PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445638

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445638

India Continuous Glucose Monitoring (CGM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

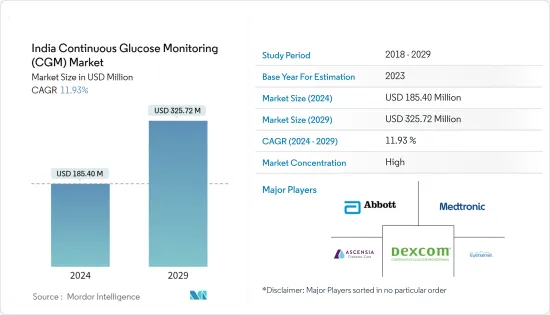

The India Continuous Glucose Monitoring Market size is estimated at USD 185.40 million in 2024, and is expected to reach USD 325.72 million by 2029, growing at a CAGR of 11.93% during the forecast period (2024-2029).

India is home to the world's second-largest adult diabetes population and every sixth person with diabetes in the world. After overcoming Covid-19, individuals are in danger of developing diabetes. India has the second-largest Covid-19 caseload in the world, behind the US, with about 32 million documented infections. Doctors around the world are debating whether Covid-19 itself is causing diabetes in patients with no previous history. In India 8-10% of patients with no history of diabetes who contracted Covid-19 continued to have high sugar levels months after recovery and were on medication.

In March 2022, the Indian Council of Medical Research-National Centre for Disease Informatics (ICMR-NCDIR), Bengaluru researchers said that THE PREVALENCE of diabetes and impaired fasting glucose is high among adults while the levels of awareness, treatment, and control are still low in India. According to AIIMS, the risk of fatal outcomes from COVID-19 is up to 50% higher in people with diabetes, than in those who do not have diabetes in India. Diabetes and high glucose levels are associated with increased complications, respiratory failure, and mortality in hospitalized patients with COVID-19.

Continuous Glucose Monitoring is a new technology glucose monitoring device, which tracks blood glucose levels day and night. Sensor: Sensors are disposable devices placed under the skin, which measure blood glucose levels. A sensor can be used for several days before it needs to be replaced. Durables consist of transmitters and receivers. Transmitters are connected to the sensor and a reader (receiver) receives and displays the measurements. The device provides real-time measurements.

The factors that have driven the number of reported cases of diabetes can be segmented into individual-level risk factors, environmental risk factors, the evolution of the disease, detection effects, and global changes.

India CGM Market Trends

Sensors is having the highest market share in current year.

The sensors segment is expected to increase with a CAGR of over 17% during the forecast period, mainly due to the demand from the Type-1 diabetes population, which was more than 60 million by the forecast period.

The sensor device is a tiny electrode that measures glucose levels in diabetes patients. The sensors continuously measure the glucose levels in the body through a small filament that is inserted under the skin and records the glucose levels. Within 5 seconds, the users can download the data stored in the sensors. In India's continuous glucose monitoring devices market, the Free Style Libre Pro sensor (14 days working), Dexcom's G4 sensor (10 days working), Medtronic's Guardian sensor (7 days working), and the fluorescence sensor are considered.

In India, Dexcom is still selling its Dexcom G4 Platinum CGM system, whereas it is selling its Dexcom G5 and G6 CGM technologies in other countries. Dexcom planned to launch its cheaper, smaller sensors developed in partnership with Verily Life Science divisions. With the advent of low-cost CGM in the coming years and the support from the government on subsidies for diabetes monitoring devices, manufacturers of CGM devices can penetrate the high-potential market of India.

India recorded the second-highest diabetes population in Asia-Pacific in current year

In India, diabetes is the fastest-growing health condition, and the country has a high population of diabetic patients.

The rising prevalence of diabetes and obesity, growing awareness regarding diabetic care, healthcare expenditure, and technological advancements are a few factors that are further driving the market study. Youth are at higher risk of developing diabetes at a younger age. The prevalence of diabetes in adults is around 9%. Diabetes affects the quality of life, shortens life expectancy, and increases healthcare costs for society. Hence, the demand for continuous glucose monitoring devices is on the rise, and their adoption rate is also increasing. These factors are expected to drive the market studied.

India CGM Industry Overview

India's continuous glucose monitoring market is highly consolidated. Manufacturers have driven constant innovation to compete in the market. The major players, such as Abbott and Medtronic, have undergone many mergers, acquisitions, and partnerships to establish market dominance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Continuous Glucose Monitoring

- 5.1.1 Sensors

- 5.1.2 Durables (Receivers and Transmitters)

6 Market Indicators

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Abbott Diabetes Care Inc.

- 7.1.2 Dexcom Inc.

- 7.1.3 Medtronic PLC

- 7.1.4 Ascensia

- 7.2 Company Share Analysis

- 7.2.1 Abbott Diabetes Care Inc.

- 7.2.2 Dexcom Inc.

- 7.2.3 Medtronic PLC

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS