PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445816

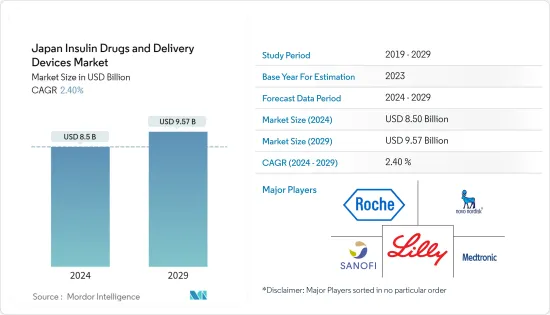

Japan Insulin Drugs and Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Japan Insulin Drugs and Delivery Devices Market size is estimated at USD 8.5 billion in 2024, and is expected to reach USD 9.57 billion by 2029, growing at a CAGR of 2.40% during the forecast period (2024-2029).

The number of Japanese victims during the COVID-19 pandemic was lower than in other countries, possibly due to genetic differences, aspects of Japanese culture, and coagulation system characteristics that are less potent in Japanese than in Caucasians. To relieve overcrowding in hospitals, the prefectural government of Osaka classified patients as mild, moderate, or severe and assigned them to various alternative accommodations. Patients were cared for in hospitals in accordance with national government guidelines. Concentrating on moderate patients, that is, those with acceptable oxygen saturation levels despite the presence of characteristics on computed tomography. While Type 1 diabetes is caused by an immune system malfunction, Type 2 diabetes is associated with a sedentary lifestyle, which leads to the development of inherent insulin resistance. As a result, Type 1 diabetes can be classified as insulin-requiring, whereas Type 2 diabetes can be classified as insulin-dependent. Japan has one of the world's largest elderly populations, making it more vulnerable to the onset of type 2 diabetes. Diabetes is becoming more common in Japan as the country's population ages. Blood glucose monitoring and management are becoming more common in order to avoid negative consequences such as cardiovascular disease, kidney disorders, and a variety of other conditions.

As a result of the aforementioned factors, the studied market is expected to grow during the analysis period.

Japan Insulin Drugs And Delivery Devices Market Trends

Growing Diabetes and Obesity Population in Japan

Diabetes cases are thought to be increasing in Japan due to an increase in the number of older adults, who are more vulnerable to disease, as well as an increase in obesity due to a lack of exercise and irregular eating habits. Another reason is that more people have been diagnosed with the disease due to being referred to a medical facility based on the results of the metabolic syndrome examination, which was introduced in 2008 to prevent lifestyle-related diseases. Diabetes cases are expected to rise even further in Japan as the population ages. Diabetes has emerged as a global epidemic; according to IDF 2021 data, Japan has approximately 11 million diabetics. While an immune system malfunction causes Type 1 diabetes, Type 2 diabetes is associated with a sedentary lifestyle, leading to inherent insulin resistance. As a result, Type 1 diabetes can be classified as insulin-requiring, whereas Type 2 diabetes can be classified as insulin-dependent. Japan has one of the world's largest elderly populations, making it more vulnerable to the onset of type 2 diabetes. Diabetes is becoming more common in Japan as the country's population ages. Blood glucose monitoring and management are becoming more popular to avoid negative consequences such as cardiovascular disease, kidney disorders, etc.

Because of the factors above, the market is expected to expand further.

The Insulin Pumps Segment is Expected to Witness Highest Growth Rate Over the Forecast Period

Insulin is delivered subcutaneously via a cannula attached to a patch. When the pump is used independently of the AID system, a remote control can adjust administration settings such as basal and bolus.

A predictive low-glucose management (PLGM) insulin pump was introduced in Japan. The sensor automatically suspends insulin delivery when it detects or predicts low glucose levels. The number of insulin pump users among Japanese patients with type 1 diabetes mellitus is estimated to be around 10,000, implying that the insulin pump has not yet permeated Japan. The MiniMed 620G device (Medtronic, Northridge, CA, USA) with sensor-augmented pump therapy was launched in February 2015, reflecting the small number of pump users in Japan, and the MiniMed 640G device was launched in March 2018, several years after each device was launched in European countries. The MiniMed 640G device's predictive low-glucose management (PLGM) component automatically suspends insulin delivery when the sensor detects low glucose values or glucose values are predicted to rise to 20 mg/dL (1.1 mmol/L) above a preset low-glucose limit within 30 minutes.

Diabetes has been identified as a healthcare priority by the Ministry of Health, Labour, and Welfare (MHLW). The high prevalence of type 2 diabetes is associated with a significant economic burden. The costs of diabetes are increased in patients with co-morbidities such as hypertension and hyperlipidemia and in patients who develop complications. Costs increase with an increasing number of complications. Well-organized medical insurance systems cover all medical fees for diabetes mellitus, and people with diabetes can visit doctors freely in Japan. Also, insulin therapy by self-injection became legal and is covered by health insurance. Such advantages have helped the adoption of these products in the Japanese market.

Japan Insulin Drugs And Delivery Devices Industry Overview

Japan Insulin Drugs and Delivery Devices Market is consolidated, with few significant and generic players. Mergers and acquisitions that happened between the players in the recent past have helped the companies strengthen their market presence. Eli Lilly and Boehringer Ingelheim together have an alliance in developing and commercializing Basaglar (Insulin Glargine). Additionally, the players in the recent past helped the companies strengthen their market presence; for example, Novo Nordisk collaborated with Ypsomed to provide better insulin therapy solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drug

- 5.1.1 Basal or Long-acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Basaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast-acting Insulins

- 5.1.2.1 NovoRapid/Novolog (Insulin aspart)

- 5.1.2.2 Humalog (Insulin lispro)

- 5.1.2.3 Apidra (Insulin glulisine)

- 5.1.2.4 FIASP (Insulin aspart)

- 5.1.2.5 Admelog (Insulin lispro Sanofi)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin/Mixtard/Actrapid/Insulatard

- 5.1.3.2 Humulin

- 5.1.3.3 Insuman

- 5.1.4 Combination Insulins

- 5.1.4.1 NovoMix (Biphasic Insulin aspart)

- 5.1.4.2 Ryzodeg (Insulin degludec and Insulin aspart)

- 5.1.4.3 Xultophy (Insulin degludec and Liraglutide)

- 5.1.4.4 Soliqua/Suliqua (Insulin glargine and Lixisenatide)

- 5.1.5 Biosimilar Insulins

- 5.1.5.1 Insulin Glargine Biosimilars

- 5.1.5.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long-acting Insulins

- 5.2 Device

- 5.2.1 Insulin Pumps

- 5.2.1.1 Insulin Pump Devices

- 5.2.1.2 Insulin Pump Reservoirs

- 5.2.1.3 Insulin Infusion sets

- 5.2.2 Insulin Pens

- 5.2.2.1 Cartridges in reusable pens

- 5.2.2.2 Disposable insulin pens

- 5.2.3 Insulin Syringes

- 5.2.4 Insulin Jet Injectors

- 5.2.1 Insulin Pumps

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Novo Nordisk

- 7.1.2 Sanofi

- 7.1.3 Eli Lilly

- 7.1.4 Biocon

- 7.1.5 Julphar

- 7.1.6 Medtronic

- 7.1.7 Ypsomed

- 7.1.8 Becton Dickinson

- 7.2 COMPANY SHARE ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS