PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835655

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835655

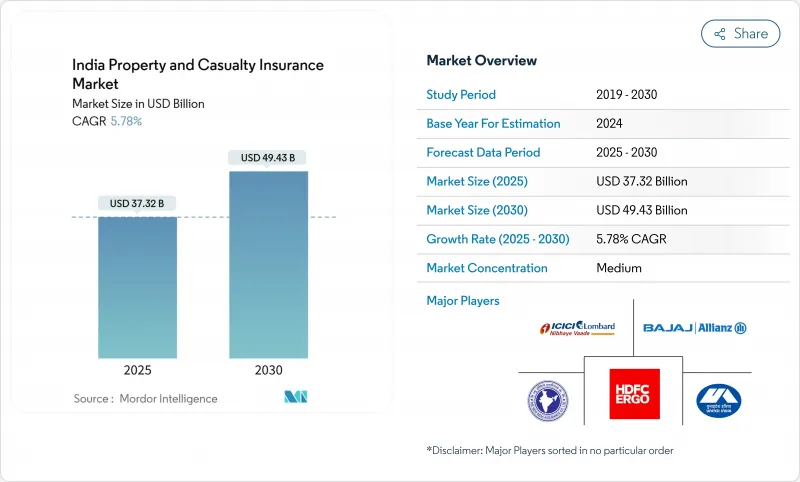

India Property And Casualty Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India property and casualty insurance market is valued at USD 37.32 billion in 2025 and is forecast to reach USD 49.43 billion by 2030, translating into a 5.78% CAGR over the period.

Robust premium growth stems from higher vehicle registrations, expanding government-funded schemes, and the 100% FDI cap that channels fresh capital and global expertise into domestic operations. Rising natural catastrophe losses, mandatory e-policy issuance, and ongoing digitalization nudge insurers toward advanced underwriting models, parametric solutions, and data-driven customer engagement. Competition intensifies as public-sector giants restructure, private players scale technology investments, and digital-only carriers employ low-cost operating models to gain share. Underwriting discipline remains pivotal because aggressive price competition continues to pressure combined ratios, especially in motor and commercial lines.

India Property And Casualty Insurance Market Trends and Insights

Rising Motorizations and Mandatory Third-Party Cover

High double-digit growth in vehicle registrations paired with stricter liability ceilings has lifted premium rates by 15-20% in 2025, delivering an immediate earnings uptick for motor underwriters. Insurers further benefit from the regulator's removal of deductibles, which improves retention on each policy and reduces claims leakage. ICICI Lombard's 23% surge in new-car premiums and a 7.2 percentage-point motor-loss-ratio improvement demonstrate how scaled carriers convert regulatory tailwinds into margin expansion. Data from connected-car telematics is now fed into pricing engines, allowing real-time risk segmentation and helping offset adverse selection risks as electric vehicle adoption accelerates. Bundled battery-protection riders are also emerging, creating cross-sell opportunities and deepening policy density per vehicle. These layered revenue levers collectively reinforce the driver's positive 1.2% CAGR contribution over the medium term.

Government-Funded Health Schemes Expanding Non-Life Pool

Pradhan Mantri Fasal Bima Yojana's 56.80-crore farmer enrolment and claims of USD 18.79 billion give non-life carriers a stable, state-backed premium spine. Satellite and drone imagery adopted under the scheme shorten loss-settlement cycles from months to days, establishing proof-of-concept for parametric triggers in wider property portfolios. Yet, actuarial stress tests reveal high-risk districts where loss ratios exceed 130%, forcing debate on premium realignment toward risk-based pricing. The USD 8.38 billion multi-year budget protects near-term revenue visibility but also incentivizes private carriers to co-create micro-covers that dovetail with government pools. Successful pilots in Odisha now bundle weather-index crop cover with personal-accident add-ons, nudging rural households toward multi-line adoption. Over the long term, these hybrid models are expected to lift absolute penetration while preserving fiscal sustainability for the exchequer.

Persistent Price Competition Keeps Combined Ratios High

Although industry combined ratios improved to 103.3% in 2024, break-even remains elusive for many mid-tier players, especially those reliant on commoditized motor and fire lines. The proposed three-insurer public-sector merger could trigger aggressive discounting as the new entity uses price to defend its 31% share while rationalizing overlapping branches. Private multi-line carriers retaliate by bundling wellness or roadside assistance services at marginal cost, diluting pure-risk pricing discipline. Digital-only entrants compound pressure by leveraging policy-admin systems that run at 10-12 basis-point unit costs, permitting thinner margins without compromising ROE. Reinsurers, wary of prolonged underpricing, have already raised catastrophe treaty costs by 4-6%, squeezing net retentions. Unless tariffs are re-imposed or solvency thresholds tightened, the restraint will continue shaving 0.9% off the forecast CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Digital-First Insurtech Distribution Lowering CAC

- Climate-Related Catastrophe Awareness Driving Property Cover

- Low Penetration in Tier-3/4 Towns Limits Scale

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motor insurance commands a 38.2% share of the India property and casualty insurance market, buoyed by sustained vehicle demand and regulatory changes that lifted premium ceilings. The segment captured 15-20% premium increases in 2025, demonstrating the pricing flexibility built into mandatory cover regulations. Liability insurance scales fastest with an 8.00% CAGR on the back of rising corporate governance requirements and escalating cyber-attack costs projected at USD 10.5 trillion by 2025. Property and fire lines benefit from industrial expansion and heightened climate risk awareness, whereas marine growth remains muted due to shallow domestic shipping volumes.

Government-supported crop insurance receives USD 8.38 billion in funding that anchors premium inflows. With infrastructure investments reaching USD 134.94 billion, the demand for engineering covers continues to grow significantly. Gas-pipeline projects, supported by surety bonds ranging from USD 0.18 to 6.02 million, further expand the underwriting landscape by providing financial assurance for project completion. As public spending on infrastructure projects maintains its momentum, engineering insurers are increasingly leveraging these opportunities to strengthen their market presence and capitalize on the growing project pipelines.

In the Indian property and casualty insurance market, individuals command a 54.5% share, largely driven by mandatory motor insurance and a growing emphasis on health coverage. This dominance is attributed to the increasing awareness of insurance benefits and the government's push for broader health insurance penetration. Micro, Small, and Medium Enterprises (MSMEs) are witnessing the fastest growth, boasting a 7.00% CAGR, fueled by streamlined compliance processes, government incentives, and the advent of digital premium financing, which enhances affordability. The rising adoption of digital tools and platforms by MSMEs further supports this growth trajectory. While large corporates represent a seasoned segment of the market, they increasingly seek advanced solutions, including captive programs and parametric triggers, navigating through intricate regulatory landscapes. These corporates demand innovative risk management strategies to address complex operational risks. Government entities, on the other hand, ensure consistent volumes but tend to focus more on tender pricing than the breadth of coverage, often prioritizing cost efficiency over comprehensive protection.

With digital distribution, insurers can finely tailor products to align with MSME cash-flow patterns, achieving a reduction in acquisition costs by nearly one-third compared to traditional agency models. This approach enhances affordability and improves accessibility for smaller businesses. Additionally, a potential shift in composite licensing could empower insurers to merge life and non-life products, thereby amplifying their share of customer spending across diverse cohorts. Such regulatory changes could pave the way for more integrated and customer-centric insurance offerings.

India Property and Casualty Insurance Market is Segmented by Line of Business (Motor, Property & Fire, and More), Customer Type (Individuals, Micro, Small & Medium Enterprises (MSMEs), and More), Distribution Channel (Agency Networks, Bancassurance, and More), Insurance Provider Type (Public-Sector General Insurers, Private-Sector General Insurers, and More), and Region. The Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- New India Assurance Co. Ltd.

- ICICI Lombard General Insurance

- Bajaj Allianz General Insurance

- HDFC ERGO General Insurance

- United India Insurance

- Oriental Insurance

- SBI General Insurance

- Tata AIG General Insurance

- Reliance General Insurance

- Cholamandalam MS General

- Kotak Mahindra General

- IFFCO-Tokio General

- Future Generali India Insurance

- Bharti AXA General (now ICICI Lombard)

- Royal Sundaram General

- Go Digit General Insurance

- ACKO General Insurance

- Liberty General Insurance

- Magma HDI General Insurance

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising motorisation & mandatory third-party cover

- 4.2.2 Government?funded health schemes expanding non-life pool

- 4.2.3 Digital-first insurtech distribution lowering CAC

- 4.2.4 Climate-related catastrophe awareness driving property cover

- 4.2.5 100 % FDI cap-lift unlocking foreign capital & expertise

- 4.2.6 IRDAI 'Insurance for All 2047' sandbox & micro-product push

- 4.3 Market Restraints

- 4.3.1 Persistent price competition keeps combined ratios high

- 4.3.2 Low penetration in Tier-3/4 towns limits scale

- 4.3.3 Under-pricing of emerging cyber risks

- 4.3.4 Limited domestic reinsurance capacity for NatCat events

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Line of Business (Value)

- 5.1.1 Motor Insurance

- 5.1.2 Property & Fire Insurance

- 5.1.3 Crop Insurance

- 5.1.4 Marine Insurance

- 5.1.5 Liability Insurance

- 5.1.6 Engineering Insurance

- 5.1.7 Travel Insurance

- 5.2 By Customer Type (Value)

- 5.2.1 Individuals

- 5.2.2 Micro, Small & Medium Enterprises (MSMEs)

- 5.2.3 Large Corporates

- 5.2.4 Government & Public Sector Entities

- 5.3 By Distribution Channel (Value)

- 5.3.1 Agency Networks

- 5.3.2 Bancassurance

- 5.3.3 Brokers

- 5.3.4 Direct In-house Sales

- 5.3.5 Digital / Web Aggregators

- 5.3.6 Affinity & Partnership Channels

- 5.4 By Insurance Provider Type (Value)

- 5.4.1 Public-Sector General Insurers

- 5.4.2 Private-Sector General Insurers

- 5.4.3 Stand-alone Health Insurers

- 5.4.4 Digital-only Insurers

- 5.5 By Region - India (Value)

- 5.5.1 North India

- 5.5.2 South India

- 5.5.3 East India

- 5.5.4 West India

- 5.5.5 Central India

- 5.5.6 North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 New India Assurance Co. Ltd.

- 6.4.2 ICICI Lombard General Insurance

- 6.4.3 Bajaj Allianz General Insurance

- 6.4.4 HDFC ERGO General Insurance

- 6.4.5 United India Insurance

- 6.4.6 Oriental Insurance

- 6.4.7 SBI General Insurance

- 6.4.8 Tata AIG General Insurance

- 6.4.9 Reliance General Insurance

- 6.4.10 Cholamandalam MS General

- 6.4.11 Kotak Mahindra General

- 6.4.12 IFFCO-Tokio General

- 6.4.13 Future Generali India Insurance

- 6.4.14 Bharti AXA General (now ICICI Lombard)

- 6.4.15 Royal Sundaram General

- 6.4.16 Go Digit General Insurance

- 6.4.17 ACKO General Insurance

- 6.4.18 Liberty General Insurance

- 6.4.19 Magma HDI General Insurance

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment