PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835644

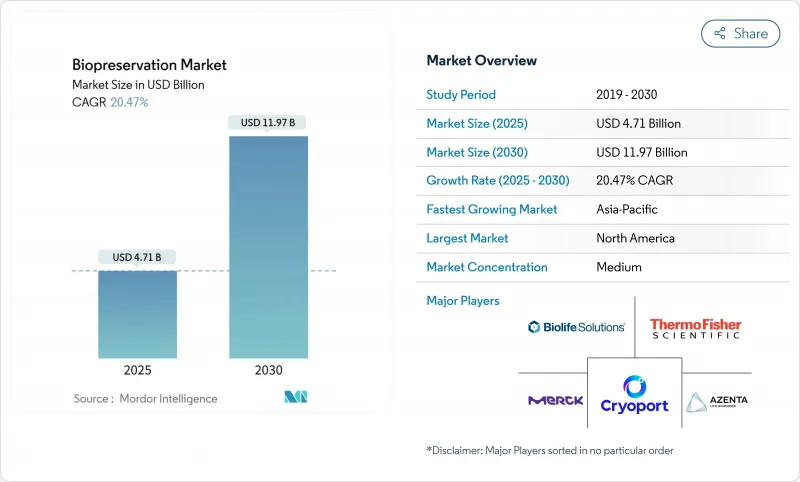

Biopreservation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biopreservation market reached a valuation of USD 4.71 billion in 2025 and is set to expand to USD 11.97 billion by 2030, reflecting a 20.47% CAGR.

The surge is underpinned by the acceleration of personalized medicine, stronger regulatory support for advanced biologics, and deployment of vaccine-era ultra-low temperature logistics. Rapid digitization of biobank inventories plus artificial-intelligence analytics is increasing specimen utility and encouraging long-term sample maintenance. In parallel, investments in cryogenic robotics and predictive monitoring improve reliability and reduce manual error, further broadening the biopreservation market footprint. Supply-side innovation, ranging from non-cryogenic polymer matrices to ice-recrystallization-inhibitor media, adds technological depth and opens new revenue streams across research and clinical settings.

Global Biopreservation Market Trends and Insights

Healthcare & life-science R&D budgets

Record-high corporate and public R&D allocations now exceed USD 200 billion annually in the United States, prompting pharmaceutical firms to outsource sample handling to specialist providers that guarantee consistent quality. Companies such as Discovery Life Sciences integrate flow cytometry with molecular analytics, illustrating how outsourced services accelerate specimen throughput, reduce cycle times, and stimulate fresh demand for consumables and equipment. Robust funding also supports artificial-intelligence models that mine multi-omic datasets, increasing the quantity and diversity of materials entering the biopreservation market. Capital availability cushions high upfront equipment costs, allowing research networks to adopt automated, energy-efficient freezers and cloud-based monitoring.

Biobanking for personalized medicine

Large-scale initiatives like the UK Biobank, now surpassing 500,000 participants, underscore the shift from passive storage to dynamic data integration platforms. Brazil's institutional repositories follow suit, validating a global appetite for diverse, longitudinal specimens that underpin precision diagnostics. Growing sample diversity demands unified quality control protocols, which translate into higher sales of advanced media and vitrification devices. As genomic, proteomic, and electronic health-record data converge, the biopreservation market benefits from repeat specimen retrievals that extend storage horizons and encourage premium service contracts.

Cryogenic equipment capital & operating costs

High-performance freezers range from USD 15,000-50,000, compounded by electricity expenses of USD 3,000-5,000 per unit each year. Smaller institutes struggle with acquisition and maintenance, delaying adoption in cost-sensitive regions. Though temperature optimization and shared facilities mitigate expenses, the upfront barrier suppresses immediate penetration of the biopreservation market in emerging economies.

Other drivers and restraints analyzed in the detailed report include:

- Hospital-based in-house sample storage

- Decentralized trials and point-of-care needs

- Risk of viability loss during preservation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equipment sales are accelerating at a 22.74% CAGR, reflecting the push toward robotics, predictive maintenance, and cryogen-free technology. The biopreservation market size for equipment is on track to climb from USD 1.78 billion in 2025 to USD 4.96 billion by 2030. Ultra-low temperature freezers now feature internet-of-things sensors that transmit operational data for proactive servicing. Automated storage modules can sort, pick, and re-rack millions of vials annually, cutting labor costs and enhancing biospecimen traceability. Parallel advances in vapor-phase nitrogen systems curb frost accumulation and reduce liquid nitrogen consumption, addressing both safety and ESG requirements.

Consumables and accessories exhibit steady growth alongside rising sample volumes. Integrated media-hardware solutions illustrate a convergence trend, where proprietary cryoprotectants are optimized for precise cooling profiles delivered by automated platforms. This symbiosis locks in customers and strengthens recurring-revenue streams, anchoring long-term resilience for suppliers within the biopreservation market.

Human tissue banks still account for the largest revenue slice, yet stem cells are the star performer with a 23.55% CAGR. Approval of cord-blood-based Omisirge validates the clinical payoff of high-quality stem-cell preservation. Sophisticated protocols now govern everything from sourcing to thaw, ensuring viability for regenerative surgeries and immunotherapies.

Organs remain experimentally challenging, but the successful thaw-and-transplant of a rat kidney demonstrates tangible progress toward clinical organ repositories. DNA, plasma, and other bio-fluids benefit from room-temperature polymer matrices that slash cold chain costs and broaden global research collaboration. This biospecimen diversification magnifies end-market opportunities and underscores the long-run momentum of the biopreservation market.

The Biopreservation Market Report is Segmented by Product Type (Biopreservation Media and Equipment [Temperature-Maintaining Units, Consumables and More), Biospecimen ( Human Tissues and More), Preservation Method (Cryopreservation, Vitrification and More), Application Area (Biobanking and More), End User (Biobanks & Gene Banks, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America continues to command the largest regional stake, holding 38.48% of the biopreservation market in 2024. Federal guidance on cell and gene therapy safety plus steady venture funding make the United States the supply-chain nexus for cryogenic equipment and specialized logistics. Canadian consortia and Mexican manufacturing corridors complement the ecosystem, adding cross-border efficiencies and broadening market access.

Asia-Pacific is the clear growth engine at a 23.41% CAGR. Chinese biopharma revenues are set to exceed CNY 1.4 trillion by 2029, fueling infrastructure orders for freezers, nitrogen generators, and monitoring software. Japan's stimulus packages and tax incentives aim to triple the domestic biotech market, accelerating adoption of advanced vitrification kits and automated biobank modules. India's contract manufacturers leverage Production-Linked Incentives to build GMP cold-chain warehouses that conform to global audit standards, opening new export pathways for preserved cell therapies.

Europe holds a mature yet evolving position. The United Kingdom's 16 million-sample expansion validates sustained government backing for national biobanks. Germany and France integrate energy-efficiency mandates, encouraging deployment of -70 °C operations and liquid-nitrogen recapture systems. Environmental, social, and governance requirements push suppliers to deliver greener cooling technologies, ensuring that sustainability and performance advance together within the regional biopreservation market.

- Thermo Fisher Scientific

- Merck

- Azenta

- BioLife Solutions

- Cryoport Inc.

- Cesca Therapeutics

- Core Dynamics Ltd.

- Custom Biogenic Systems

- Lifeline Scientific

- MVE Biological Solutions

- Princeton CryoTech

- Danaher Corp.

- Sartorius

- Eppendorf

- Stem Cell Technologies

- Lonza Group

- Bio-Rad Laboratories

- CryoConcepts LP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Healthcare & Life-Science R&D Budgets

- 4.2.2 Expansion Of Biobanking For Personalised Medicine

- 4.2.3 Rapid Adoption Of Hospital-Based, In-House Sample Storage

- 4.2.4 Decentralised Trials Driving Point-Of-Care Preservation

- 4.2.5 Repurposed Ultra-Low-Temp Logistics From mRNA Supply Chain

- 4.2.6 Venture Funding Into Cryogenic Robotics & Monitoring

- 4.3 Market Restraints

- 4.3.1 High Capital & Operating Costs Of Cryogenic Equipment

- 4.3.2 Risk Of Cell/Tissue Viability Loss During Preservation

- 4.3.3 Medical-Grade Liquid-Nitrogen Supply-Chain Fragility

- 4.3.4 ESG Pressure On Energy-Intensive Long-Term Storage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Biopreservation Media

- 5.1.2 Equipment

- 5.1.2.1 Temperature-Maintaining Units

- 5.1.2.2 Consumables

- 5.1.2.3 Accessories & Monitoring Systems

- 5.2 By Biospecimen

- 5.2.1 Cells & Cell Lines

- 5.2.2 Human Tissues

- 5.2.3 Organs

- 5.2.4 Stem Cells

- 5.2.5 Other Bio-fluids (DNA/RNA, Plasma, etc.)

- 5.3 By Preservation Method

- 5.3.1 Cryopreservation

- 5.3.2 Vitrification

- 5.3.3 Hypothermic Storage

- 5.3.4 Lyophilisation

- 5.4 By Application Area

- 5.4.1 Biobanking

- 5.4.2 Regenerative Medicine

- 5.4.3 Drug Discovery & Pre-clinical Testing

- 5.4.4 Other Applications

- 5.5 By End User

- 5.5.1 Biobanks & Gene Banks

- 5.5.2 Hospitals & Transplant Centres

- 5.5.3 Pharmaceutical & Biotechnology Companies

- 5.5.4 Academic & Research Institutes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA

- 6.3.3 Azenta US Inc.

- 6.3.4 BioLife Solutions Inc.

- 6.3.5 Cryoport Inc.

- 6.3.6 Cesca Therapeutics Inc.

- 6.3.7 Core Dynamics Ltd.

- 6.3.8 Custom Biogenic Systems Inc.

- 6.3.9 Lifeline Scientific Inc.

- 6.3.10 MVE Biological Solutions

- 6.3.11 Princeton CryoTech Inc.

- 6.3.12 Danaher Corp.

- 6.3.13 Sartorius AG

- 6.3.14 Eppendorf AG

- 6.3.15 STEMCELL Technologies Inc.

- 6.3.16 Lonza Group AG

- 6.3.17 Bio-Rad Laboratories Inc.

- 6.3.18 CryoConcepts LP

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment