PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644855

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644855

India Mobile Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

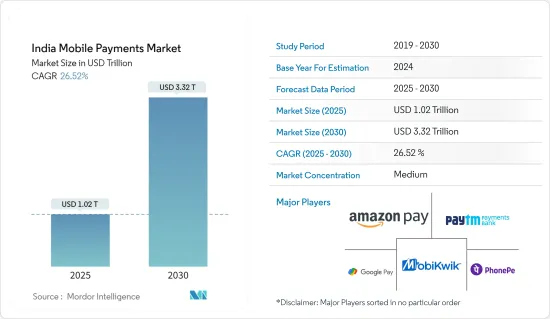

The India Mobile Payments Market size is estimated at USD 1.02 trillion in 2025, and is expected to reach USD 3.32 trillion by 2030, at a CAGR of 26.52% during the forecast period (2025-2030).

Key Highlights

- The expanding e-commerce business and the increased prevalence of smartphones nationwide can be linked to market growth. The growing internet use for online shopping will likely drive market expansion throughout the forecast period. Businesses nationwide are making their payment methods mobile-friendly, resulting in market growth potential.

- According to Worldline, with merchant adoption of UPI rising rapidly in India, the average ticket size of UPI P2M (person to merchant) transactions is steadily increasing, while ATS for P2P (person to person) transactions is decreasing. However, this is due to the volume of transactions as well as a shift to P2M transactions. P2M transactions UPI transactions have risen to 57.5 percent in June 2023 from 40.3 percent in January 2022 and are expected to keep growing, of complete UPI transactions.

- Further, through its policy statement "Regulation and Supervision of PFMIS Regulated by RBI," the RBI has approved the PFMIS published jointly by the Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions. As a result, all RBI-authorized payment systems designated as systemically important payment systems/system comprehensive vital payment systems, as well as Securities Settlement Systems, ccps, Central Securities Depositories, and Trade Repositories, are required to adhere to the PFMI standards. The RBI-owned and operated RTGS and NEFT systems must be evaluated and published regularly in accordance with the PFMI criteria.

- Web 3.0 is the third generation of web technology, focusing on integrating structured data and intelligent services for the web to comprehend and fulfill user goals. In the area of payments, Web 3.0 can be leveraged to provide users with more intelligent and tailored payment experiences. Web 3.0 technology, for example, can be leveraged to enable users to make payments using natural language processing (NLP) and voice commands, allowing them to tell their devices what and how much they intend to pay.

- The adoption of digital payments was increasing before the commencement of the COVID pandemic. Still, Reserve Bank actions and the additional thrust supplied by the pandemic have hastened the change, resulting in a substantial increase in contactless and online payments. Effective digital payments strategy and operations are critical for all organizations that rely on or participate in the payments ecosystem. Because of the contactless nature of digital modes offered by modern technologies and legislative flexibility, crores of Indians can practice social distancing when making payments. Another noteworthy trend is the adoption of digital payments by small firms. Data reveals a more than 500% growth in retailers taking digital payments over the last two years.

- Additionally, cross-border trade increases in India as companies across industries adopt global trade. However, the complexities of cross-border commerce have hampered the market's growth. As most cross-border transactions are handled through correspondent banking relationships, increasing operational costs and trade volumes further accelerate the adoption of other payment methods, such as digital and mobile payment systems. The increase in international trade, internationalization of production, and cross-border e-commerce suggest that demand for digital cross-border payments will continue to grow in the region. However, digital payments from one country to another are costlier, slower, and less transparent than domestic payments due to the complexity involved in the procedure.

India Mobile Payments Market Trends

Booming E-Commerce Sector Propelling the India Mobile Wallet Market Growth

- In India's retail industry, luxury shopping is progressively gaining traction. As travel has grown more constrained and offline shopping has lost its shine, established enterprises, such as Darveys, in India have become the new luxury sanctuary for fashion shoppers. The shift from offline to online shopping has increased the sales of luxury online players; consumers are still looking forward to trying new ways to get their hands on luxury and rare things. For instance, According to IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026. There is a significant demand for international brands and foreign products among digitally connected Indian shoppers, creating substantial orders for advanced automated warehouses to handle the increased inflow of general merchandise volumes. Such a rise in online shopping is expected to drive the studied market.

- The government encouraged the MSMEs to market their products on the E-commerce site and through the Government e-Marketplace (GeM), which is run and owned by the government. Many Ministries and PSUs (public sector undertakings) source their procurement from GeM. As of July 14, 2022, according to the Indian Brand Equity Foundation, the GeMportal had served about 10.55 million orders worth INR 266,533 crores (USD 33.28 billion) from 4.73 million registered service providers and sellers for 61,208 buyer organizations.

- The Government e-Marketplace (GeM) platform provided 60,632 customers with 10.35 million orders of Rs. 258,359 crores (USD 33.07 billion) from 4.56 million registered sellers and service providers in June 2022. The Department for Promotion of Industry and Internal Trade (DPIIT) is reportedly planning to use the Open Network for Digital Commerce (ONDC) to establish protocols for cataloging, vendor discovery, and price discovery in an effort to systematize the onboarding process of retailers on e-commerce platforms. For the nation's and its citizens' greater benefit, the department seeks to give all market participants equitable chances to utilize the e-commerce ecosystem to its fullest potential.

