PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644788

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644788

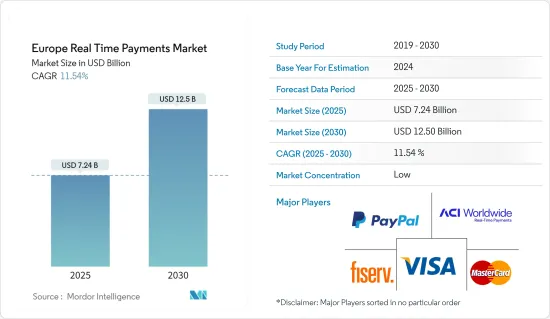

Europe Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Real Time Payments Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 12.50 billion by 2030, at a CAGR of 11.54% during the forecast period (2025-2030).

The rapid proliferation of smartphones, consumers' need for quicker settlements, and government initiatives in the European region, among others, are the key reasons driving the market's growth.

Key Highlights

- Increasing real-time payment adoption rates and continuous development and evolution of infrastructure across Europe indicate strong growth of real-time payments in the region in the coming years. Most European markets, including the UK and the Netherlands, experienced significant growth in volumes and values of real-time fund transfers; with the introduction of the P27 in the Nordic region, the real-time payment market is anticipated to grow.

- The European Payments Council (EPC) designed a pan-European instant payment system to accelerate the development of real-time payments in Europe. The SEPA Instant Credit Transfer (SCT Inst) process is based on the EPC's current SEPA credit transfer (SCT) scheme.

- Furthermore, this payment system enables euro credit transfers, with funds becoming available on the account in seconds at any time and in a region that will progressively expand to encompass 36 European countries. Several regional banking institutions are using SEPA Instant Credit Transfer (SCT inst.). Citi, for example, just implemented Single Euro Payments Area (SEPA) Instant Payments throughout Europe.

- Moreover, several initiatives based on ISO 20022 for real-time payments exist in Europe. In the United Kingdom, there is the New Payments Architecture (NPA), P27 in the Nordic region countries, SCT Inst. in Germany, and the EU is pushing on with the European Payments Initiative (EPI). These real-time payment systems will provide simpler access for increased participation, boost ongoing stability and resilience, and increase innovation through greater competition in the real-time payments market.

- Furthermore, the use of ISO 20022 is anticipated to improve cross-border and regional connectivity and enable additional data frames that can use to build new services. Furthermore, strong mobile and internet penetration in many countries of the EU, such as Sweden, Spain, Denmark, Poland, etc., is providing a strong platform for the growth of real-time payments in the region.

- However, growing payment frauds in real-time payments, such as Authorized Push payments, can hamper the growth of the real-time payments market in the region. With the 3D Secure 2.2 protocol and other SCA technologies to accommodate PSD2, card fraud in the region declined, but Authorized Push Payments frauds increased in the region.

- The COVID-19 pandemic enormously impacted how people shop and pay in the region. The new practices, including real-time and digital payments, are more convenient for customers and are likely to grow in the coming years.

Europe Real Time Payments Market Trends

Rising Penetration of Smartphone is Expected to Foster the Market Growth

- The increasing penetration of smartphones across many European countries is increasing the real-time payment market in the region. As per data reported by GSMA Intelligence, the smartphone penetration in Finland at the start of 2023 was 169.5% of the total population. Similarly, in other European countries such as Austria, Germany, Spain, and the United Kingdom was 138.8%, 141%, 119%, and 105% of the total population, respectively.

- Furthermore, the rise of mobile commerce is further proliferating real-time payments in the region as many e-commerce platforms offer real-time credit or buy now pay later services to the e-commerce users in the region.

- Consumers prefer mobile BNPL services due to their affordability and convenience. BNPL, consumer credit, or after-pay enables consumers to pay money only. Some key European players offering BNPL service include Klarna, PayPal Credit, and Splitit.

- Furthermore, the increasing adoption of smartphone usage for real-time fund transfer from Person to Person (P2P) and Person to business (P2B) is further supported by the strong smartphone penetration across the region. These factors are further expected to augment the real-time payments market in Europe over the forecast period.

United Kingdom is Anticipated to Hold the Largest Share

- Real-time payments have been available in the United Kingdom since 2008 with the launch of the U.K.'s real-time payments system called the Faster Payments System (FPS), operated by Pay. the U.K. in the country. Furthermore, the Faster Payment System also powers Paym, the country's mobile payments service, making it possible to pay family, friends, and small businesses using mobile numbers.

- Furthermore, most financial institutions in the country are participants of the FPS, making it reach millions of people. Moreover, many banking institutions in the region are adopting FPS. For instance, in May 2022, The Bank of London, one of the leading-edge technology companies, announced that it had become a Directly Connected Settling Participant of the Faster Payment System (FPS), the United Kingdom's 24*7 real-time payments infrastructure.

- Payment infrastructure in the United Kingdom is still very much tied to traditional tools, especially cards, despite being easy and cheap for consumers to access real-time payments. Further, real-time payments in the U.K. are still focused on low-volume, high-value transfers, not everyday expenditures. However, the scenario is continuously changing, and the adoption of real-time payments is increasing in the region and is further expected to grow over the forecast period.

- The U.K. further supports the growth of the United Kingdom's real-time payments system. For instance, real-time payments operator Pay. U.K. is modernizing the Faster Payments Service as part of its New Payments Architecture (NPA) program, which also involves procuring a new ISO 20022-ready central infrastructure. The New Payments Architecture (NPA) will be a resilient, scalable platform that will expand the growth of real-time payments in the United Kingdom.

- All the abovementioned factors are expected to boost demand for the UK real-time payments industry throughout the forecast period.

Europe Real Time Payments Industry Overview

The competition in the Europe real-time payments market is intensifying, and the market appears to be fragmented due to the presence of numerous players. These market players offer innovative payment solutions and are involved in various strategies, such as mergers and acquisitions, to gain a competitive advantage. Major players in the Europe real-time payments market include ACI Worldwide Inc., Fiserv Inc., Mastercard Inc., and Visa Inc., among others.

- June 2023 - Global paytech firm ACI Worldwide has launched ACI Instant Pay, a real-time payment solution for European and UK merchants. Merchants using Instant Pay can accept instant online, mobile, and in-store payments through a single API integration with the ACI payments orchestration platform.

- April 2023 - PayPal's online payment solution enables SMBs to accept PayPal payments, credit and debit cards, digital wallets, and more. Beginning, SMBs will also be able to accept payments with Apple Pay, allow their customers to save payment methods with the PayPal vault and keep their cards up to date with real-time account updater, as well as get access to features to help them run their business including interchange plus (IC++) pricing with gross settlement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in Europe

- 4.4 Key market trends pertaining to the growth of cashless transaction in Europe

- 4.5 Impact of COVID-19 on the payments market in Europe

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Immediacy and Ease of Convenience of the Real Time Payments

- 5.2 Market Challenges

- 5.2.1 Payment Fraud such as Authorized Push Payment Scams

- 5.2.2 Existing Dependence on Cash in Major Countries such as Germany

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Italy

- 6.2.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 Fiserv Inc.

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 VISA Inc.

- 7.1.6 FIS Global

- 7.1.7 Apple Inc.

- 7.1.8 Finastra

- 7.1.9 Volante Technologies Inc

- 7.1.10 Nets (Nexi Group)

8 Investment Analysis

9 Future Outlook of the Market