Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693530

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693530

Europe Micronutrient Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 225 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

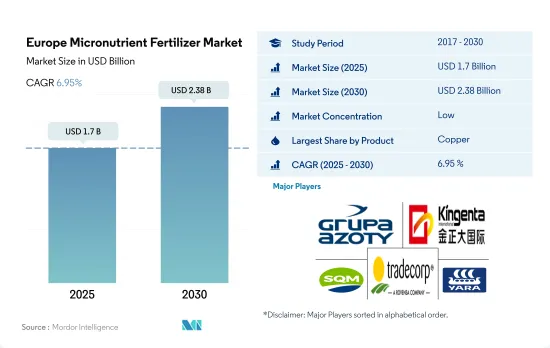

The Europe Micronutrient Fertilizer Market size is estimated at 1.7 billion USD in 2025, and is expected to reach 2.38 billion USD by 2030, growing at a CAGR of 6.95% during the forecast period (2025-2030).

Zinc dominates the micronutrient fertilizers market in the region

- In Europe, Russia accounted for the majority of micronutrient fertilizers, holding 24.2% of the value of Europe's micronutrient fertilizer market. Moreover, it is anticipated to register a CAGR of 7.0% between 2023 and 2030.

- By form, the specialty type micronutrient market was the largest in 2022, accounting for 62.6% of the market value, and was majorly applied to field crops at 87.0%. With increased technological and scientific advancements, specialty fertilizer applications are primarily used for field crops. The conventional type fertilizer micronutrient market accounted for 37.3%, and this fertilizer application was majorly applied to field crops at 88.8%.

- By nutrient type, zinc dominated the micronutrient fertilizers market in the region, accounting for 29.2% of the market value in 2022. Zinc is a major component of plant enzyme systems. Zinc aids in the activation of various types of enzymes, boosting carbohydrate metabolism, followed by copper at 26.4%, and molybdenum accounting for 15.7%. Micronutrient fertilizers are mostly applied through foliar application in the region, accounting for 65.0% of the market value in 2022, followed by fertigation at 34.9%.

- Micronutrient deficiency in plants and soil has been steadily increasing and has become a major cause of concern in the European Union. Factors such as depleting soil health, steadily increasing area under high-value crops, the requirement for higher productivity, and improved awareness about advanced fertilizers and their increasing adoption are expected to drive the regional market for micronutrient fertilizers between 2023 and 2030.

France is the largest micronutrient fertilizer market in the European region.

- In 2022, France held the top spot in the Europe's micronutrient fertilizer market, commanding a significant 14.1% value share, equivalent to USD 218.4 million. French farmers are increasingly recognizing the significance of micronutrient deficiencies in their soils, leading to a surge in demand for these fertilizers.

- Russia emerged as the leading micronutrient fertilizer market in Europe, capturing a market share of 9.6% and a value of USD 149.3 million in 2022. Among the micronutrients, zinc-based fertilizers dominated the Russian market, comprising 28.2% of the total volume.

- Ukraine accounted for 13.8% of the European micronutrient fertilizer market, valued at USD 214.1 million in 2022. The country consumed 61.2 thousand metric tons of these fertilizers in the same year. Notably, the Ukrainian market has exhibited consistent growth, even amidst the challenges posed by the COVID-19 pandemic.

- Europe's micronutrient fertilizer consumption might face headwinds from heatwaves and an ongoing energy crisis. However, the market is poised for growth, driven by farmers' increasing embrace of advanced technologies and fertilizers, particularly specialty micronutrient variants.

- The European micronutrient fertilizer market is set to be propelled by factors such as deteriorating soil health, expanding cultivation of high-value crops, the pursuit of enhanced productivity, and the growing availability of fertilizers.

Europe Micronutrient Fertilizer Market Trends

The cultivation area of field crops is steadily rising to meet domestic needs and export demand

- Field crops, such as rapeseed, wheat, rye, and triticale, are the main winter crops in Europe, while maize, sunflowers, rice, and soybean are summer crops. Both winter and spring types of barley are widely available. The area harvested under major food crops in Europe has been steadily increasing, primarily due to the growing population and increasing demand for food grains. Field crops accounted for 78.5 thousand ha in 2017, which increased to 108 thousand ha in 2022.

- The European Union harvested 282.7 million tons of common wheat in 2022, the equivalent of 54.0% of all cereal grains harvested. This was 11.0 million tons more than in 2020, an increase of 9.3%. This upturn reflected a rise in the area harvested (up 5.6% to 21.8 million hectares) and improved apparent yields.

- Between 2019 and 2022, there was a notable 34% decline in the harvested area within the region. Despite this overall reduction, the areas dedicated to corn/maize and wheat cultivation experienced increases of 11% and 2%, respectively, while the acreages for other field crops decreased during the same period. It is anticipated that farmers will augment their fertilizer usage during the 2023-2030 period, aiming to enhance yields and mitigate the impact of the overall decrease in harvested areas observed in recent years.

- Therefore, with rising pressure on farmers to improve yield and grain production to meet the growing demand and with the overall field crop cultivation area increasing, the fertilizer market is expected to grow significantly during the 2023-2030.

Zinc has become the most used micronutrient fertilizer in the region

- Micronutrient deficiencies in European soils stem from factors such as leaching losses, excessive rainfall, and shallow soil profiles. In 2022, the average application of micronutrients for field crops in Europe stood at 3.85 kg/hectare. In 2022, zinc, copper, iron, manganese, and boron commanded the highest market values, with shares of 38.28%, 25.09%, 13.68%, 11.68%, 4.168%, and 0.021%, respectively. Manganese, with an average application rate of 9.33 kg/ha, led the pack, accounting for 11.68% of the total micronutrient fertilizer consumption in the region. Its scarcity severely hampers the production of key field crops like soy, wheat, sugarcane, and maize.

- Among the crops, wheat, sorghum, soybean, and cotton were the major consumers of micronutrient fertilizers, while corn and rice had a smaller share. In 2022, wheat topped the charts, consuming 11.54 kg/ha of manganese, 5.87 kg/ha of zinc, and 6.60 kg/ha of copper. Zinc emerged as the most widely used micronutrient fertilizer in the region, accounting for 38.28% of the total consumption in 2022, with an average application rate of 5.72 kg/ha. Copper, iron, and boron followed with average application rates of 6.31, 3.70, and 1.50 kg/ha, respectively.

- Micronutrients play a crucial role in providing balanced nutrition to crops, and their deficiency can hinder crop growth. As a result, the market for micronutrient fertilizers in Europe is witnessing growth, significantly fueled by the escalating prevalence of soil micronutrient deficiencies.

Europe Micronutrient Fertilizer Industry Overview

The Europe Micronutrient Fertilizer Market is fragmented, with the top five companies occupying 21.44%. The major players in this market are Grupa Azoty S.A. (Compo Expert), Kingenta Ecological Engineering Group Co., Ltd., Sociedad Quimica y Minera de Chile SA, Trade Corporation International and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92595

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product

- 5.1.1 Boron

- 5.1.2 Copper

- 5.1.3 Iron

- 5.1.4 Manganese

- 5.1.5 Molybdenum

- 5.1.6 Zinc

- 5.1.7 Others

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Russia

- 5.4.6 Spain

- 5.4.7 Ukraine

- 5.4.8 United Kingdom

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 AGLUKON Spezialduenger GmbH & Co.

- 6.4.2 Fertiberia

- 6.4.3 Grupa Azoty S.A. (Compo Expert)

- 6.4.4 Haifa Group

- 6.4.5 Kingenta Ecological Engineering Group Co., Ltd.

- 6.4.6 Sociedad Quimica y Minera de Chile SA

- 6.4.7 Trade Corporation International

- 6.4.8 Valagro

- 6.4.9 Verdesian Life Sciences

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.