand for electric vehicle charging equipment during the forecast period.

While Vehicle manufacturers who are planning to launch electric vehicles into the market are also investing in charging technology to widen their customer reach some others are investing in installing chargers throughout the United States. For instance,

- In June 2022, Volkswagen Group and Siemens invested in the growth plans of Electrify America, LLC to build an ultra-fast charging network for electric vehicles from all vendors in North America. Volkswagen and Siemens have invested an amount of USD 450 Million to expand the charging infrastructure across 1,800 locations and 10,000 fast chargers across the United States.

- In October 2021, General Motors announced a new charging program to install up to 40,000 Level 2 EV chargers across the United States. This initiative, which will begin in 2022, is part of GM's recently announced commitment to invest nearly USD 750 million to expand home, workplace, and public charging infrastructure through its Ultium Charge 360 ecosystem.

- General Motors plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in the United States during the forecast period.

- Siemens Corporation announced a commitment to invest and expand its manufacturing operations in the US to support electric vehicle infrastructure in the country. It will add production of the VersiCharge Level 2 AC series product line of commercial and residential EV chargers. With the expansion and added production, Siemens aims to manufacture more than 1 million electric vehicle chargers for the United States over the next four years.

- In November 2021, EVgo Inc., owner and operator of a public fast-charging network for electric vehicles, and General Motors announced an expansion of a fast-charging infrastructure build-out collaboration currently underway across the U.S. EVgo and GM previously announced a tripling of the EVgo network with plans to build 2,750 charging stalls through 2025.

Moreover, with new players entering the market coupled with heavy investments by existing players is likely to propel the market growth. The sales of electric vehicles are increasing rapidly in the country, and the ongoing technological developments will fuel growth of the electric vehicle charging system and equipment market over the forecast period.

AC Charger Segment to Witness Highest Demand During the Forecast Period

AC charging has been a first-off in the electric vehicle charging technology with the majority of the stations offering AC charging outlets across the United States. In AC charging stations, the electrical grid is connected to the onboard charger. The main advantage of AC stations is their affordability. As they are significantly smaller, and their installation is simpler, faster, and less expensive.

In the past few years, various electric vehicle manufacturers have come up with pick-up trucks. One of the major challenges for this kind of vehicle is charging stations in remote areas, but as more and more automakers are introducing pick-up trucks, they are also planning to install AC chargers on the adventure trails for promoting their upcoming vehicle models. For instance,

- In December 2020, Rivian announced that it began working on its own charging network with a strategy that will include DC fast charging and slower AC charging, previously the company confirmed that it is working on other solutions, like auxiliary batteries and truck-to-truck charging. Rivian is planning to locate stations near hiking trails, kayaking spots, and other recreational destinations, as the company is about to launch its R1T pickup truck and R1S SUV.

The charging infrastructure industry has aligned a common standard called Open Charge Point Interface, which dictates standards for AC charging, like Electric Vehicle Supply Equipment (EVSE) port and connector, with multiple connector types, like CHAdeMO and CCS.

Moreover, the United States also poses a total of 82,263 units publicly available for EVSE chargers based on AC charging, standing second-highest after China, as of 2020. In addition, OEM involvement in developing AC charging technology has also aided the market growth in the country.

As per the aforementioned statements, the AC charger segment of the market is expected to witness a healthy growth rate during the forecast period.

US EV Charging Systems Industry Overview

The United States Electric Vehicle Charging Systems and Equipment Market are dominated by several companies Tesla Inc., ABB Ltd, Siemens AG, CHargepoint Inc. and many others that are focusing on expanding their product portfolio owing to technological advancements and various other charging equipment manufacturers are improving their presence in the market by launching a new product, investments, and partnerships. For instance,

- In September 2022, ABB Ltd expanded its manufacturing capacity for charging stations in the United States. The company has announced that it will invest several million dollars in a new site in Columbia, South Carolina. The facility will produce up to 10,000 charging stations per year from 2023.

- In January 2022, ABB Ltd acquired the electric vehicle (EV) commercial charging infrastructure solutions company InCharge Energy. Through this acquisition, ABB Ltd strengthens its E-mobility division across North America.

- In November 2021, ChargePoint Holdings Inc. announced its acquisition of ViriCiti, a leading provider of electrification solutions for eBus and commercial fleets for a total purchase price of approximately EUR 75 million in cash, subject to adjustments. This transaction confirms ChargePoint's commitment to the electrification of fleet and commercial segments in North America.

- In August 2021, Siemens to expand electric vehicle charging manufacturing in the United States to support rapid market growth and plans to manufacture over 1 million EV chargers by 2025. The company will bolster its existing manufacturing footprint of EV infrastructure with the VersiCharge Level 2 AC series product line of commercial and residential EV chargers.

- In June 2021, Schneider Electric completes investment in Operation Technology Inc. ('ETAP') to spearhead smart and green electrification. The ETAP investment completes Schneider's existing software portfolio for electric power systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Application Type

- 5.1.1 Public

- 5.1.2 Private (Residential and Non-public/Commercial)

- 5.2 By Equipment Type

- 5.2.1 Pillar/Charging Station/Dock

- 5.2.2 Inverter

- 5.2.3 Charger

- 5.2.3.1 AC Charger

- 5.2.3.2 DC Charger

- 5.2.4 Others (Cord, Port, etc. (if any))

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Charge Point Inc.

- 6.2.2 Blink Charging Co.

- 6.2.3 EVBox Group

- 6.2.4 ABB Ltd

- 6.2.5 Webasto Group

- 6.2.6 Siemens AG

- 6.2.7 Schneider Electric

- 6.2.8 EvoCharge Inc.

- 6.2.9 Tesla Inc.

- 6.2.10 Leviton Manufacturing Co. Inc.

- 6.2.11 Sema Connect Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS