PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441694

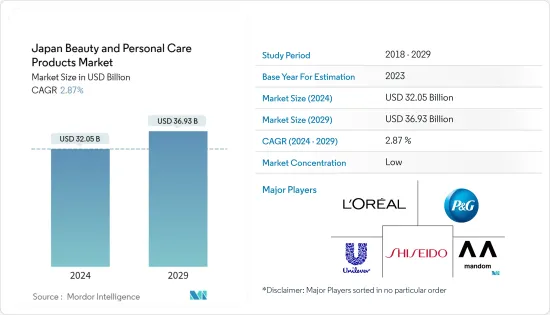

Japan Beauty and Personal Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Japan Beauty and Personal Care Products Market size is estimated at USD 32.05 billion in 2024, and is expected to reach USD 36.93 billion by 2029, growing at a CAGR of 2.87% during the forecast period (2024-2029).

Japan is one of the largest markets for cosmetics and personal care products globally. Japanese consumers are extremely sophisticated and well-informed regarding the chemical formulations in hair products. Natural ingredients and organic formulations are witnessing high demand in the market, which is driving key manufacturers to launch products with natural/clean product labels. Popular items for Japanese consumers are high-performance products, quick-acting skincare products, and crossover products with multi-appeal attributes. Japanese consumers have the highest per capita expenditure on cosmetics, including skin care products, which is boosting the growth of the beauty and personal care market in the country.

Furthermore, the rise in penetration of online distribution channels and e-commerce websites like Amazon, Rakuten, Yahoo, and many local websites provide multiple cosmetics and personal care options that grab the attention of consumers. The development of skincare innovations is continuously happening in Japan. The market players are innovating technologies for personalized beauty products. For instance, in October 2022, the AS Watson Group launched "SkinlifeLab," an innovative skin analysis tool that creates highly personalized skincare product recommendations based on customers' selfies.

Japanese Beauty and Personal Care Products Market Trends

Rising Demand for Natural Cosmetics and Skincare Products

The demand for natural skin care products has increased significantly in the past few years in Japan. The growing interest of consumers in the use of natural ingredients in cosmetics and skin care products has led to various product innovations. The benefits that these natural ingredients have has been recognized and utilized to cater to changing customer demands. Companies like Unilever, Shiseido, and many others are functional with their prompt research and development to create new products for customers. In June 2021, Shiseido introduced a sustainable skincare brand named Baum in Japan. The company suggested that 90% of the formula for the products of this brand was derived from trees. The development of e-commerce is also one of the reasons for the cosmetic market's growth in the region. Different brands of organic cosmetics are available on e-commerce websites like Amazon, Rakuten, Yahoo, Lahaco, and many more. Because of this, consumers can get options for cosmetic products.

High Expenditure on Advertising and Promotions

Japanese companies are very much active when it comes to the advertising and promotions of their products. The market players are actively and vigorously advertising their products to stay in the competition and grab consumer attention. Japan has a high number of young people who uses social media platforms like Instagram, Youtube, Facebook, TikTok, Twitter, Line, and many more. The companies promote cosmetics and other beauty products via these platforms and gain consumer attention. Traditional advertising media like television and newspapers are also used. According to Dentsu Inc.'s report of advertising expenses in Japan from 2021, cosmetics advertising expenses increased by 5.3% and accounted for 9.7% of the total advertising expenditure. According to the report, advertising of cosmetics for women, toothbrushes, and makeup removers has increased in the last five years.

Japanese Beauty and Personal Care Products Industry Overview

The beauty and personal care market in Japan is a highly competitive market. The market is fragmented and led by numerous global and local players. The major players, such as Shiseido company, Mandom Corporation, Loreal, Procter and Gamble, Unilever, and others, are actively driving the market in the nation with their constant efforts to provide consumers with innovative products. The strategies adopted by active companies include product launches, followed by the acquisition of small players so as to hold a major share of the market in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Personal Care

- 5.1.1.1 Hair Care

- 5.1.1.1.1 Shampoo

- 5.1.1.1.2 Conditioners

- 5.1.1.1.3 Other Products

- 5.1.1.2 Skin Care

- 5.1.1.2.1 Facial Care Products

- 5.1.1.2.2 Body Care Products

- 5.1.1.2.3 Lip Care Products

- 5.1.1.3 Bath and Shower

- 5.1.1.3.1 Shower Gels

- 5.1.1.3.2 Soaps

- 5.1.1.3.3 Other Products

- 5.1.1.4 Oral Care

- 5.1.1.4.1 Toothbrushes

- 5.1.1.4.2 Toothpaste

- 5.1.1.4.3 Mouthwashes and Rinses

- 5.1.1.4.4 Other Products

- 5.1.1.5 Men's Grooming Products

- 5.1.1.6 Deodrants and Antiperspirants

- 5.1.2 Cosmetics/Make-up Products

- 5.1.2.1 Colour Cosmetics

- 5.1.2.1.1 Facial Make-up Products

- 5.1.2.1.2 Eye Make-up Products

- 5.1.2.1.3 Lip and Nail Make-up Products

- 5.1.2.1.4 Hair Styling and Coloring Products

- 5.1.1 Personal Care

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Distribution Channel

- 5.3.1 Specialist Retail Stores

- 5.3.2 Supermarkets/Hypermarkets

- 5.3.3 Convenience Stores

- 5.3.4 Pharmacies/Drug Stores

- 5.3.5 Online Retail Channels

- 5.3.6 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Unilever PLC

- 6.3.2 Procter & Gamble Co

- 6.3.3 Kao Corporation

- 6.3.4 Mandom Corporation

- 6.3.5 Lion Corporation

- 6.3.6 Shiseido Company

- 6.3.7 L'Oreal SA

- 6.3.8 AS Watson Group

- 6.3.9 SK-II

- 6.3.10 Makanai

7 MARKET OPPORTUNITIES AND FUTURE TRENDS