Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690986

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690986

Germany Plant Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 218 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

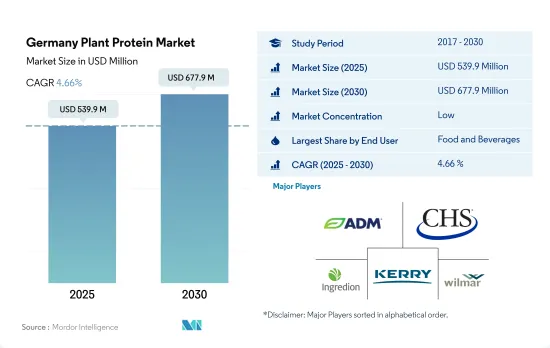

The Germany Plant Protein Market size is estimated at 539.9 million USD in 2025, and is expected to reach 677.9 million USD by 2030, growing at a CAGR of 4.66% during the forecast period (2025-2030).

Increasing lactose-intolerant population in Germany with growing demand for natural products is driving the segmental growth

- By end user, the market is led by the food and beverages segment, majorly due to the increasing preference for plant-based foods as a sustainable alternative. It was mainly driven by the meat alternatives segment, with a share of around 25% by value in 2022, due to the growing demand for meat substitutes owing to the rising trend of veganism. The trend resonates with consumers' growing interest in veganism and the increasing lactose-intolerant population in the country. Germany ranked second in Europe in terms of the number of vegans in 2022. More than 2.5 million vegans reside in the nation, and the country is renowned for its plant-based and meat alternative industries.

- Supplements are anticipated to be the fastest-growing segment in the market, with a CAGR of 7.15% during the forecast period, owing to their several health benefits. Weight management and general health and well-being are the major concerns among German consumers, and they act as driving factors for the increasing demand for plant protein in various supplements. Plant proteins, such as rice and peas, are gaining popularity for being hypoallergenic and a nutritious alternative for people suffering from lactose intolerance. About 16% of the German population was lactose intolerant in 2022, leading to a high demand for plant-based proteins.

- The usage of plant proteins in the personal care and cosmetic industry is still at a nascent stage due to the prevalence of other effective bioactive ingredients such as antioxidants, mineral oils, and alcohol. The German population's interest in a greener lifestyle is boosting the demand for natural and plant-based beauty products with vegan claims. Germany has the most number of vegans in Europe, which doubled from 1.3 million in 2016 to 2.6 million in 2020.

Germany Plant Protein Market Trends

The consumption growth of plant protein fuels opportunities for key players in the ingredients segment

- The German plant protein market is driven by consumers' increasing conversion toward vegan diets due to their functional efficiency, the cost competitiveness offered by reliable plant protein products such as soy, wheat, and pea, and their increasing application in various processed foods. Soy protein is considered healthy for all age groups and helps maintain proper body functions. Plant-based protein alternatives are widely used in the food and beverage and supplement segments. They can be derived from sources such as soy, wheat, and other vegetables, which are essential parts of the food and beverage segment, boosting plant protein consumption in Germany. As more consumers increased their preference for vegan diets, the number of vegans in Germany doubled, reaching 2.6 million people and accounting for 3.2% of the population from 2016 to 2020.

- Favorable government policies to reduce various diseases, such as obesity and diabetes, by controlling meat consumption may result in a growing consumer shift toward wheat protein. At least 7.2% of the population in Germany has diabetes, most of them type 2 diabetes. The number of people with diabetes is expected to increase significantly over the next two decades.

- The growing demand for clean-label ingredients and stringent labeling regulations by food authorities are compelling food manufacturers to adopt natural ingredients. Thus, ingredient manufacturers operating in the market focus on developing innovative ingredients to cater to the growing demand and achieve a competitive advantage. Germany has a rising demand for vegan food products and an increasing number of lactose-intolerant consumers. As a result, the overall plant protein consumption increased from 47 g in 2017 to 53 g in 2022.

Soy, wheat, and pea production contributes majorly as raw material for plant protein ingredients manufacturers

- In 2023, the winter wheat area accounted for just under half (48%) of the area under grain production in Germany. Wheat production for 2019-2020 reached 24.2 million tons, up from 20.3 million tons in the previous year. Farmers in Germany were growing winter wheat for harvest in 2022 on 2.89 million hectares, 0.6% more than the previous year.

- The area under soybean cultivation in Germany has grown continuously to reach over 32,900 ha in 2020. The biggest part of this area is found in Bavaria and Baden-Wuerttemberg (26,700 ha), with the rest in the other federal states (several hundred ha each). The German government's program to encourage soybean cultivation has been successful, with plantings for the 2020 crop expanding by 13.8% to 32,900 ha, but with no harvest forecast available. The soybean production in the country recorded an increase of 110% in 2020 since 2016.

- Over the past ten years, pea production in Germany has almost tripled. In Germany, farmers currently grow pea crops on just under 2% of the total arable land in the country. The Federal Ministry of Agriculture's targeted protein crop and arable farming strategy aims to increase cultivation to 10% by 2030 and make it more attractive for farmers. The seed company KWS is also moving with the times and wants to expand its breeding successes with peas further, as many food manufacturers are demanding pea protein ingredients in a variety of foods such as "schnitzels" pasta, yogurt, drinks, ice cream, and sports bars.

Germany Plant Protein Industry Overview

The Germany Plant Protein Market is fragmented, with the top five companies occupying 17.09%. The major players in this market are Archer Daniels Midland Company, CHS Inc., Ingredion Incorporated, Kerry Group PLC and Wilmar International Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90147

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Plant

- 3.3 Production Trends

- 3.3.1 Plant

- 3.4 Regulatory Framework

- 3.4.1 Germany

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Protein Type

- 4.1.1 Hemp Protein

- 4.1.2 Pea Protein

- 4.1.3 Potato Protein

- 4.1.4 Rice Protein

- 4.1.5 Soy Protein

- 4.1.6 Wheat Protein

- 4.1.7 Other Plant Protein

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Confectionery

- 4.2.2.1.6 Dairy and Dairy Alternative Products

- 4.2.2.1.7 Meat/Poultry/Seafood and Meat Alternative Products

- 4.2.2.1.8 RTE/RTC Food Products

- 4.2.2.1.9 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 A. Costantino & C. spa

- 5.4.2 Archer Daniels Midland Company

- 5.4.3 Brenntag SE

- 5.4.4 CHS Inc.

- 5.4.5 Glanbia PLC

- 5.4.6 Ingredion Incorporated

- 5.4.7 Kerry Group PLC

- 5.4.8 Lantmannen

- 5.4.9 Roquette Frere

- 5.4.10 Sudzucker AG

- 5.4.11 Wilmar International Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.