PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690107

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690107

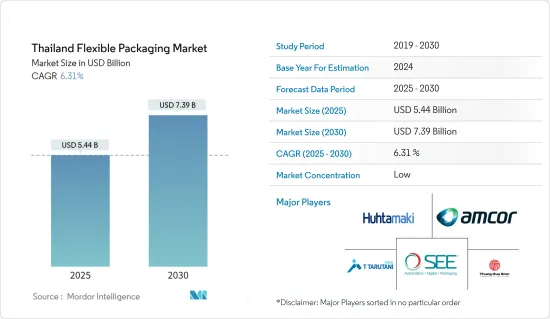

Thailand Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Thailand Flexible Packaging Market size is estimated at USD 5.44 billion in 2025, and is expected to reach USD 7.39 billion by 2030, at a CAGR of 6.31% during the forecast period (2025-2030).

Flexible packaging is produced from paper, plastic, film, aluminum foil, or a combination of those materials. The wide variety of flexible packaging products, such as pouches, bags, sachets, and wraps, available in the market for industries like food and beverages, pharmaceuticals, and personal care boosts the market growth in Thailand.

According to the US Department of Agriculture, Thailand is Southeast Asia's second-largest economy and a major exporter of canned tuna, canned pineapple, and frozen shrimp. Thailand's food industry's revenue is projected to grow to USD 71.79 billion in 2024, driven by the expanding beverage industry, which is estimated to propel the market growth.

The growing tourism in Thailand has contributed to the country's increased food and beverage consumption. According to the Pacific Asia Travel Association, International tourist arrivals in Thailand exceeded 18 million in 2023. Growing consumer expenditure on carbonated drinks, ready-to-eat meals, and baked goods in Thailand drives the market growth.

Also, various packaging expos and events are organized in Thailand every year, where companies showcase new and innovative packaging solutions and advancements in packaging machinery and processing technologies, which helps manufacturers stay ahead of the competition. In June 2024, the International Processing and Packaging Exhibition for Asia will be held in Bangkok, showcasing advanced automation and technology in food and beverage processing and packaging.

However, flexible packaging is a constantly evolving market with changing technological advancements in manufacturing. High competition in the market to enhance the consumer base and high market growth can hamper the market growth in Thailand.

Thailand Flexible Packaging Market Trends

The Food Segment is Expected to Witness Significant Growth

- Flexible packaging is widely used for food products because it can preserve freshness, enhance shelf life, and protect against contamination. Flexible plastic packaging is used for various food products, including fresh produce, meat and poultry, dairy products, snacks, and ready-to-eat meals. Thailand's growing food and beverage industry drives the segment's need for flexible plastic packaging.

- Besides food delivery from restaurants, online grocery services are also rising in Thailand. The food delivery industry in Thailand has seen tremendous growth in recent years due to the rising demand for online ordering and the need for speed and convenience in food delivery. According to the US Department of Agriculture, Thailand's foodservice value grew by 12.6% in 2023 compared to the previous year, boosting the market growth.

- Increasing demand for processed food products and growing consumer spending on convenience food products in Thailand are significant growth factors for the demand for flexible packaging. According to data from the US Department of Agriculture, growth in Thailand's food retail industry is attributable to rising living costs impacting consumers' spending power.

- According to data from the US Department of Agriculture, Thailand's exports of processed foods constituted 54% of the total exports in 2023, propelling market expansion.

- The increasing importance of flexible packaging in Thailand for food and beverage industries is experiencing a major shift to pouches that contain high liquid contents. Also, using sustainable packaging options and their depreciation of materials boost product appeal to consumers who prefer buying from companies with eco-friendly practices.

BOPP to Witness Robust Growth

- Biaxially oriented polypropylene (BOPP) is a thermoplastic polymer with properties similar to PET (polyethylene terephthalate). Biaxially oriented polypropylene (BOPP) is a polypropylene film stretched in both directions during manufacturing to create a material with high tensile strength.

- BOPP film products are widely used in flexible packaging as they have high barrier properties that protect products from moisture, UV, and any external challenge. Using BOPP film in food packaging helps extend the shelf life of perishable food items, including bakery and confectionery, savory snacks, and ready-to-eat food.

- Companies such as Kingchaun Packaging manufacture BOPP films in Thailand. They provide advanced, multi-functional films in matte, glossy, anti-fog, holographic, and pearlized formats suitable for various applications.

- BOPP pouches are extensively used for pharmaceutical packaging. They help preserve the productivity and reliability of medicines by ensuring protection from moisture and external environmental situations. The growing pharmaceutical industry in Thailand and increased consumer healthcare spending further boost the market growth.

Thailand Flexible Packaging Market Overview

The Thai flexible packaging market is fragmented and competitive, with a high number of market players such as Thug Hua Sinn Group (TPN FlexPak), Amcor PLC, T Tarutani Pack Co. Ltd, Sealed Air Corporation, and Huhtamaki OYJ. This market is distinguished by limited product differentiation, increasing product penetration, and intense competition. Design, technology, and application innovation can provide a long-term competitive edge.

In December 2023, Kao Industrial Co. Ltd, a Thai-based company, partnered with SCG Chemicals, a Thai-based chemical manufacturer, and Dow Thailand Group to develop sustainable packaging using innovative plastics such as INNATE, ELITE, and Dow PCR. This partnership will develop new materials and use innovative manufacturing technologies to provide rigid and flexible sustainable packaging, enabling Kao to lower its carbon footprint and meet consumer demand.

In July 2023, TPBI launched the "LifeHakStore by TPBI" to provide online distribution services, providing convenience to customers who wish to order various packaging from TPBI and its partners anytime. Such business expansion approaches enable the company to reach a broader customer base while generating new revenue streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Current Geo-political Scenarios on the Market

- 4.5 Vendor Level Presence in Major Verticals

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from End-user Industries

- 5.1.2 Increased Demand for Convenient Packaging

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Pouches

- 6.1.1.1 Type

- 6.1.1.1.1 Stand-up

- 6.1.1.1.2 Flat

- 6.1.1.2 End User

- 6.1.1.2.1 Food

- 6.1.1.2.2 Beverage

- 6.1.1.2.3 Pet Food

- 6.1.1.2.4 Other End Users

- 6.1.2 Bags

- 6.1.3 Films and Wraps

- 6.1.3.1 Type

- 6.1.3.1.1 BOPP (Biaxially Oriented Polypropylene)

- 6.1.3.1.2 BOPET (Biaxially-oriented Polyethylene Terephthalate)

- 6.1.3.1.3 CPP (Cast Polypropylene)

- 6.1.3.1.4 PVC (Polyvinyl Chloride)

- 6.1.3.1.5 PE (Polyethene)

- 6.1.3.1.6 Other Types

- 6.1.3.2 End User

- 6.1.3.2.1 Food

- 6.1.3.2.2 Consumer Goods

- 6.1.3.2.3 Medical

- 6.1.3.2.4 Other End Users

- 6.1.4 Other Product Types

- 6.1.1 Pouches

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki OYJ

- 7.1.2 Sealed Air Corporation

- 7.1.3 T Tarutani Pack Co. Ltd

- 7.1.4 Amcor PLC

- 7.1.5 Thug Hua Sinn Group (TPN FlexPak)

- 7.1.6 JR Pack Co. Ltd

- 7.1.7 Thai Artec Co. Ltd

- 7.1.8 Innopack industry co. ltd

- 7.1.9 TPBI Public Company Limited

- 7.1.10 Mondi Group

- 7.1.11 SCG Packaging Public Company Limited

- 7.1.12 Scientex Packaging (Ayer Keroh) Berhad

- 7.1.13 Kim Pai Co. Ltd

- 7.1.14 Print Master Co. Ltd

- 7.1.15 South East Packaging Industry Co. Ltd

- 7.1.16 LLH Printing & Packaging

- 7.1.17 Majend Macks Co. Ltd

- 7.1.18 Fuji Seal Inc.

- 7.1.19 Royal Meiwa Pax Co. Ltd

- 7.1.20 Craftz Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET