PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689811

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689811

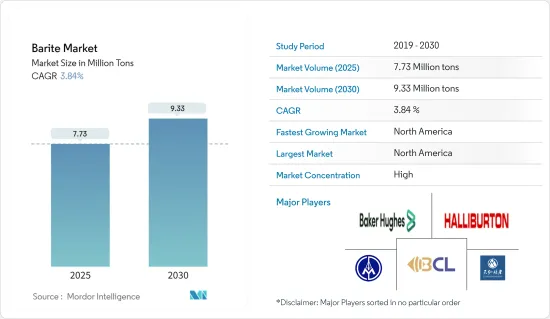

Barite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Barite Market size is estimated at 7.73 million tons in 2025, and is expected to reach 9.33 million tons by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in 2020 due to the sudden shutdown of operations in major end-user industries. However, the market recovered significantly during 2021-22 due to rising consumption from various end-user industries such as oil and gas, chemicals, and rubber.

Key Highlights

- Over the long term, the major factors driving the barite market are likely to be the growing demand from oil and gas drilling activities and the increasing usage in the plastics industry worldwide.

- However, the availability of close substitutes, such as celestite and iron ore, is restraining the growth of the barite market.

- The surge in the adoption of barite from the paint and medical industries will likely provide new growth opportunities for the market.

- North America is projected to be the largest market for barite due to the growing oil and gas industry, where barite plays a very crucial role.

Barite Market Trends

High Demand from the Oil and Gas Industry

- Barite has massive demand in oil and gas drilling operations as a weighing agent in the drilling mud. It prevents the explosive release of oil and gas during drilling. It has unique physical and chemical properties such as high specific gravity, chemical and physical inertness, low solubility, and magnetic neutrality.

- The majority of the global demand is from the petroleum industry. Given its importance in the transportation and industrial end-use sectors, the global demand for barite will likely continue until petroleum products are preferred as the chief energy source.

- The properties of barite, such as its non-corrosiveness, non-abrasiveness, insolubility in water, inertness, and high specific gravity, allow it to be used as a weighting agent in drilling operations to remove cutting from bits, transport cutting to the surface to reduce friction in the drilling string, control pressure, prevent blow-out, and provide lubrication.

- The prospectus for the future growth of the petroleum industry suggests that petroleum exploration will continue to grow, along with the consumption of barite. More drilling must be done per unit of oil as hydrocarbon discoveries become less productive with time.

- According to a report by the International Energy Agency, surging oil use for power generation and gas-to-oil switching in the wake of soaring European natural gas prices boosted the growth trajectory for oil demand over 2022 and into 2023.

- According to the Energy Institute, China's crude oil processing reached an average of 14.8 million b/d in 2023, a record high. Recently, China added more refinery capacity than any other country, partly to meet its transportation fuel requirements and produce petrochemical feedstocks.

- According to the International Energy Agency (IEA), during 2023-2030, India is expected to account for more than one-third of global oil demand growth.

- As a result, over the next few years, the market's growth is likely to be driven by the rising demand for barite from the global oil and gas industry.

North America is Expected to Dominate the Market

- Barite, or barium sulfate, is utilized in the chemical industry as a weighting agent in drilling fluids for oil and gas exploration, catalyst support, a source of barium in the production of various compounds, a filler in paints, coatings, plastics, and rubber, and for its high density in radiation shielding materials, illustrating its versatility in diverse applications.

- According to the BASF Report 2023, in the United States, demand for chemicals is projected to grow slightly in 2024 (1.1%), following a Y-o-Y decline due to inventory destocking and low industrial growth.

- According to the United States Census Bureau, oil product exports from the United States reached an all-time high of 6.1 million b/d in 2023, 2.5% higher than in 2022.

- According to the Energy Institute, in December 2023, Y-o-Y growth in primary energy production was 3.2%, with crude oil leading the way with a Y-o-Y increase of 8.1%.

- While not a primary material in the electronics industry, barite can be employed as a filler in certain polymers and resins used in electronic components, contributing to enhanced properties. Its high density also makes it useful for radiation shielding in electronic equipment and medical equipment.

- Hence, the rising demand for barite from various industries is expected to considerably boost the market's growth in North America over the forecast period.

Barite Industry Overview

The barite market is consolidated in nature. Some of the key companies in the market (not in particular order) include The Andhra Pradesh Mineral Development Corporation Ltd, Guizhou Tianhong Mining Co. Ltd, Halliburton Energy Services Inc., Baribright Co. Ltd, and Baker Hughes Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Demand from the Oil and Gas Industry

- 4.1.2 Growing Use in the Plastic Industry

- 4.2 Restraints

- 4.2.1 Availability of Close Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview

- 4.6 Trade Overview

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Bedded

- 5.1.2 Vein and Cavity Filling

- 5.1.3 Residual

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemical

- 5.2.3 Fillers

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Andhra Pradesh Mineral Development Corporation Ltd

- 6.4.2 Baker Hughes Inc.

- 6.4.3 Baribright Co. Ltd

- 6.4.4 Cimbar Performance Minerals

- 6.4.5 Guizhou Saboman Import and Export Co. Ltd

- 6.4.6 Guizhou Tianhong Mining Co.

- 6.4.7 Halliburton Energy Services Inc.

- 6.4.8 International Earth Products LLC

- 6.4.9 New Riverside Ochre

- 6.4.10 Newpark Resources Inc.

- 6.4.11 Pulapathuri

- 6.4.12 PVS Global Trade Private Limited

- 6.4.13 Sachtleben Minerals GmbH & Co. KG

- 6.4.14 Schlumberger Limited

- 6.4.15 The Kish Company Inc.

- 6.4.16 Zhongrun Barium Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Gradual Surge in Adoption of Barite from Paints & Medical Industry