Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693527

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693527

North America Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 157 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

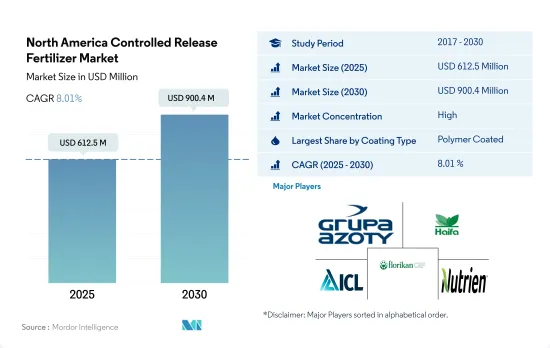

The North America Controlled Release Fertilizer Market size is estimated at 612.5 million USD in 2025, and is expected to reach 900.4 million USD by 2030, growing at a CAGR of 8.01% during the forecast period (2025-2030).

Initiatives toward achieving right amount of nutrients at the right time will increase the CRFs adoption in the region

- Between 2017 and 2022, the North American controlled-release fertilizers market witnessed a CAGR of 15.0%. Precision farming, a widely embraced approach in the region, prioritizes timely and precise nutrient delivery to crops. Controlled-release fertilizers, in this context, assume a pivotal role, ensuring crops receive optimal nutrient dosages, thus becoming integral to precision farming.

- In 2022, field crops dominated the North American controlled-release fertilizers market, capturing 88.4% of the market share. Horticultural crops accounted for 3.7%. Controlled-release fertilizers found extensive usage in high-value crops like cereals, grains, vegetables, orchards, and nurseries. While specialty chemical adoption in row crops is not yet widespread, it is gradually rising due to surging grain prices, heightened environmental concerns, and stricter nutrient application regulations.

- In 2022, the United States led the consumption of controlled-release fertilizers, accounting for 69.9%. This dominance can be attributed to the nation's regulations governing nutrient application rates and fertilizer pollution control.

- Recognizing the technological strides in the fertilizer industry, the Environmental Protection Agency (EPA) and the US Department of Agriculture (USDA) have collaborated with key stakeholders like The Fertilizer Institute (TFI), the International Fertilizer Development Center (IFDC), The Nature Conservancy (TNC), and the National Corn Growers Association (NCGA). Their collective aim is to raise awareness about controlled-release fertilizers among farmers, with a positive ripple effect anticipated on the country's field crop production.

Environmental concerns about excessive use of fertilizers and reduced nitrogen use by major crops may drive the CRF market

- In 2022, the United States recorded a 69.9% share of the CRF market. The market grew by a CAGR of 14.0% during the study period. Polymer coating emerged as the leader, commanding a 76.4% share in 2022. Around 69% of the US cropland is dedicated to field crops, including barley, corn, cotton, oats, peanuts, sorghum, soybeans, and wheat. Given the high nitrogen requirements of these crops, the adoption of polymer-coated urea, known for its nitrogen efficiency, is on the rise, further bolstering the market share of polymer-coated fertilizers.

- Canada is witnessing a surge in the cultivation of field crops like wheat, canola, and maize. To support this trend, the Canadian government, through initiatives like Farm Credit Canada, is facilitating increased credit accessibility for farmers, specifically for inputs like controlled-release fertilizers. This favorable environment is poised to propel the controlled-release fertilizer market in Canada in the coming years.

- In 2021, the Mexican legislature approved a USD 2.70 billion budget for the Secretariat of Agriculture and Rural Development (SADER) in its 2022 Federal Government Budget. Around 70% of this allocation was earmarked for fertilizer subsidies. This is expected to be a key driver for the controlled-release fertilizer market in Mexico.

- The Rest of North America is witnessing a surge in the adoption of controlled-release fertilizers driven by the push for precision agriculture practices and climate-smart initiatives. These measures address environmental concerns and promote sustainable farming practices.

- Across the region, the imperative to boost field crop production, coupled with robust government initiatives and growing farmer awareness, sets the stage for a promising market outlook in the coming years.

North America Controlled Release Fertilizer Market Trends

The financial support by the government such as subsidies has contributed to the expansion of field crops

- A wide array of crops are grown on North American farms, mainly covering field crops. Corn, Cotton, Rice, Soybean, and Wheat are some of the dominating field crops across the region. The United States, Canada, and Mexico are major contributors to the region's agricultural output. In 2022, field crops covered around 97.6% of the overall cultivation in North America, with cereals and oilseeds dominating the market.

- By country, the United States dominates the market, covering 135.7 million hectares of the overall area under crop cultivation during the study period. Among them, field crops and horticulture are covering the majority of the area and accounted for 97.2% and 2.8% in 2022. However, between 2018-2019, the country witnessed a significant dip in crop acreages which is majorly due to unfavorable environmental conditions resulting in heavy floods in areas like Texas and Houston.

- The largest crop cultivated is corn, the majority of which is grown in a region known as the 'Corn Belt' traditional area in the midwestern United States, roughly covering western Indiana, Illinois, Iowa, Missouri, eastern Nebraska, and eastern Kansas, in which corn (maize) and soybeans are the dominant crops. Also, It is the major rice exporter, and the rice cultivation in the region is mainly concentrated within 4 regions with three in the South and one in California. Therefore, the increased market potential for the region's field crop, coupled with the increased government funding and protection is anticipated to positively drive the area under field crop cultivation in the region.

Among all the primary nutrients, nitrogen is applied in a higher quantity for field crops

- Field crops, such as rice, corn/maize, wheat, and rapeseed/canola, are some of the major primary nutrient-consuming crops in the region. In 2022, about 140.85 kg/hectare of primary nutrients were consumed by rice, followed by 118.40 kg/hectare consumed by rapeseed/canola. Cereals are anticipated to consume the maximum amount of nitrogen fertilizer. As they are grown intensively in the region, they deplete the nutrients in the soil and require more fertilizers to supplement growth.

- Among all the primary nutrients, nitrogen is applied in a higher quantity, accounting for about 74.0% in 2022, equivalent to 229.8 kg/hectare for field crops. Nitrogen deficiency, however, is one of the most prevalent crop nutrient problems in the region. Hence, most of the nitrogen supplement is provided through soil application. When applied to the soil, nitrogen is converted to mineral nitrate for the plants to absorb easily. Rapeseed, the major nitrogen-consuming crop, is widely grown in the United States.

- Rapeseed is used for extracting oil for industrial applications, like lubricants, hydraulic fluids, and plastics. While fertilizer usage is based on soil quality and rainfall potential, its nitrogen requirements range from 100 to 150 lbs/acre. Phosphorus and potassium fertility rates also vary from soil to soil. However, the recommended rates range from 0 to 80 lbs/acre and 0 to 140 lbs/acre, as per the AgMRC.

- Since primary nutrients are the major sources of nutrients for various crops, their application rates are anticipated to grow significantly over the years due to soil depletion, leaching, etc.

North America Controlled Release Fertilizer Industry Overview

The North America Controlled Release Fertilizer Market is fairly consolidated, with the top five companies occupying 88.15%. The major players in this market are Grupa Azoty S.A. (Compo Expert), Haifa Group, ICL Group Ltd, New Mountain Capital (Florikan) and Nutrien Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92591

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 AgroLiquid

- 6.4.2 Grupa Azoty S.A. (Compo Expert)

- 6.4.3 Haifa Group

- 6.4.4 ICL Group Ltd

- 6.4.5 New Mountain Capital (Florikan)

- 6.4.6 Nutrien Ltd.

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.