- According to California Life Sciences. Indians spent more than USD 41 billion on e-commerce in the fiscal year 2021. This was predicted to exceed USD 129 billion by the fiscal year 2026. Total online consumption is predicted to rise from 72 billion dollars in 2021 to more than 237 billion dollars in the fiscal year 2026. These are expected to create an opportunity for the local and international players to develop new solutions to capture the market share.

- Over the past few years, several technology start-ups specializing in the financial segment have emerged, disrupting how we make purchases. For instance, in India, from app-based wallets and Aadhaar/UPI-linked instant transactions to single-window e-commerce apps, fintech start-ups need to be mindful of the threats and invest in creating a robust data security framework for the apps. This needs to be addressed as these may be boot-strapped start-ups and generally avoid the hefty investment needed for a more than essential digitally secure ecosystem. This needs to be addressed by collaboration with cybersecurity firms that provide customized and value-driven services against the big-budget packages.

Proximity Payment is Expected to Hold Major Market Share

- Proximity payment uses Near Field Communication (NFC) technology for payment facilitation. It consists of a small antenna within a smartphone that allows bi-directional communication with NFC readers (contactless POS) to perform contactless payment transactions. Its adoption is favored by the growing NFC-enabled smartphone base and by the already established underlying POS infrastructure supporting contactless credit/debit cards.

- By developing a user-friendly app for the same, Apple is adopted widely. The attempt made the registration easy by clicking a picture of the contactless card. And availability over the phone or smartwatch enables swift payments over the terminal. The company also has been able to surpass the other payment forms available in the US (Starbucks, Android Pay, etc.) from the spread of new point-of-sale (POS) systems that work with the NFC signals Apple Pay functions on.

- Proximity mobile-based payment depends on the vast majority of new smartphones being equipped with an NFC chip and an increasing number of outlets. The mainstream usage of such technology will enable consumers to purchase goods and services directly at the point of sale using their mobile phones. Further, the COVID-19 impact is a potential way for NFC-based contactless payments as it will reduce the need to touch a payment terminal physically. Also, shops in Denmark are encouraging customers to pay with contactless methods instead of cash, alongside government officials mandating contactless and mobile payments to slow the spread of disease.

- Retailers, in addition, are required to decide on the mobile payment solution to adopt and support based on the relative ease of adoption and use for customers and on the ease of implementation for the retailer. The overall retail industry observes that the global population with the younger generation of smartphone-enabled consumers are among the prime drivers demanding shopping convenience in-store as they enjoy online.

- According to the Reserve Bank of India, in the last year, acceptance of the BHIM UPI QR code had increased by approximately 128 million in India. BHIM is a payment software created by the National Payments Corporation of India to facilitate simple transactions over the Unified Payment Interface. Such gradual growth is expected to drive the studied market over the forecasted period. In the last financial year, around 71 billion digital payments were recorded across India. This was a significant increase compared to the previous three years.

India Mobile Payments Industry Overview

The Indian payment market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions to expand their product portfolio, expand their geographic reach, and primarily stay competitive in the market.

In September 2023, PayU, a prominent online payment solutions provider in India, partnered with WhatsApp to offer native and seamless online payment experiences for companies using the WhatsApp Business platform. Businesses can currently offer clients 150+ payment choices, including cards, UPI, and net banking, all within the WhatsApp platform without needing redirection by using PayU's Checkout experience. This feature is now available to all PayU merchants with WhatsApp integration without charging additional setup or maintenance costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of India Mobile Payments Market

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Booming E-Commerce Sector Propelling the India Mobile Wallet Market Growth

- 5.1.2 An Increase in Smartphone Owners and Internet Users Will Drive Market Growth.

- 5.1.3 Favorable Government Initiatives

- 5.2 Market Challenges

- 5.2.1 Poor Internet Connectivity and Security Issues

- 5.3 Market Opportunities

- 5.3.1 Move towards Cashless Society

- 5.4 Key Regulations and Standards in the Mobile Payments Industry

- 5.5 Analysis of Business Models in the Industry

- 5.6 Analysis of the Increasing Market Penetration of Mobile Wallets

- 5.7 Analysis on Enabling Technologies (Coverage to include NFC, QR, etc.)

- 5.8 Commentary on the growth of Mobile Commerce and its influence on the Market

6 MARKET SEGMENTATION

- 6.1 BY TYPE (Market share in percentage based on relative adoption)

- 6.1.1 Proximity

- 6.1.2 Remote

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAYTM PAYMENTS BANK LIMITED (Paytm)

- 7.1.2 PhonePe

- 7.1.3 Alphabet Inc. (Google Pay)

- 7.1.4 Amazon Payments, Inc. (Amazon Pay)

- 7.1.5 ICICI Bank Limited (ICICI Pockets)

- 7.1.6 Freecharge Payment Technologies Pvt. Ltd.

- 7.1.7 State Bank of India (Yono SBI)

- 7.1.8 Bharti Airtel (Airtel Money)

- 7.1.9 HDFC Bank Limited (HDFC PayZapp)

- 7.1.10 Meta Platforms, Inc. (WhatsApp pay)

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET