PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910808

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910808

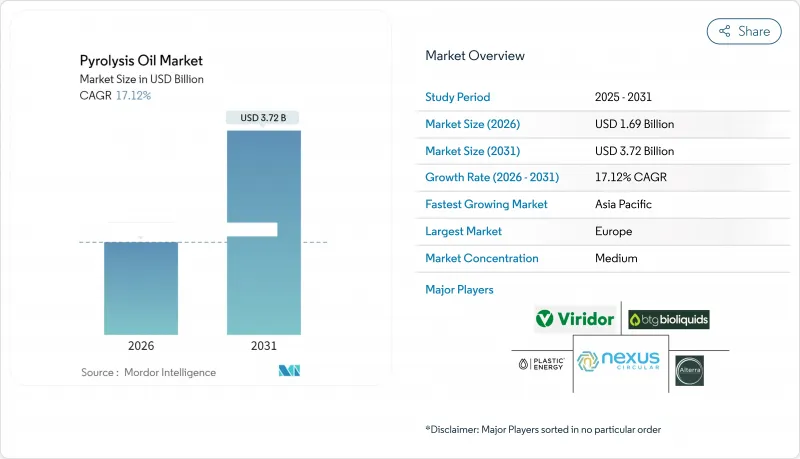

Pyrolysis Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Pyrolysis Oil Market was valued at USD 1.44 billion in 2025 and estimated to grow from USD 1.69 billion in 2026 to reach USD 3.72 billion by 2031, at a CAGR of 17.12% during the forecast period (2026-2031).

Heightened plastic-waste regulations, circular-economy mandates and refinery co-processing breakthroughs together accelerate demand, while generous carbon-credit schemes improve plant economics. Strategic funding from Europe's Innovation Fund and Japan's NEDO program underpins capacity additions that shift the competitive balance toward regions with supportive policy ecosystems. Producers pursue vertical integration with refiners to reduce capital outlays and secure guaranteed offtake, and technology licensors are racing to commercialize microwave-assisted or supercritical routes that improve yield and cut emissions. At the same time, contaminant management, particularly for polycyclic aromatic hydrocarbons, remains the key operational hurdle as specification-driven customers tighten acceptance limits.

Global Pyrolysis Oil Market Trends and Insights

Rising Demand for Renewable and Circular Fuel Substitutes

California's Low Carbon Fuel Standard now targets a 30% carbon-intensity cut by 2030, issuing high-value credits that make waste-derived pyrolysis oil competitive with petroleum inputs. Canada's Clean Fuel Regulations set a 15% reduction goal and earmark USD 1.5 billion for domestic production, reinforcing North American demand. In parallel, Japan's plastics resource-circulation strategy and U.S. sustainable aviation-fuel tax credits position pyrolysis oil as a qualifying feedstock with direct financial upside. Together these measures transform waste oil from an environmental liability into a compliance-grade decarbonization commodity.

Stricter Plastic-Waste Regulations and Bans Worldwide

Europe's mandate for 100% recyclable packaging by 2030 and China's push to recycle 4 billion tons of bulk solid waste by 2025 sharply raise demand for processing routes beyond mechanical recycling. Canada's Federal Plastics Registry, effective September 2025, adds transparent feedstock tracking that favors advanced facilities capable of quality certification. Indonesia's 30% waste-reduction target further broadens the raw-material pool. These regulatory forces provide predictable long-term feedstock streams and catalyze investments in high-efficiency thermal decomposition.

Corrosivity and Instability During Storage/Transport

Tire-derived oils often contain more than 10% polycyclic aromatic hydrocarbons such as benzo[a]pyrene, requiring stainless or lined tanks and inert-gas blanketing, which inflate logistics costs. Mixed-plastic oils exhibit elevated sulfur, oxygen and chloride levels that foul refinery catalysts unless pre-treated. Ongoing post-production reactions alter viscosity and acidity during long-haul shipment, demanding stabilizers and temperature control. These technical complications restrict cross-border trade and limit standardization, slowing global adoption.

Other drivers and restraints analyzed in the detailed report include:

- FCC/Hydro-Processing Co-Feeding Lowers Refinery CAPEX

- Carbon-Credit Monetization for Low-Carbon Pyrolysis Oil

- PAH/Contaminant Concerns Triggering Regulatory Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waste plastics held 55.02% of the pyrolysis oil market share in 2025, and the segment is tracking a 18.92% CAGR through 2031. The pyrolysis oil market size attributable to waste-plastic feedstock is projected to rise in tandem as global plastic waste exceeds 380 million t y while mechanical recycling stalls below 10% recovery.

Advances in mixed-plastic processing, such as Resonac's more than or equal to 60% yield technology and synergistic co-pyrolysis of polypropylene with biomass, simplify feed preparation and cut sorting costs. Tire waste, the second-largest input group, benefits from well-organized collection but suffers from higher PAH contamination that commands price discounts. Biomass streams face oxygen-removal challenges that require costly hydrotreatment, limiting immediate scale-up. As regulators tighten chloride and sulfur limits for refinery feed, demand is rising for high-purity plastic oils, creating a premium segment within overall feedstock markets.

The Pyrolysis Oil Report is Segmented by Raw Material (Waste Plastics, Waste Tires, Biomass, and Others), Application (Fuels and Chemicals), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe accounted for 35.74% of global sales in 2025, underpinned by policy clarity and dedicated funding streams. The region hosts LyondellBasell's 50,000 tons per year Wesseling unit and OMV's 16,000 tons per year ReOil plant, both demonstrating scalable output with lower carbon footprints versus incineration.

Asia-Pacific is the fastest-growing market at a 22.98% CAGR, fueled by Japan's NEDO funding, China's 4 billion-t waste-utilization target and breakthrough projects such as ENEOS-Mitsubishi Chemical's hydrothermal plant in Ibaraki. Southeast Asia is following suit, with Indonesian partners JGC and Marubeni evaluating modular Pyro-Blue systems to tackle rising marine-plastic inflows.

North America shows accelerating potential through long-term offtake contracts and robust LCFS credit structures. Dow's supply deal with Freepoint anchors a 180,000 tons per year Arizona complex, and NOVA Chemicals will add 66,000 tons per year of capacity in Ontario using Plastic Energy's Tacoil process, supporting its 30% recycled content pledge by 2030.

- Agilyx

- Alterra Energy, LLC

- Arbios Biotech

- Bioenergy AE Cote-Nord

- BTG Bioliquids (Green Fuel Nordic Oy)

- Kerry Group plc

- New Energy Kft.

- New Hope Energy

- Nexus Circular

- Plastic Energy

- Pyrocell (Setra)

- Scandinavian Enviro Systems AB

- Trident Fuels pty ltd

- Twence

- Viridor Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for renewable and circular fuel substitutes

- 4.2.2 Stricter plastic-waste regulations and bans worldwide

- 4.2.3 Rising chemical-recycling investment pipelines

- 4.2.4 FCC / hydro-processing co-feeding lowers refinery CAPEX

- 4.2.5 Carbon-credit monetisation for low-carbon pyrolysis oil

- 4.3 Market Restraints

- 4.3.1 Corrosivity and instability during storage/transport

- 4.3.2 High CAPEX and scale-up execution risk

- 4.3.3 PAH/contaminant concerns triggering regulatory delays

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Waste Plastics

- 5.1.2 Waste Tires

- 5.1.3 Biomass

- 5.1.4 Others

- 5.2 By Application

- 5.2.1 Fuels

- 5.2.2 Chemicals

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Morocco

- 5.3.5.8 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Agilyx

- 6.4.2 Alterra Energy, LLC

- 6.4.3 Arbios Biotech

- 6.4.4 Bioenergy AE Cote-Nord

- 6.4.5 BTG Bioliquids (Green Fuel Nordic Oy)

- 6.4.6 Kerry Group plc

- 6.4.7 New Energy Kft.

- 6.4.8 New Hope Energy

- 6.4.9 Nexus Circular

- 6.4.10 Plastic Energy

- 6.4.11 Pyrocell (Setra)

- 6.4.12 Scandinavian Enviro Systems AB

- 6.4.13 Trident Fuels pty ltd

- 6.4.14 Twence

- 6.4.15 Viridor Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment