PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644793

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644793

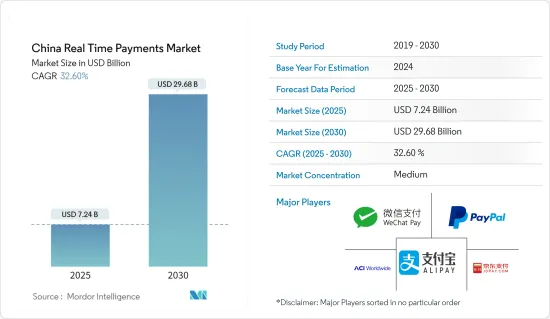

China Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Real Time Payments Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 29.68 billion by 2030, at a CAGR of 32.6% during the forecast period (2025-2030).

In view of the increasing number of Internet and mobile users, the growing number of bank accounts, and the increasing need for instant payments, the market is growing.

Key Highlights

- China has a one of large population with booming access to digital technology, and the country has quickly adopted digital wallets, which are now a dominant force in the china payments market. In addition, there is a lot of room for realtime payments to grow in the region, given the high level of mobile wallet adoption in China, mainly offered by AliPay and WeChat Pay.

- According to National Library Board Catalogue, around 60 percent of China's 1.3 billion population will have purchased via mobile payment by 2023. The significant increase in the number of transactions of real-time payments in the region is further expected to boost the real-time payments market in the region.

- Furthermore, there's been a surge of interest in Buy now pay later services in China over the last decade. A few factors driving BNPL are unprecedentedly low-interest rates associated with BNPL payments, the growth of online payments through Alipay and WeChat Pay, as well as highly funded fintech startups that are looking to attract new clients. The BNPL services are provided by various ECommerce Platforms in the region to their customers.

- With the country's rapid development of 5G infrastructure, new opportunities are anticipated to emerge in the Chines real-time payments market owing to the availability of a low latency network.

- However, a series of stringent rules and regulations on fintech companies has also been implemented in the region, which may hamper the growth of the real-time payments market in the region.

- Moreover, the COVID-19 pandemic has further spurred financial inclusion, driving a large surge in digital payments amid the expansion of formal financial services in China. After the COVID-19 pandemic, China launched its digital currency, the digital Yuan or RMB, to become a cashless society using contactless payments. Such trends are anticipated to positively influence the studied market's growth post-COVID-19.

China Real Time Payments Market Trends

Increasing Penetration of Smartphone across China to Propel the Real Time Payments Market Growth

- The high smartphone penetration across the region supports the increasing adoption of real-time payments in China. As major real-time payment providers such as AliPay and WeChat Pay offers real-time payments through mobile applications, increased smartphone penetration is a much-needed push to flourish real-time payments in China.

- According to GSMA, 5G subscriptions in China will likely account for nearly a third of the global total by 2030. Furthermore, the technology is expected to add USD 290 billion to the Chinese economy in 2030, spreading benefits across industries.

- Further, with consumers in Mainland China increasingly shifting from cash to mobile-based real-time payments and skipping payment cards, real-time payments are expected to grow over the forecast period. Moreover, the high banked population and increasing internet penetration over the past few years further fuel the growth of the market.

- The country's high internet penetration also governs the success and growth of real-time payments in China. For instance, according to China Internet Network Information Center (CNNIC), China's internet population grew by 11 million in June 2023 compared to December 2022. Over one billion people had access to internet in the country. All of the factors combined are expected to boost the real-time payments market in the region over the forecast period.

P2B Segment is Expected to Witness the Growth

- China's real-time payments are adopted widely by shopkeepers, restaurants, and various E-commerce platforms. This is further supported by high smartphone and internet penetration. Additionally, fast and immediate payments in seconds are attracting businesses and individuals in the region to perform P2B transactions through real-time payments owing to the immediacy and ease of convenience.

- The growing popularity of online shopping increased the number of online shoppers in the region, supported by high mobile internet penetration and fast payment checkout solutions such as real-time payments in China. For instance, as reported by CNNIC, there were about As of June 2023, about 884 million people in China had purchased goods online, compared to 610.11 million in 2018. This is further expected to boost the P2B real-time transaction in the region over the forecast period.

- With this growth anticipated to sustain, the studied market is projected to witness an upward growth trend in the e-commerce segment during the forecast period.

- Moreover, major players such as Alipay and WeChat Pay rapidly grow as preferred payment solutions for E-commerce platforms. These platforms offer innovative real-time payment solutions to online shoppers, increasing the P2B real-time transactions in the region. Hence, all these factors combined will likely boost the P2B transactions in China over the forecast period.

China Real Time Payments Industry Overview

The China real-time payments market appears to be semi-consolidated, as few players currently hold significant market share. Major market players provide innovative payment solutions and are involved in various strategies, such as product innovations, acquisitions, and partnerships, among others, to gain a competitive edge. Some key market players include Paypal Holdings Inc.,

- In Januray 2024, PayPal Holdings, Inc introduces reimagined checkout and guest checkout experiences, new advanced offers platform for merchants, and new consumer app to earn cash back and give customers more reasons to shop with PayPal

- In April 2023, Changshu, located in the province of Jiangsu, announced its plans to start a new payment process in May, which is expected to be the biggest rollout of the currency, also known as the e-CNY, in China. After the launch, In a city in eastern China, government workers will receive full pay in the electronic yuan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in China

- 4.4 Key market trends pertaining to the growth of cashless transaction in China

- 4.5 Impact of COVID-19 on the payments market in China

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphone is Expected to Boost the Real Time Payments Market

- 5.1.2 Growing Need For Faster Payments and Falling Reliance on Traditional Banking

- 5.2 Market Challenges

- 5.2.1 Payment Fraud and Security Issues

- 5.2.2 Challenges Related to Strict FinTech Regulations

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across China

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 AliPay (Alibaba Group)

- 7.1.2 WeChat Pay (Tencent Holdings Ltd.)

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 ACI Worldwide Inc.

- 7.1.5 JDPay.com (JD.com)

- 7.1.6 FIS Global

- 7.1.7 Mastercard Inc.

- 7.1.8 VISA Inc.

- 7.1.9 Fiserv Inc.

- 7.1.10 Apple Inc.

8 Investment Analysis

9 Future Outlook of the Market