Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693539

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693539

Africa Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 197 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

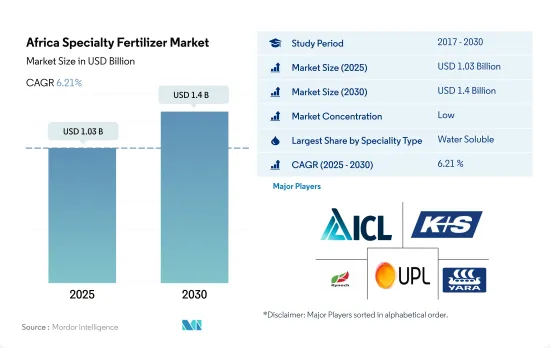

The Africa Specialty Fertilizer Market size is estimated at 1.03 billion USD in 2025, and is expected to reach 1.4 billion USD by 2030, growing at a CAGR of 6.21% during the forecast period (2025-2030).

The various advantages of using specialty fertilizers over conventional fertilizers is expected to bolster the growth of the market

- In 2022, controlled-release fertilizers (CRFs) held a 7.4% share of the specialty fertilizer market. The steady growth of CRFs can be attributed to their distinct advantages over traditional fertilizers and the increasing awareness of efficient agricultural practices. CRFs gradually release nutrients over an extended period, ensuring a consistent nutrient supply to plants. This not only reduces nutrient wastage but also minimizes the risk of leaching or evaporation, which is common with conventional fertilizers.

- Water-soluble fertilizers, with a 47.8% market share, ranked second in the specialty fertilizer market in 2022. The use of water-soluble fertilizers has shown potential in reducing both water and fertilizer requirements for cultivating healthy plants.

- The liquid fertilizer market is poised for growth, propelled by advancements in irrigation systems and the rising adoption of advanced cultivation techniques such as hydroponics and aquaponics. The market value of liquid fertilizers is projected to witness a CAGR of 5.8% during 2023-2030.

- The adoption of slow-release fertilizers offers farmers not only economic benefits but also environmental advantages, such as water conservation, prevention of nitrogen volatilization and leaching, and reduced labor in fertilizer handling. These factors are expected to drive a 5.4% growth in the market value of slow-release fertilizers during 2023-20230.

- Given the benefits of specialty fertilizers, including precise nutrient release, reduced application rates, and economic advantages for farmers, the specialty fertilizer market is poised for growth in the coming years.

Government initiatives and farmers' focus on increasing productivity are expected to bolster the growth of the market

- In 2022, Nigeria held a commanding 27.0% value share in the African specialty fertilizer market. The country's agricultural sector, while facing challenges such as complex land tenure issues, inadequate irrigation infrastructure, the adverse effects of climate change, and the gradual adoption of cutting-edge agricultural technologies, has seen growth in the market supported by government initiatives. These include the Agriculture Promotion Policy (APP), the Nigeria-Africa Trade and Investment Promotion Programme, the National Agricultural Technology and Innovation Plan (NATIP), and the Anchor Borrowers Program (ABP), all of which have been instrumental in enhancing agricultural productivity.

- South Africa distinguishes itself as the continent's most advanced, productive, and diverse agricultural region. In 2022, its robust agricultural sector held a substantial 37.0% share of the total African specialty fertilizer market. The market is expected to record a CAGR of 6.7% during forecast period. This anticipated growth is largely due to the increasing need to mitigate the effects of climate-related risks, such as prolonged droughts and intense heat waves, by adopting more efficient fertilizer solutions.

- The African specialty fertilizer market is set to expand, driven by a rapidly growing population, the diminishing availability of arable land, the urgent necessity to improve yields on existing farmland, and concerted efforts to enhance agricultural productivity across the region. Thus, the market is forecasted to witness a CAGR of 6.0% from 2023 to 2030.

Africa Specialty Fertilizer Market Trends

The rising domestic demand will lead to double the agricultural production in the near future

- The agro-ecological zones in Africa span from dense rainforests with bi-annual rainfall to arid deserts with minimal precipitation. Key field crops in the region include corn, sorghum, wheat, and rice. In 2022, the cultivation area for these crops reached 224.8 million hectares, accounting for over 95% of the region's agricultural land. In response to a surplus of corn stocks leading to price suppression, South African corn farmers scaled back their planting by 10% to 2.1 million hectares in the 2018-19 season. Consequently, corn production in the country dipped by 11% from 13 million to 12 million tonnes, and exports fell from 2.5 million to 1 million tonnes. This shift prompted producers to allocate more of their fields to oilseed crops, particularly soybeans, resulting in an overall decline in corn cultivation across Africa in 2018-2019.

- Nigeria takes the lead as the largest sorghum producer in Africa, closely followed by Ethiopia. Sorghum, accounting for 50% of the total cereal output, dominates about 45% of Nigeria's cereal crop land. Known for its drought and waterlogging tolerance, sorghum thrives in diverse soil conditions. These attributes position sorghum as the go-to staple crop in Africa's drier regions, ensuring both food and income security.

- Kenya, Somalia, and significant parts of Ethiopia are grappling with the looming specter of severe food shortages. Over the past decade, Africa's spending on food imports has nearly tripled, even as its agricultural industry and cultivated land have continued to expand.

Rapeseed is the highest nitrogen consuming crop

- Rapeseed crops have the highest potassium and phosphorous application rates, accounting for 162.4 kg/hectare and 281.7 kg/hectare, respectively. Meanwhile, the average nitrogen application rate for field crops in Africa stands at 364.9 kg/hectare. In 2022, field crops in Africa accounted for 87.1% of the total primary nutrient consumption, which amounted to 556.1 thousand metric tons. This dominance can be attributed to the extensive land area dedicated to field crops. Specifically, the average nutrient application rates for nitrogen, phosphorous, and potassium in these crops were 223.2 kg/ha, 125.3 kg/ha, and 155.3 kg/ha, respectively.

- The Guinea savannas in Nigeria offer favorable environmental conditions for maize production. However, despite this potential, farmers in the region struggle with low yields. The primary culprits are soil degradation and nutrient depletion, primarily nitrogen, resulting from intensified land use. Field crops prioritize nitrogen application due to its multiple benefits, including promoting tillering, leaf area development, grain formation, filling, and protein synthesis. Nitrogen also plays a crucial role in enhancing both grain yield and quality.

- Given that primary nutrients are vital for crop growth and with concerns over soil depletion and nitrogen leaching, the application rates for primary nutrients are expected to witness significant growth in the coming years.

Africa Specialty Fertilizer Industry Overview

The Africa Specialty Fertilizer Market is fragmented, with the top five companies occupying 29.76%. The major players in this market are ICL Group Ltd, K+S Aktiengesellschaft, Kynoch Fertilizer, UPL Limited and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92604

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 Nigeria

- 5.4.2 South Africa

- 5.4.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Gavilon South Africa (MacroSource, LLC)

- 6.4.2 Haifa Group

- 6.4.3 ICL Group Ltd

- 6.4.4 K+S Aktiengesellschaft

- 6.4.5 Kynoch Fertilizer

- 6.4.6 UPL Limited

- 6.4.7 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.