PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439773

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439773

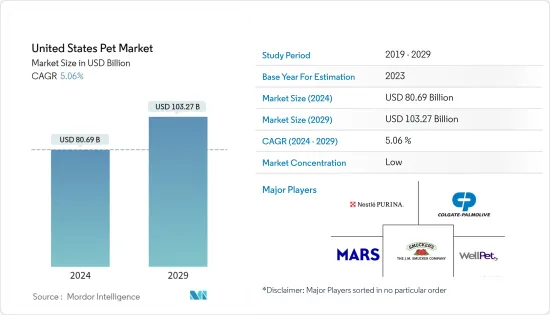

United States Pet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States Pet Market size is estimated at USD 80.69 billion in 2024, and is expected to reach USD 103.27 billion by 2029, growing at a CAGR of 5.06% during the forecast period (2024-2029).

Key Highlights

- Being the largest pet market in North America, the United States pet market's growth is attributed to the increase in millennial pet owners and the shift in the way pets are viewed. According to the 2021-2022 APPA National Pet Owners Survey, 70% of households in the United States own a pet, which equates to 90.5 million homes. Millennials are the most popular generation to own at least one pet, in 2021 approximately 35% of millennials own at least one pet. Further, the recent rise of pet humanization wherein pets are treated with increased care and hygiene is proving to be a major driver for the market and is leading to major changes in product packing and resourcing of ethically viable products.

- The development of private label stores focusing on unique and locally sourced products to increase their overall appeal and the increasing density of nuclear families are the other major drivers of the market studied. The increase in penetration of the e-commerce sector has been proving to be a major opportunity for low-cost marketing for the innovative and novel product lines developed by these emerging companies.

- Furthermore, Americans have always been heavy spenders when it comes to their pets. The United States is home to the highest number of pet dogs and cats. Consequently, quality ingredients are of the utmost importance for American pet owners. With the increase in concern for pet health, the demand for pet food products is expected to have a high potential for growth.

US Pet Market Trends

Increase in the Number of Pet Owners and Increased Expenditures on Pets

With the growing ownership of pets, pet owners seem to increasingly spend on service packages with more options, including food and grooming options. The desire for improved pet care products and accessories, such as pet furniture increased, and this is owing to the growing importance of pets and their related services.

According to National Pet Owner's Survey (2021-2022) conducted by the American Pet Products Association (APPA), in the United States, almost 70% of United States households own a pet, which equates to 90.5 million homes an increase of approximately 6.5% from the year 2019, and this boomed the pet care spending which has resulted in a huge increase in products and services aimed toward affluent pet owners.

The rising aging population in the United States is one of the reasons driving the growth of the market studied, as pets are considered good companions for the elderly. Customization holds more appeal to the customers, as it adds a personal touch to the pet, and this factor is expected to play a large role in the growth of the pet market. Manufacturers are using organic or natural materials for manufacturing grooming products, such as shampoos, soaps, tick powders, etc. The introduction of advanced cost-effective and customized services, rising concerns towards pet care, and an increase in health expenditure for animals in the United States are leading to the growth in the market.

The Rise in Shift to Online Pet Product Sales

The millennial who now constitute most pet owners are people who spend long hours working. This drives the demand for convenience, such as online retail channels, in the purchase of pet products and services that they use. The internet is well suited for sales of info-centric health-related products, such as natural and organic products. Internet sales channels can communicate product benefits and detailed product information through websites, blogs, and social media. The largest pet food online retailers are Petsmart.com and Pecto.com, followed by other leading retailers like PetFlow.com, PetFoodDirect.com, PetFoodExpress.com, and PetSupermarket.com.

Many smaller marketers and retailers turn to the internet as a sales medium to increase their consumer range and demand. In 2020, Hungry Bark, a Hungry Pet Nutrition brand, launched its online website offering complete custom meal plans for dogs, composed of superfood-packed dry foods, vitamin supplements for wholesome health benefits, and protein mix-ins for added variety and nutritional boost. These Superfoods for Super Dogs include four recipes of quality dry dog food, three single protein mix-ins, and five tasty dog supplement chews that double as treats. The brand's mission is entirely focused on improving dogs' and their humans' lives through personalized nutrition, directly delivering to their customer's doors.

US Pet Industry Overview

The United States pet market is highly competitive, with the presence of many international players, such as Mars Inc., Nestle SA (Purina), Colgate Palmolive (Hill's Pet Nutrition), and Blue Buffalo Co. Ltd. These players engage in product launches, mergers, and acquisitions, as their market strategy to strengthen their position in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Pet type

- 5.1.1 Dog

- 5.1.2 Cat

- 5.1.3 Bird

- 5.1.4 Fresh Water Fish

- 5.1.5 Other Pet Types

- 5.2 By Product Type

- 5.2.1 Food

- 5.2.2 Supplies/OTC Medicine

- 5.2.3 Other Product Types

- 5.3 By Distribution Channel

- 5.3.1 Supermarket/Hypermarket

- 5.3.2 Specialty Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Mars Inc.

- 6.3.2 Nestle SA (Purina)

- 6.3.3 Colgate Pamolive (Hill's Pet Nutrition)

- 6.3.4 The J.M. Smucker Company

- 6.3.5 WellPet

- 6.3.6 Diamond Pet Foods

- 6.3.7 United Pet Group Inc.

- 6.3.8 Blue Buffalo Co. Ltd

- 6.3.9 Pure and Natural Pet

- 6.3.10 Darling Ingredients Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS