PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835651

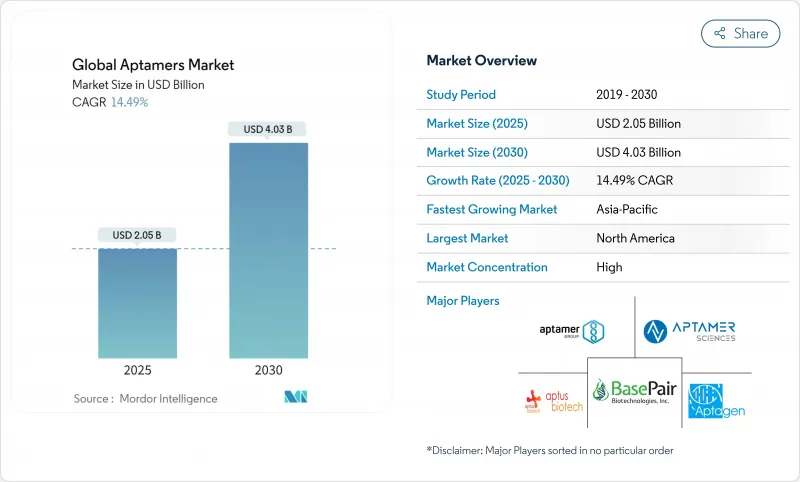

Global Aptamers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aptamer market size reached USD 2.05 billion in 2025 and is forecast to grow to USD 4.03 billion by 2030, reflecting a robust 14.49% CAGR.

Momentum comes from regulatory validation, accelerated discovery powered by artificial intelligence, and rising deployment in precision diagnostics and targeted therapeutics. The U.S. Public Health Emergency Medical Countermeasures Enterprise has earmarked USD 79.5 billion for 2023-2027, a sizable funding pool that is spurring rapid pathogen-sensor development and directly benefiting the aptamer market . Breakthroughs such as the FDA approval of IZERVAY for geographic atrophy in 2023 and the 2025 debut of UltraSELEX, which completes selection in a single round, are lowering risk perceptions and compressing development timelines. Alongside these drivers, microfluidic automation and enzymatic DNA synthesis are easing manufacturing constraints, although analytical-grade oligonucleotide capacity remains a near-term bottleneck that could temper expansion despite strong underlying demand

Global Aptamers Market Trends and Insights

Rising demand for ultra-sensitive diagnostics (sub-pM LoD)

Point-of-care settings and precision-medicine workflows require assays that identify biomarkers at femtomolar levels. Aptamer-based sensors routinely achieve sub-1 pM limits of detection, outperforming enzyme-linked immunoassays by 2-3 orders of magnitude. COVID-19 underscored the value of rapid, sensitive pathogen screening, catalyzing sustained investment in next-generation diagnostic formats. Electrochemical aptasensors now detect cardiac troponin at 10 pg/mL, enabling early myocardial infarction triage in emergency departments. Integration with microfluidic chips reduces sample volumes to microliters, a critical benefit for pediatric and geriatric testing scenarios. These performance gains reinforce the aptamer market's positioning against antibody-centric technologies.

Growth of mRNA/LNP platforms enabling RNA aptamer co-formulation

Successes in mRNA vaccination have normalized lipid nanoparticle (LNP) delivery, opening co-formulation pathways for RNA aptamers. Combined LNP-aptamer constructs demonstrate 10-fold improvements in cell-specific uptake relative to naked mRNA. Pharmaceutical pipelines targeting oncology and liver disease increasingly license aptamer ligands to sharpen tissue selectivity, as evidenced by an AstraZeneca-Aptamer Group collaboration announced in 2024. As formulation toolkits mature, RNA aptamers transition from research curiosities to core components of next-generation nucleic-acid medicines.

Intellectual-property thickets around modified nucleotides

More than 130 patents for 2'-modified nucleotides were filed between 2020-2024, creating overlapping claims that complicate freedom-to-operate analyses. Developers often negotiate complex cross-licensing deals, an expensive hurdle for smaller entrants and a deterrent to geographic expansion. Enforcement is strongest in the United States and Europe, prompting some firms to pivot early-stage R&D into jurisdictions with lighter patent scrutiny. Strategic partnerships mitigate the issue but can dilute long-term economics. Until landmark licensing frameworks emerge, intellectual-property uncertainty will remain a drag on aptamer market growth.

Other drivers and restraints analyzed in the detailed report include:

- Gen AI-accelerated in-silico aptamer discovery

- Funding surge for novel bispecific aptamer-drug conjugates

- Analytical-grade oligo synthesis capacity bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DNA aptamers accounted for 58.30% of aptamer market share in 2024, reflecting their superior nuclease stability and well-established production workflows. Diagnostics developers favor DNA scaffolds for room-temperature robustness, a key requirement for decentralized testing. The aptamer market size for DNA aptamers thereby remained the largest revenue contributor, anchored by strong demand from cardiac, infectious-disease, and environmental assays.

RNA aptamers are expected to grow at a 15.45% CAGR to 2030 on the back of mRNA-lipid nanoparticle co-formulation advances that mitigate historical stability challenges. Modified XNA forms achieve binding affinities up to 100-fold stronger than native sequences, albeit within a complex patent landscape. Pharmaceutical firms are signing option deals that attach milestone-rich structures to access RNA aptamer intellectual property, signaling confidence in clinical translation. This momentum diversifies the product mix and reinforces technology-driven competition within the aptamer market.

Diagnostics retained 46.56% share of the aptamer market size in 2024, underpinned by high-sensitivity biosensor rollouts in infectious-disease and cardiac triage settings. Laboratories embrace aptamer-based electrochemical and FET platforms because they deliver antibody-level specificity without cold-chain dependence.

Therapeutics exhibit the fastest expansion at 15.67% CAGR, a trajectory catalyzed by IZERVAY's 2023 approval and encouraging oncology proof-of-concept data. The aptamer market size for therapeutics is projected to close the gap with diagnostics as bispecific conjugates reach clinical-phase milestones. Persistent awareness gaps among clinicians constitute a soft barrier, yet growing publication volume and targeted education are narrowing this divide, positioning therapeutic programs as the next major revenue pillar.

The Aptamers Market Report is Segmented by Product Type (RNA Aptamer, DNA Aptamer and More), by Application (Diagnostics, Therapeutics, Research and Development, and More), by Technology (Conventional SELEX, Cell-SELEX and More) and Geography (North America, Europe, Asia-Pacific and More). The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America held 44.45% aptamer market share in 2024 on the strength of its established biotech ecosystem, supportive regulatory framework, and USD 79.5 billion PHEMCE funding pipeline. FDA guidance following IZERVAY's approval clarified chemistry-manufacturing-controls expectations for oligonucleotide impurities, accelerating therapeutic filings. Venture-capital inflows and well-capitalized instrument suppliers foster continuous platform upgrades. Production bottlenecks in analytical-grade oligos could temporarily cap growth, but ongoing investments in enzymatic synthesis plants are expected to ease pressure from 2027 onward.

Europe delivers steady revenue backed by advanced healthcare infrastructure and coordinated regulatory oversight from the European Medicines Agency. Germany's analytical-instrumentation strength and France's biotech research clusters provide fertile ground for diagnostic innovation. The United Kingdom maintains momentum despite Brexit through partnerships such as Aptamer Group's projects in liver fibrosis and Alzheimer's testing. Reimbursement policies favor high-value assays, making Europe an attractive launchpad for premium diagnostics and early-phase therapeutics.

Asia-Pacific is the fastest-growing region with a projected 17.56% CAGR through 2030. China invested more than CNY 20 billion (USD 2.8 billion) of public funds into biotech in 2023 and now hosts 27% of the global pipeline merics.org. Japan's sophisticated pharma sector and Australia's translational-research hubs further expand the addressable base. India and South Korea provide cost-competitive manufacturing and electronics capabilities that align with microfluidic SELEX automation. Intellectual-property complexities persist, yet government incentives and expanding local manufacturing temper risk perceptions, positioning the region as an essential growth engine for the aptamer market

- SomaLogic

- Aptamer Group plc

- Base Pair Biotechnologies

- Twist Bioscience

- NeoVentures Biotechnology Inc.

- Aptus Biotech

- TriLink BioTechnologies LLC

- IBA GmbH

- Exicure Inc.

- Vivonics Inc.

- Novaptech

- Moderna

- Regado Biosciences Inc.

- NOXXON Pharma AG

- Ocera Therapeutics (RiboX)

- DNA Technology A/S

- TAGCyx Biotechnologies

- Ionis Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gen AI-accelerated in-silico aptamer discovery

- 4.2.2 Rising demand for ultra-sensitive diagnostics (sub-pico-molar LoD)

- 4.2.3 Growth of mRNA/LNP platforms enabling RNA aptamer co-formulation

- 4.2.4 Funding surge for novel bispecific aptamer-drug conjugates

- 4.2.5 Mainstream SELEX automation lowering cost per candidate

- 4.2.6 Government pandemic-preparedness grants for rapid pathogen sensors

- 4.3 Market Restraints

- 4.3.1 Intellectual-property thickets around modified nucleotides

- 4.3.2 Analytical-grade oligo synthesis capacity bottlenecks

- 4.3.3 Low clinician familiarity versus antibodies

- 4.3.4 Stringent FDA CMC expectations for oligo impurities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 DNA Aptamers

- 5.1.2 RNA Aptamers

- 5.1.3 XNA & Modified Aptamers

- 5.2 By Application (Value)

- 5.2.1 Diagnostics

- 5.2.2 Therapeutics

- 5.2.3 Research & Development

- 5.2.4 Others

- 5.3 By Technology (Value)

- 5.3.1 Conventional SELEX

- 5.3.2 Cell-SELEX

- 5.3.3 Capillary Electrophoresis SELEX

- 5.3.4 Microfluidic & Microarray SELEX

- 5.3.5 Other Emerging SELEX Variants

- 5.4 By End User (Value)

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Academic & Research Institutes

- 5.4.3 Contract Research Organizations

- 5.4.4 Hospitals & Clinical Laboratories

- 5.4.5 Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 SomaLogic Inc.

- 6.3.2 Aptamer Group plc

- 6.3.3 Base Pair Biotechnologies Inc.

- 6.3.4 Twist Bioscience

- 6.3.5 NeoVentures Biotechnology Inc.

- 6.3.6 Aptus Biotech S.L.

- 6.3.7 TriLink BioTechnologies LLC

- 6.3.8 IBA GmbH

- 6.3.9 Exicure Inc.

- 6.3.10 Vivonics Inc.

- 6.3.11 Novaptech

- 6.3.12 Moderna

- 6.3.13 Regado Biosciences Inc.

- 6.3.14 NOXXON Pharma AG

- 6.3.15 Ocera Therapeutics (RiboX)

- 6.3.16 DNA Technology A/S

- 6.3.17 TAGCyx Biotechnologies

- 6.3.18 Ionis Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment