Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693409

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693409

Military Helicopters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 334 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

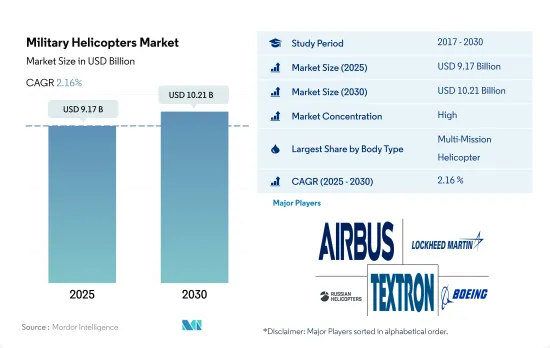

The Military Helicopters Market size is estimated at 9.17 billion USD in 2025, and is expected to reach 10.21 billion USD by 2030, growing at a CAGR of 2.16% during the forecast period (2025-2030).

The multi-mission helicopter segment is expected to generate the highest demand in the overall military helicopters market to counter various emerging threats

- There is an increase in the use of rotorcraft due to increased military conflicts, terrorism, border disputes, territory invasions, and violations. A number of regional armed forces are also upgrading their helicopters with cutting-edge technologies to gain a military advantage over their adversaries. In addition to providing close air support to troops and destroying enemy armor, multi-mission helicopters can be used for anti-tank missions.

- During the historical period, the multi-mission helicopter was the most procured model, accounting for 49% of the total military helicopter fleet, followed by other rotorcrafts (utility helicopters, maritime helicopters, anti-submarine warfare helicopters, and training helicopters) and transport helicopters, which accounted for shares of 37% and 13%, respectively. During the same period, some of the most procured rotorcraft models were the UH-60 series helicopter with 409 procurements, followed by AH-1Z and CH-47D/F with 180 and 173 aircraft procurements, respectively.

- Furthermore, the demand for military helicopters has been fueled by several factors, such as the changing nature of modern warfare, characterized by asymmetric threats and complex operational environments, which has necessitated the need for highly adaptable and flexible platforms. The rise of hybrid warfare conventional and unconventional tactics has also increased the demand for helicopters with advanced ISR capabilities. Factors such as these are expected to drive the demand for military aircraft procurement. During the forecast period, a total of 2,854 rotorcraft are expected to be delivered globally.

Rising Geopolitical Threats Associated With Increasing Defense Budgets Are Driving The Market

- The global military helicopter market has grown significantly over the years, driven by increasing defense budgets, evolving security threats, and advancements in helicopter technology. Military helicopters are crucial in modern warfare, providing rapid transport, close air support, and combat capabilities.

- In 2022, the war between Russia and Ukraine further fueled the defense budgets across various countries and the need to reassess the operational readiness of the armed forces globally. The global military expenditure rose by 3.7% in 2022 to reach a record high of USD 2240 billion. Russia's invasion of Ukraine was a major driver of the growth in spending in 2022. The five biggest spenders in 2022 were the United States, China, Russia, India, and Saudi Arabia, which together accounted for 63% of world military spending

- In terms of military helicopter procurements during 2017-2022, North America dominates the market, with 38% of the total helicopter fleet, primarily driven by the United States. The United States has the largest military helicopter fleet globally, with 32% of the global share. Asia-Pacific is another significant market, with a share of 25%, due to the increasing defense budgets of countries like China and India. Europe has witnessed a substantial growth of 20%, with countries like Russia, France, Germany, and the United Kingdom investing in helicopter modernization programs. The Middle East Africa and South America are also investing in military helicopters to enhance their defense capabilities and have a share of 15% and 3% respectively. Due to such developments, the global rotorcraft aircraft market is expected to procure 2,854 helicopters between 2023 and 2030.

Global Military Helicopters Market Trends

Increased border tensions and the need for new aircraft has led to a surge in defense expenditure

- Asia-Pacific spent a total of USD 569 billion on military expenditures. Geopolitical conflicts such as border issues between China and India, internal security challenges, maritime surveillance, and counter-terrorism operations are some of the factors aiding the growth of the fixed-wing aircraft fleet of the countries in this region. The rise in military spending in China and India was the main cause of the increase in 2022. The combined military spending of the two nations in the region in 2022 was 66%. The increase in defense spending of the nations over the past ten years was driven by economic growth and territorial disputes.

- Major military powers, including India, China, Japan, and South Korea, are present in the Asia-Pacific region and are yearly growing their defense budgets. This budget includes a significant portion for the improvement and expansion of air superiority, which is driving the growth of military aviation in the region. For instance, in the budget of FY 2023, the Indian government allocated about 10% more for the Indian Air Force compared to the previous budget, including payments for the new Rafale fighters and the manufacturing of Sukhoi-30MKIs and Tejas fighters.

- The increased military spending in the Asia-Pacific region is intended to gain an advantage in several political and border conflicts, such as the tension in the South China Sea with many regional sovereign entities and border conflicts between India-China and India-Pakistan. The defense spending of major countries in China is expected to cross over USD 400 billion by 2030.

Fleet modernization and new procurements are projected to improve the APAC's military active fleet

- By the end of 2022, there were 15,543 active aircraft in the Asia-Pacific region, of which fixed-wing aircraft accounted for 60% while rotorcraft accounted for the remaining fleet. China, India, Japan, and South Korea together accounted for 55% of the total active fleet in the region.

- In 2020, the average aircraft fleet age in Asia-Pacific amounted to 9.5 years, which was projected to increase by 2030, when the average aircraft fleet age across the region was expected to be 10.7 years. The older aircraft, some of which date back to the 1960s, have been slowly phased out by the Indian Air Force. The MiG 21 and MiG 27 have been the backbone of the Indian Air Force (IAF). The average age of these aircraft is around 45 years. Australia's two fighter aircraft, FA-18 and F-35, have been in service for the last 16 years and 8 years, respectively.

- Countries such as China, India, and South Korea are expanding their aircraft fleet size to fulfill the demands of modern warfare. They may continue to produce and acquire next-generation aircraft during the forecast period. The regional armed forces are also enhancing the capabilities of helicopters with cutting-edge technology to obtain military superiority over the external threat.

- Asia Pacific's active fleet increased by 3% in 2022 compared to 2017. Indonesia and Thailand accounted for 63% of the total fleet in Southeast Asia. In the coming years, the aircraft fleet may increase as major countries like Thailand, Malaysia, Singapore, Indonesia, and the Philippines plan to procure over 135 aircraft. The active fleet of the region is expected to expand at a healthy rate during the forecast period.

Military Helicopters Industry Overview

The Military Helicopters Market is fairly consolidated, with the top five companies occupying 76.84%. The major players in this market are Airbus SE, Lockheed Martin Corporation, Russian Helicopters, Textron Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92465

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.1.1 Asia-Pacific

- 4.1.2 Europe

- 4.1.3 Middle East and Africa

- 4.1.4 North America

- 4.1.5 South America

- 4.2 Active Fleet Data

- 4.2.1 Asia-Pacific

- 4.2.2 Europe

- 4.2.3 Middle East and Africa

- 4.2.4 North America

- 4.2.5 South America

- 4.3 Defense Spending

- 4.3.1 Asia-Pacific

- 4.3.2 Europe

- 4.3.3 Middle East and Africa

- 4.3.4 North America

- 4.3.5 South America

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Multi-Mission Helicopter

- 5.1.2 Transport Helicopter

- 5.1.3 Others

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 Australia

- 5.2.1.2 China

- 5.2.1.3 India

- 5.2.1.4 Indonesia

- 5.2.1.5 Japan

- 5.2.1.6 Malaysia

- 5.2.1.7 Philippines

- 5.2.1.8 Singapore

- 5.2.1.9 South Korea

- 5.2.1.10 Thailand

- 5.2.1.11 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Germany

- 5.2.2.3 Italy

- 5.2.2.4 Netherlands

- 5.2.2.5 Russia

- 5.2.2.6 Spain

- 5.2.2.7 Turkey

- 5.2.2.8 UK

- 5.2.2.9 Rest of Europe

- 5.2.3 Middle East and Africa

- 5.2.3.1 Algeria

- 5.2.3.2 Egypt

- 5.2.3.3 Qatar

- 5.2.3.4 Saudi Arabia

- 5.2.3.5 United Arab Emirates

- 5.2.3.6 Rest of Middle East and Africa

- 5.2.4 North America

- 5.2.4.1 Canada

- 5.2.4.2 Mexico

- 5.2.4.3 United States

- 5.2.4.4 Rest of North America

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Chile

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Hindustan Aeronautics Limited

- 6.4.3 Leonardo S.p.A

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 MD Helicopters LLC.

- 6.4.6 Russian Helicopters

- 6.4.7 Textron Inc.

- 6.4.8 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.