PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444208

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444208

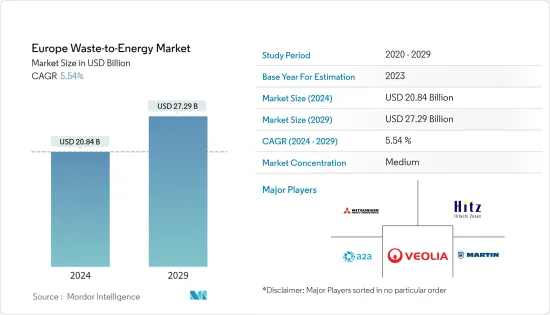

Europe Waste-to-Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Waste-to-Energy Market size is estimated at USD 20.84 billion in 2024, and is expected to reach USD 27.29 billion by 2029, growing at a CAGR of 5.54% during the forecast period (2024-2029).

The COVID-19 outbreak had a moderate impact on the market due to reduced investments in new projects caused by a global economic slowdown. The market is expected to revive toward the latter part of the forecast period after the revival of the global economy. For instance, in August 2020, Doosan Heavy Industries & Construction was awarded an EPC contract valued at about KRW 220 billion (USD 185.5 million) for a waste-to-energy (WtE) plant in Poland. The power plant is expected to have a capacity to treat about 300 ton of municipal waste per day to generate a heat and electricity supply of about 12 MW. The construction of the project is likely to be complete by 2023. Factors such as the increasing amount of waste generation, growing concern for waste management to meet the need for sustainable urban living, and rising focus on non-fossil fuel sources of energy are driving the demand for waste-to-energy in the region. The market growth is expected to be restrained by the expensive nature of incinerators, as energy prices decline and several plants cannot cover operating costs. Furthermore, several European countries plan to focus more on recycling, which saves three to five times more energy, thus restraining the waste-to-energy market.

Key Highlights

- Thermal technology is expected to dominate the waste-to-energy market in the coming years, owing to the increasing development in incineration and gasification technologies and the growing amount of waste generated in European countries.

- Emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), four times more efficient in electricity generation, with additional benefits of no emission discharge and effluence problems at plant sites, are expected to create significant opportunities for the market players over the coming years.

- Germany dominated the market across Europe. An increase in the number of municipal waste energy plants and rapid urbanization in the country is driving the growth.

Europe Waste to Energy Market Trends

Thermal-based Waste-to-Energy Segment to Dominate the Market

- Thermal technology is expected to account for the highest market share in the European waste-to-energy market during the forecast period, owing to the increasing development of waste incineration facilities across Europe.

- It is estimated that plants, which utilize cogeneration of thermal power (heating and cooling), together with electricity generation, can reach optimum efficiencies of 80%.

- In the present scenario, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing. However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks. To reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in terms of environmental sustainability.

- In October 2020, Doosan Lentjes was awarded the contract by DHE (Dinslakener Holz-Energiezentrum) to build lot 1 of the new wood combustion plant located in Dinslaken. Once in operation, the new plant will thermally treat about 200,000 metric ton of waste wood (class l-lll) per year.

- Also, in October 2020, Shetland Islands Council selected B&W Renewable to upgrade the Lerwick waste-to-energy plant under a USD 3 million contract to reduce emissions and increase the efficiency of the plant. The project is slated to be commissioned by the end of 2021.

- Thus, due to the factors mentioned above, thermal-based waste-to-energy conversion is expected to lead the market. The rising urban population is a key contributing factor to increasing municipal solid waste (MSW) in Europe.

Germany is Expected to be the Fastest-growing Market

- Germany has witnessed significant development in the waste-to-energy industry in the past few years. The country has dominated the market across the European region, with increasing efforts taken by the government in adopting better MSW management practices, providing incentives for waste-to-energy projects in the form of capital subsidies and feed-in tariffs, and offering financial support for R&D projects on a cost-sharing basis.

- Germany is among the most populous and rapidly-growing economies in the European Union. The rapid urbanization in the country has led to increased electricity demand, thereby leading to massive investment in new energy generation plants. The electricity consumption in the country is set to rise from 641.59 TWh in 2018 to 880 TWh in 2040.

- Increasing energy generation through waste in Germany can be primarily attributed to the banning of the landfill in 2005 due to the increase in methane emissions. The prohibition of the landfill has led to the rising demand for waste-to-energy plants to accommodate the waste initially going into the landfills.

- With the high amount of waste generation becoming a pressing issue in the country, harnessing energy from waste is considered one of the most promising and sustainable solutions for growing electricity and waste management needs. The installed capacity of waste energy in Germany reached 1,072 MW in 2020, followed by the United Kingdom and Sweden, with 711 MW and 568 MW, respectively.

- Additionally, many waste-to-energy projects were awarded in the recent past. A few more projects are scheduled to open in the coming years in Germany, driving the market growth during the forecast period. For instance, scheduled to be built by 2024, the Wiesbaden WtE plant in the central-western city of Germany will have the capacity to process 600 ton of municipal solid waste per day to produce 22MW worth of electricity and provide 40MW-scale district heating.

- Therefore, factors such as the increasing amount of waste generated and increasing waste-to-energy plants in Germany during the forecast period may drive the market in the country.

Europe Waste to Energy Industry Overview

The European waste-to-energy (WtE) market is moderately fragmented. Some of the major players operating in the market include Mitsubishi Heavy Industries Ltd, Martin GmbH, A2A SpA, Veolia Environnement SA, and Hitachi Zosen Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Thermal

- 5.1.2 Physical

- 5.1.3 Biological

- 5.2 Country

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 Italy

- 5.2.4 France

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Hitachi Zosen Corp

- 6.3.2 Mitsubishi Heavy Industries Ltd

- 6.3.3 Martin GmbH

- 6.3.4 A2A SpA

- 6.3.5 Veolia Environnement SA

- 6.3.6 Suez SA

- 6.3.7 Wheelabrator Technologies

- 6.3.8 STEAG Energy Services GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS