PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444936

Billiards and Snooker Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

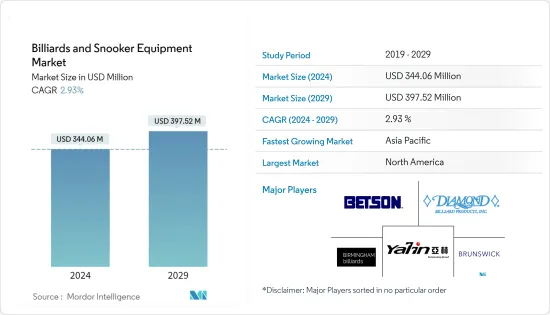

The Billiards and Snooker Equipment Market size is estimated at USD 344.06 million in 2024, and is expected to reach USD 397.52 million by 2029, growing at a CAGR of 2.93% during the forecast period (2024-2029).

The market for equipment for billiards and snooker is predicted to increase rapidly in the upcoming years. The increasing popularity of sports and leisure activities among people all over the world is a crucial factor in the market's growth. Also, the global market for billiards and snooker equipment is expanding as these games become increasingly popular in different parts of the world. One of the elements boosting the growth of the worldwide billiards and snooker industry is the increase in e-commerce websites selling equipment for the billiards and snooker equipment industry.

With the growing trend of customization, the players have started designing customized billiards and snooker equipment and acquiring companies to increase their customer base and expand their presence. For instance, in January 2022, Escalade, Inca leader in sporting goods and indoor/outdoor recreation equipment, announced the signing of a definitive agreement to purchase the assets of the Brunswick Billiards business from Life Fitness, LLC, a portfolio company of KPS Capital Partners, LP. Brunswick Billiards is the largest and oldest provider of billiards tables, game tables, and game room furniture in the United States. The acquisition of Brunswick Billiards presents a significant opportunity to expand Escalade's reach into the billiards and indoor recreation markets. Brunswick Billiards complements Escalade's portfolio of billiards brands. Key players are using customer interaction platforms to get customer feedback regularly. With the increasing number of sports bars, especially in emerging economies, such as China and India, the demand for billiards and snooker equipment is also growing. Several sports halls, recreational centers, and clubs also provide billiards and snooker equipment for their members. Resorts, hotels, and sports bars are adding billiards and snooker halls to capitalize on the rising popularity of the sport which is expected to propel the market growth.

Billiards & Snooker Equipment Market Trends

Increased Sports Participation Propelling the Billiards and Pools Equipment Sales

There has been a significant rise in the percentage of the population adopting a healthy lifestyle, and the preference for staying fit has increased consumer indulgence in various sports activities. In line with the trend, consumers are increasingly seeking various sports equipment including billiards and snooker. The standard of snooker facilities continues to rise with a growing number of official academies being launched worldwide. The increased number of grassroots programs in schools, colleges, and clubs is one of the major factors driving the global billiards and snooker market sales.

The billiards and snooker equipment demand is expected to rise as a result of the widespread popularity of cue sports and other recreational activities, as well as the numerous associations that promote the sport. As a result, the billiards and snooker equipment market will be driven by an increase in demand for recreational activities during the forecast period. Projects, such as World Disability Snooker, the World Women's Snooker Tour, and Cue Zone into Schools, supported by accredited coaching programs, are all now gaining momentum. Additionally, various governing bodies and associations played a significant role in promoting billiards and snooker as a sport which is boosting participation in such sports and eventually driving the billiards and snooker equipment sales.

North America Holds the Significant Share in the market

Strong penetration of cue sports and various recreational activities, along with numerous associations promoting the sport in the region, is expected to boost the demand for billiards and snooker equipment in the region. Favorable support from various governing bodies such as the United States Billiard Association (USBA) is further propelling the demand for billiards and snooker equipment across the region. The major players in the market are adopting online retail strategies to reduce costs and increase their margins, which may benefit the market during the forecast period. The players are also focusing on launching products with innovation. For instance, in October 2020, Billiards King, LLC Announced the launch Of Cue View 360 - Pool Sticks Recorded In 4K Ultra HD while they rotate, Cue View 360 is primarily for the intermediate player who already had their first starter or entry-level cue.

Snooker equipment manufacturers have started to put innovation in place to encourage their usage as a family pastime. One of the ideas that have materialized in this space is the availability of their convertible versions, wherein a table can be used as a snooker table, dinner table, and other multipurpose household utilities. Recently, the growing demand for outdoor snooker tables has been tracked by vendors who have responded positively to it by bringing weatherproof and lightweight snooker tables onto the market shelves which is expected to propel the market growth in the region.

Billiards & Snooker Equipment Industry Overview

Brunswick Corporation, Diamond Billiard Products Inc., H. Betti Industries Inc., Birmingham Billiards Ltd, and Yalin International Billiard Goods are some prominent players operating in this market. These players are embarking on product launches, mergers and acquisitions, expansion, and entering into partnerships as one of their key strategies to achieve consolidation and optimize their offerings. For instance, in February 2021, WG Wholesale announced the launch of its PhoenixHit Pool Cue Stick Set for people looking to update their pool, snooker, or billiard playing. The newly launched PhoenixHit Pool Cue Stick Set from WG Wholesale aimed to give beginner and professional pool players a kit containing everything they need for their playing experiences, such as a 100% Canadian Maple wood pool stick, a billiard glove, chalk, and a carry bag.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Carom

- 5.1.2 Pool

- 5.1.3 Snooker

- 5.2 Equipment

- 5.2.1 Table

- 5.2.2 Ball

- 5.2.3 Cue

- 5.2.4 Other Equipment

- 5.3 Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Stores

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Belgium

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Brunswick Corporation

- 6.3.2 Diamond Billiard Products Inc.

- 6.3.3 H. Betti Industries Inc.

- 6.3.4 Birmingham Billiards Ltd

- 6.3.5 Yalin International Billiard Goods

- 6.3.6 Snooker & Pool Table Company Ltd

- 6.3.7 Kaldera Billiards

- 6.3.8 Imperial International

- 6.3.9 Franklin Billiard Company

- 6.3.10 Berner Biliards

7 MARKET OPPORTUNITIES AND FUTURE TRENDS