PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687742

Europe Halal Food and Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

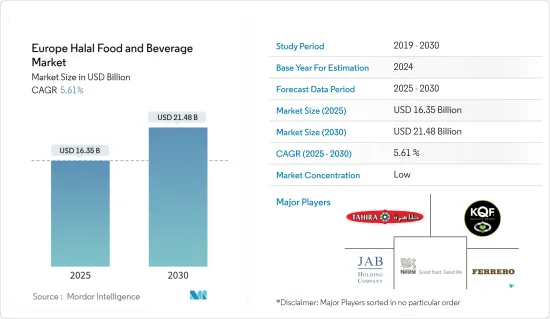

The Europe Halal Food and Beverage Market size is estimated at USD 16.35 billion in 2025, and is expected to reach USD 21.48 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

Halal food preparation and consumption have substantial religious effects on Islamic community members. The global halal food and beverage market is expected to grow significantly due to the increasing Muslim population in the European region and growing concern regarding the hygiene and reliability of food products. Hence, the manufacturers have been trying to change the entire value chain, from raw materials and product developments to finished product packaging, marketing, and spreading awareness about the benefits of consuming these products through social media advertisements.

Over the short term, halal cuisine is gaining popularity among Muslim and non-Muslim consumers as it matured from a religious mark to assure the safety and hygiene of food and beverage products. As per the data published by Office for National Statistics (ONS), the Muslim population stood at 3.9 million of the total United Kingdom population in 2021. The meat product segment is expected to hold a significant market share due to the increasing consumer demand for halal-certified meat products. According to the Halal Monitoring Committee in the United Kingdom in March 2020, in the poultry market, 104 million chicken per month was slaughtered, of which 20% (8 million) is Halal to cater to the growing demand, the retailer's formats are marketing halal food and meat products. For instance, retail chains such as Tesco, Sainsbury's, Marks & Spencer, and Waitrose are merchandising halal food, including meat, bakery, confectionery, cereals, and snacks.

Europe Halal Foods & Beverages Market Trends

Increasing Muslim Population in Europe

The European region has witnessed the fastest-growing and most significant market for halal food and beverage products owing to the increasing Muslim population. According to the Central Intelligence Agency (CIA), the United Kingdom will hold 6.30% of the Muslim population in the country in 2022. Therefore, the surging Muslim population in Europe has enormously accelerated the demand for halal food and beverages across various countries in the region. Furthermore, to a lesser extent, the rise in Muslim tourism in European countries has further supplemented the demand for halal food and beverages. As a result, manufacturers and retailers respond to this demand by locally producing halal products or importing them from other countries. Major European supermarket chains such as Tesco, ASDA, Auchan, Carrefour, and Edeka also offer halal meat sections in selected stores. The surging European halal market resulted in manufacturers expanding their businesses into niche sectors, including bread, biscuits, and cookies and spreads. Thus, the growing Muslim population in this region is projected to drive the market studied in the forecast period.

France Holds the Largest Market Share

France has a high number of Muslims in Europe. The halal offerings have also moved upscale, from the traditional neighborhood butcher who sold meat slaughtered following Islamic law to a significant presence in French food industries, supermarkets, and even restaurants. For instance, according to a study by the French Public Institute (IFOP) in 2020, 59% of the Muslim population consumes halal-certified meat systemically and 20% consume halal meat as much as possible. Since the demand for halal food is constantly developing, supermarkets have increased their services and dedicated more shelves to this kind of product. For instance, Casino France is one of the largest supermarket chains offering halal product lines under the brand name Wassila. Additionally, Isla Delice, Oriental Viandes, Reghalal, Isla Mondial, Medina, and Saada are some of the leading halal brands which have been established locally. In France, the government is only involved in halal certification to the extent that it has designated the three prominent mosques as the only distributors of permits for halal slaughter.

Europe Halal Foods & Beverages Industry Overview

The European halal food and beverage market is highly competitive, with several players competing to gain significant market share. The major manufacturers operating in the market are focusing on expanding their presence and developing various flavors in various product segments, engaging in partnerships, mergers, and acquisitions to cater to the growing needs of consumers. The key players in the market are Nestle SA, Ferrero International SA, KQF Foods, JAB Holding Company, and Tahira Foods. Key players in the market have been indulging in strategies like product innovations and expansions to establish a solid consumer base and earn an esteemed position in the market studied. Furthermore, to serve the region's large Muslim population, companies are introducing new and innovative halal-certified products in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Halal Food

- 5.1.1.1 Meat Products

- 5.1.1.2 Bakery Products

- 5.1.1.3 Dairy Products

- 5.1.1.4 Confectionery

- 5.1.1.5 Other Halal Foods

- 5.1.2 Halal Beverages

- 5.1.3 Halal Supplements

- 5.1.1 Halal Food

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialty Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 Ferrero International SA

- 6.3.3 KQF Foods

- 6.3.4 Tahira Foods

- 6.3.5 JAB Holding Company

- 6.3.6 Bilal Group

- 6.3.7 Mars Incorporated

- 6.3.8 The Coca Cola Company

- 6.3.9 The Bitlong Factory

- 6.3.10 Mission Foods

7 MARKET OPPORTUNITIES AND FUTURE TRENDS